Johnson & Johnson (NYSE: JNJ) stands as one of the safest havens for dividend investors globally. The healthcare behemoth churns out sustainable cash flow and boasts a balance sheet as impenetrable as a fortified castle. These attributes lay a bedrock foundation for its robust dividend yield of 3.4%.

For those seeking an unwavering income stream, here’s why investing in Johnson & Johnson proves to be a wise choice.

Fortified by the Seal of Johnson & Johnson

Johnson & Johnson holds the prestigious distinction of being one of just two companies worldwide with a AAA bond rating from multiple credit rating agencies. The other entity sharing this rare air is Microsoft. Surpassing even the U.S. federal government, which boasts only a single AAA rating, Johnson & Johnson’s pristine credit rating signals an unparalleled ability to meet its financial commitments.

The company flaunts a balance sheet akin to an impregnable fortress. Exiting the first quarter, Johnson & Johnson sat on a substantial $26 billion in cash and marketable securities against $34 billion in debt. With a meager $7 billion in net debt, the company maintains an exceptionally low leverage ratio. In the prior year, it generated a staggering $18 billion in free cash flow, ample to cover its net debt twice over.

Johnson & Johnson’s robust free cash flow acts as a linchpin in securing the safety of its dividends. After allocating $15.1 billion to research and development (R&D) last year, the company was left with $18 billion in surplus cash – easily exceeding its $11.8 billion dividend payout. This surplus empowered the healthcare giant to reward shareholders further by repurchasing $2.5 billion in stock and fortifying its already stellar balance sheet.

Enabled by its top-tier balance sheet, Johnson & Johnson holds the flexibility to pursue acquisitions to bolster its drug pipeline and enhance its medical technology arm. Demonstrating this, the company inked a $13.1 billion deal for Shockwave Medical to accelerate its sales trajectory. Concurrently, it sealed a $2 billion agreement for Ambrx Biopharma to amplify its drug portfolio.

Reigning Supreme Among Dividend Stocks

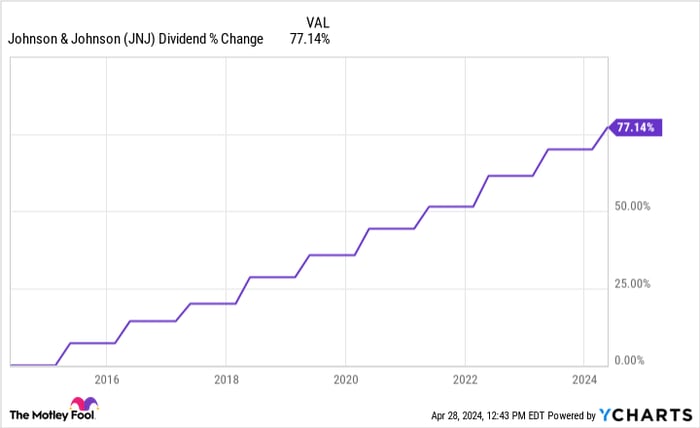

Johnson & Johnson’s sturdy financial bedrock has enabled it to deliver a sustainable and escalating dividend. Earlier this year, the company upped its dividend by 4.2%, marking its 62nd consecutive year of dividend growth. This landmark places it within the elite echelon of Dividend Kings, comprising companies with over 50 years of unbroken dividend growth.

Over the last decade, Johnson & Johnson has consistently delivered mid-single-digit annual dividend growth.

A striking feature of Johnson & Johnson is its elevated dividend yield, currently standing at 3.4%. This figure surpasses double the S&P 500’s prevailing dividend yield of 1.4%. At this rate, a $1,000 investment in Johnson & Johnson equates to approximately $34 in annual dividend income – in stark contrast to the $14 dividend income generated by a $1,000 invested in an S&P 500 index fund.

Investors can rely on receiving Johnson & Johnson’s dividends annually, with a high degree of certainty that the dividend level will continue to ascend at a mid-single-digit pace. The company’s long-term forecast, envisioning operational sales growth of 5% to 7% yearly through 2030, is set to propel adjusted operational earnings-per-share growth of over 7% annually within the midpoint of its guidance range. This optimistic outlook is fueled by organic growth, substantial R&D investments, and the potential for accretive acquisitions.

An Unassailable Income Stream

Johnson & Johnson epitomizes robustness

The Resilient Legacy of Johnson & Johnson: A Financial Standout in Volatile Markets

Deciphering the Financial Fortitude of Johnson & Johnson

Johnson & Johnson is a stalwart in the financial realm, boasting one of the most robust balance sheets globally. Its durable free cash flow serves as a cornerstone, underpinning one of the most secure dividends across industries. The company’s financial prowess not only supports its dividend but also provides the flexibility to reinvest in Research and Development (R&D) and strategic acquisitions, propelling both earnings and dividend growth. This unique combination of stability and growth potential catapults Johnson & Johnson to the forefront for investors seeking a reliable dividend.

The Verdict on Investing in Johnson & Johnson Today

Contemplating an investment in Johnson & Johnson? Consider this:

The astute analysts at the Motley Fool Stock Advisor have recently unveiled the top 10 stocks poised for significant growth, yet Johnson & Johnson did not make the prestigious cut. The chosen ten stocks are projected to yield exceptional returns in the foreseeable future, indicating promising prospects outside the realm of this enduring healthcare giant.

The Stock Advisor service by Motley Fool offers a comprehensive roadmap to success for investors, including expert advice on portfolio construction, real-time updates from seasoned analysts, and bi-monthly stock recommendations. Notably, the Stock Advisor service has outperformed the S&P 500 by more than threefold since its inception in 2002*.

Curious about the top 10 stocks? Dive into the selection here.

*Stock Advisor returns as of April 22, 2024