In a surprising turn of events, lawmakers on Capitol Hill displayed a particular fondness for Apple stock in 2023, emerging as the sole net buyers of a FAANG stock among the 100 members who engaged in stock trading that year. While FAANG stocks experienced a meteoric rise, with Facebook parent Meta Platforms posting remarkable returns, it was Apple that captured the attention of legislators, reflecting a unique trend in their investment behavior.

Apple: A Favorite Among Politicians

Apple, symbolized by AAPL on the NASDAQ, garnered significant interest from representatives and senators, with a total investment of $2.4 million in 2023. This placed Apple as the second most purchased stock, a close runner-up to ConocoPhillips. Notably, Apple ranked fifth in terms of the number of shares traded by members of Congress.

Although Microsoft and JPMorgan Chase remained equally popular choices, Apple attracted notable figures like Rep. Ro Khanna and former House Speaker Nancy Pelosi from the Democratic Party, as well as Republican representatives and senators such as Dan Newhouse, Blake Moore, Michael Guest, Shelley Moore Capito, and Markwayne Mullin.

The Singular Allure of Apple

The preference for Apple stock by lawmakers can be attributed to its stature as one of the world’s largest companies by market capitalization in 2023. This tech giant has consistently been a preferred investment for many individuals over the years. However, what sets this trend apart is the exclusive focus on Apple, neglecting other high-performing FAANG stocks like Meta Platforms, Amazon, Netflix, and Alphabet.

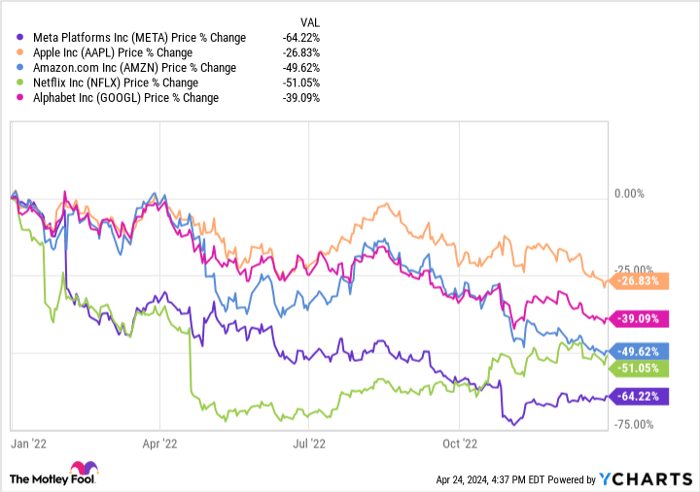

The deviation from popular choices such as Meta Platforms, which witnessed a significant surge in returns compared to Apple, could be linked to behavioral biases like recency bias. The historical plunge experienced by FAANG stocks in 2022 may have influenced the legislators’ cautious approach towards these stocks, favoring the relatively stable performance of Apple.

Apple’s Future Prospects Under Scrutiny

In the current landscape, the tides seem to be turning for Apple as members of Congress are inclined towards divesting from the tech giant. Concerns loom over Apple’s modest revenue growth of 2% in the quarter ending Dec. 30, 2023, coupled with a forward earnings multiple of 25.6, indicating a potentially overvalued stock.

Despite these apprehensions, anticipation mounts over Apple’s forthcoming innovations in artificial intelligence (AI), with CEO Tim Cook hinting at groundbreaking developments in generative AI. Such advancements could potentially drive a new wave of iPhone upgrades, hinting at a possible resurgence in Apple’s market appeal.

Investing Outlook for Apple

While the trajectory of Apple stock remains uncertain, strategic considerations are advised before committing investments. Analyzing the dynamic landscape of AI innovations and market performance could offer valuable insights into the future viability of Apple stock.

For investors seeking diversified opportunities, exploring alternative investment avenues beyond Apple might yield favorable returns, as identified by renowned analyst teams like the Motley Fool Stock Advisor. By aligning with expert recommendations and staying informed on evolving market trends, investors can navigate the ever-changing market terrain with confidence.