In the world of electric vehicles, Rivian Automotive (RIVN) burst onto the scene like a comet streaking across a night sky, dazzling investors with promises of cleaner transportation and exciting growth potential. However, as the dust settles and the stars dim, the reality facing Rivian seems more like a shooting star—bright but fleeting. With its upcoming first-quarter 2024 earnings announcement looming like a storm cloud on the horizon, investors are left wondering if Rivian is a ship in troubled waters or a phoenix poised to rise.

Unmasking the Price Plunge

Once a titan among electric vehicle makers, Rivian’s fall from grace reads like a cautionary tale of hype meeting harsh reality. Fueled by the backing of industry giants like Amazon and Ford, Rivian soared to stratospheric valuations that defied gravity. Yet, beneath the glossy exterior, cracks began to show. Production snags, dwindling demand, and fierce competition painted a grim picture. The once-majestic market cap plummeted, sending shockwaves through the investor community.

Rivian’s meteoric rise and subsequent fall stand as a stark reminder of the risks lurking in the EV space. As the company grapples with adversity, investors must tread carefully, lest they find themselves caught in the undertow of uncertainty.

Deciphering Rivian’s Downfall

Behind Rivian’s unraveling lies a tangled web of challenges—from supply chain woes to heightened competition and economic headwinds. With every setback, Rivian’s once-rosy outlook dims, casting doubt on its ability to weather the storm. The road ahead for Rivian is riddled with potholes, and only time will tell if the company can navigate the treacherous terrain.

Crunching the Numbers

As investors weigh the pros and cons of betting on Rivian, the numbers paint a sobering picture. Rivian’s financial health, characterized by mounting losses and liquidity concerns, raises red flags. With profitability hanging in the balance and operational efficiency in question, Rivian finds itself at a crossroads.

The company’s ambitious plans to introduce new vehicle models offer a sliver of hope amidst the turmoil. However, whether these offerings can steer Rivian back on course remains uncertain. As Rivian charts its course through choppy waters, investors must keep a keen eye on the horizon, wary of lurking risks and potential rewards.

Rivian’s Rocky Road Ahead

Analyze This: Rivian’s Valuation and Future Outlook

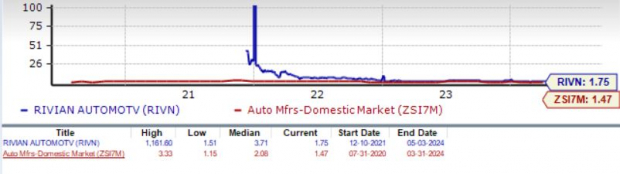

Rivian, currently trading at a forward sales multiple of 1.75, lags significantly behind its five-year median of 3.71. This tumble from its historical valuation peak leaves investors questioning the underlying fundamentals. As it stands, Rivian holds a Value Score of F.

Insights from Zacks: Projections & Predictions

The consensus anticipates a first-quarter 2024 loss of $1.13 per share for Rivian, a dip from the $1.06 loss forecasted 90 days prior. The prior year’s first-quarter loss stood at $1.25 per share. Revenue projections for the quarter aim for $1.15 billion, marking a substantial 73% upturn from the previous year.

Looking ahead to full-year 2024, analysts foresee a $3.97 per share loss, slightly wider than the loss of $4.88 per share reported in 2023. Revenue expectations hint at a modest 7.6% increase for the year.

The Critical Model and Market Sentiment

According to our quantitative model, a positive Earnings ESP and a Zacks Rank #3 or higher typically boost the likelihood of an upbeat earnings surprise. Unfortunately, Rivian carries a Zacks Rank #3 designation and an Earnings ESP of -0.52%, casting uncertainty over its potential for an earnings beat.

Considerations for Investors

Before considering an investment in Rivian, waiting for management’s comments on cost-cutting initiatives and operational advancements is prudent. Investors should closely monitor Rivian’s affirmation of positive GPU per vehicle projections, progress in lower-priced model development, and delivery growth targets for the upcoming year.

Despite Rivian’s current undervaluation, the company grapples with challenges such as sluggish EV demand, production inefficiencies, and cash burn rates. Therefore, exercising caution and deciphering clearer signals post first-quarter earnings release is advisable before delving into Rivian’s stock.