Throughout the tumultuous landscape of the stock market, there are always hidden gems waiting to be discovered by savvy investors. Today, May 3, we present three such shining stars with buy ranks, each boasting robust growth characteristics that cannot be ignored.

Dycom Industries, Inc. (DY) stands tall among the competition. The Zacks Consensus Estimate for its current year earnings has surged by 7.2% over the last 60 days, signaling a bullish trajectory that is hard to overlook.

The Dycom Industries, Inc. Success Story

Dycom Industries, Inc. flaunts a tantalizing PEG ratio of 0.82, overshadowing the industry average of 1.11, and radiates a Growth Score of A, underscoring its potential for further expansion.

The Rise of PDD Holdings Inc.

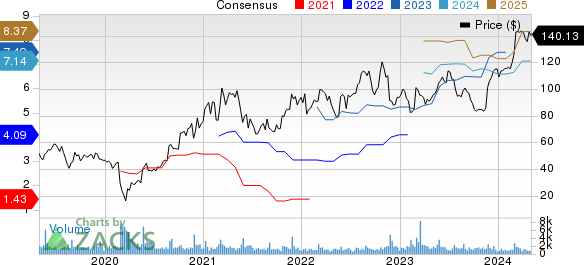

PDD Holdings Inc. (PDD) emerges as a prime contender in the e-commerce realm. With a Zacks Rank #1, its current year earnings estimate has surged by a remarkable 18% over 60 days, showcasing an upward momentum that is hard to ignore.

Unveiling PDD Holdings Inc.’s Potential

PDD Holdings Inc. boasts a striking PEG ratio of 0.30, dwarfing the industry average of 0.58, and proudly displays a Growth Score of A, indicating its prowess in the market.

The Promising Future of AZZ Inc.

AZZ Inc., known for its galvanizing and coil coating solutions, is not to be overlooked. The Zacks Consensus Estimate for its current year earnings has surged by 5.5% over the last 60 days, hinting at a bright future ahead.

AZ Galvanizes the Stock Market

AZZ Inc. shines with a PEG ratio of 1.07, surpassing the industry average of 1.51, while boasting a Growth Score of B, showcasing its potential in the market.

For a comprehensive list of top-ranked stocks, investors are encouraged to explore further opportunities.

Discover more about the Growth score and its calculation to make informed investment decisions in the ever-evolving market landscape.

Highest Returns for Any Asset Class

It’s a race like no other. Amidst the rollercoaster ride of investments, Bitcoin emerges as the top performer in the world of decentralized, borderless currencies. With staggering returns in the past three presidential election years – 2012 with +272.4%, 2016 with +161.1%, and 2020 with +302.8% – Bitcoin has proven its mettle. Zacks foresees another significant upsurge on the horizon, enticing investors with the promise of lucrative returns.

Hurry, Download Special Report – It’s FREE >>

Are you hungry for the latest insights from Zacks Investment Research? Satiate your curiosity with the 7 Best Stocks for the Next 30 Days. Click to obtain this valuable report, providing you with a wealth of information to inform your investment decisions.