Apple, alongside its peer Amazon, showcased resilience in the market following reassuring statements from Fed Chair Jerome Powell about the absence of rate hikes.

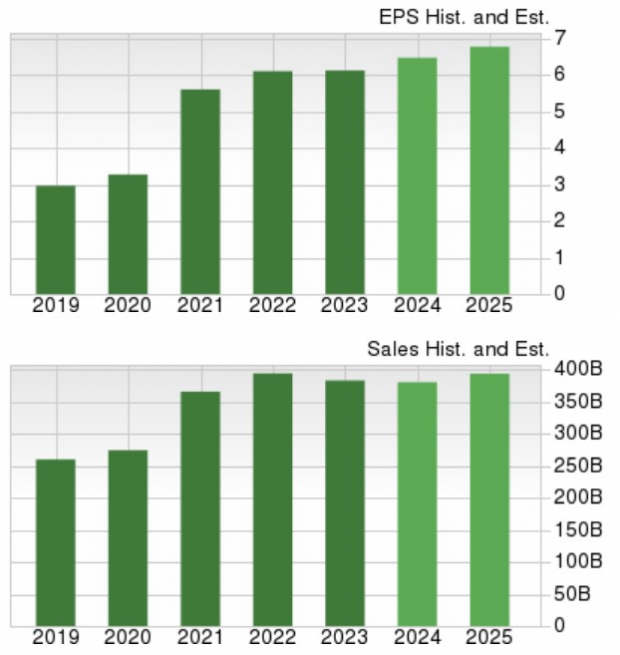

Apple’s fiscal second-quarter results surpassed expectations, bolstered by revenue records in multiple countries, pushing its Q2 EPS to a new high at $1.53 per share, slightly above estimates and a percentage higher than the previous year.

The tech giant exceeded both top and bottom-line projections for the fifth consecutive quarter, with an average earnings surprise of 4.14% across the last four reports.

Image Source: Zacks Investment Research

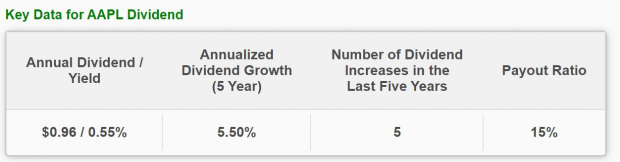

Apple’s board approved additional funds for share repurchases, illustrating confidence in its operations and a commitment to maintaining cash neutrality. The company also raised its dividend by 4% to $0.25 per share quarterly.

Image Source: Zacks Investment Research

Analysts project Apple’s earnings to climb by 6% in fiscal 2024 and another 8% in FY25, with sales anticipated to remain stable this year and grow by 5% in FY25, reaching $403.72 billion.

Image Source: Zacks Investment Research

Apple currently holds a Zacks Rank #3 (Hold), demonstrating resilience against regulatory concerns by expanding globally, though there may be better opportunities on the horizon.

Highest Returns for Any Asset Class

Bitcoin has proven to be the most lucrative investment, outperforming all other decentralized currencies significantly. In presidential election years, Bitcoin boasted impressive returns: 2012 +272.4%, 2016 +161.1%, 2020 +302.8%. Anticipation is high for another surge, as predicted by Zacks.

No guarantees for the future, but in the past three presidential election years, Bitcoin’s returns were as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%. Zacks predicts another significant surge in months to come.

Hurry, Download Special Report – It’s FREE >>