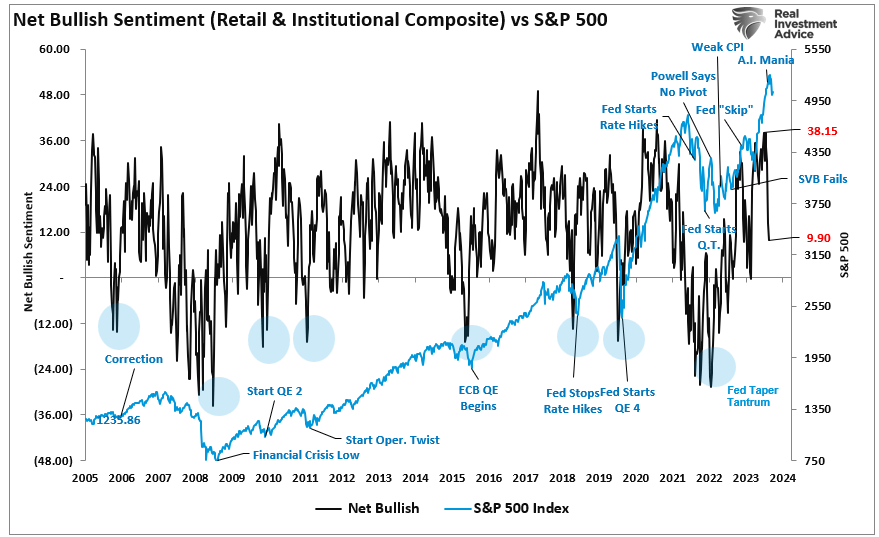

Amidst a tumultuous reversal in bullish sentiment, investors find solace in the unwavering strength of earnings and the resurgence of buybacks. The swing from exuberance to fear has investors on edge, reminiscent of past corrections that marked market bottoms.

Earnings Continue to Remain Strong

Despite market jitters, earnings growth stands firm, particularly among the renowned “Magnificent 7,” where tech giants like Google (GOOG) and Microsoft (MSFT) have exceeded expectations. Bolstered by recent fiscal policies, earnings have been on an upward trajectory since the lows of 2022, providing a strong foundation for the market.

The continuous optimism around earnings is further supported by estimates anticipating a potential Federal Reserve rate cut later in the year. Such a move would reduce borrowing costs, fuel economic activity, and bolster corporate performances, creating a positive outlook for investors.

Buybacks Returning

The resurgence of corporate buybacks heralds a significant shift in market dynamics. Historically, buybacks have been a crucial pillar of market stability, with corporations driving nearly all net equity purchases in recent years. The recent lull in buyback activity, due to a strategic blackout period, saw a substantial market contraction, highlighting the importance of these corporate maneuvers.

However, this quiet spell is set to end, as corporations gear up to resume buybacks imminently. With over $1 trillion slated for buybacks in 2024, the market anticipates a renewed wave of liquidity injection, with tech titan Google (NASDAQ:) poised to contribute significantly to this uptrend.

The combined forces of robust earnings and revitalized buybacks paint a promising picture for the market’s resilience. While the ongoing correction may have more ground to cover, the foundations seem steady, minimizing the risk of a profound downturn, at least for the foreseeable future.