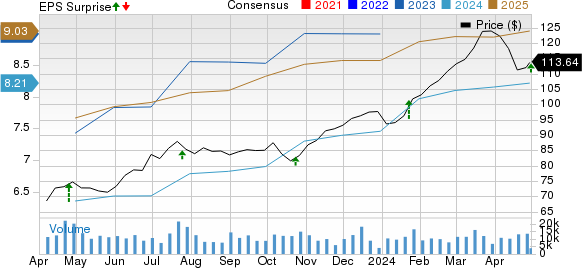

For PACCAR Inc. (PCAR), the first quarter of 2024 was a testament to its ability to exceed expectations and continue its impressive earnings trend. The company reported earnings of $2.27 per share, outperforming the Zacks Consensus Estimate of $2.17 per share and marking an increase from the previous year’s $2.25 per share.

Revenue Growth and Segment Performance

In Q1, consolidated revenues, including trucks and financial services, reached $8.74 billion, up from $8.47 billion in the same quarter of 2023. The Trucks segment contributed significantly to this growth, with revenues totaling $6.54 billion, higher than the previous year’s $6.41 billion.

Global truck deliveries stood at 48,100 units, showcasing the company’s robust performance in this segment. Meanwhile, the Parts segment also saw an uptick in revenues to $1.67 billion and reported pre-tax income of $455.8 million. Financial Services segment revenues came in at $509.3 million, indicating solid growth.

PACCAR managed to decrease its selling, general, and administrative expenses in Q1, showing operational efficiency. Cash and marketable debt securities stood at $7.72 billion as of March 31, 2024, reflecting the company’s strong financial position.

Dividend Declaration and Future Outlook

The company declared a quarterly dividend of 27 cents per share, underscoring its commitment to rewarding shareholders. Looking ahead, PACCAR anticipates capex and R&D expenses for 2024 to fall within the ranges of $700-$750 million and $460-$500 million, respectively.

Peer Performances

In comparison to its peers, PACCAR’s performance in Q1 stands out. General Motors (GM) reported adjusted earnings of $2.62 per share, surpassing estimates and showing improvement from the previous year. Ford (F) also posted adjusted earnings per share of 49 cents, exceeding expectations.

While GM and Ford provided positive outlooks for the future, PACCAR’s consistent earnings beat streak sets it apart in the industry. The company’s resilience and ability to surpass estimates demonstrate its strong market position and operational strength amid challenging conditions.