How much weight should investors put on the recommendations of Wall Street analysts? The sway of these brokerage-firm-employed analysts on stock prices is well-documented. Does their consensus view on Riot Platforms, Inc. (RIOT) warrant your attention?

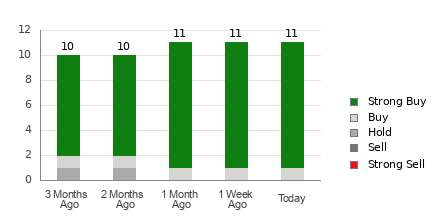

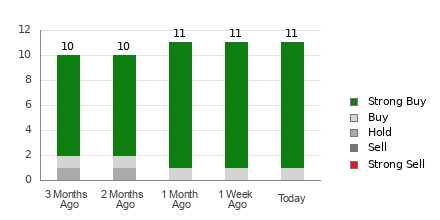

Let’s delve into the ABR (average brokerage recommendation) for RIOT — currently standing at 1.09, suggesting a consensus between Strong Buy and Buy, based on inputs from 11 brokerage firms. The breakdown shows a strong favor for the stock, with 10 Strong Buy ratings and one Buy rating, hinting at an overwhelming positive sentiment.

Deciphering Brokerage Recommendation Trends for RIOT

However, before you jump headfirst into an investment, it’s crucial to recognize the limitations of relying solely on brokerage recommendations. These analysts, driven by a vested interest in the stocks they cover, often exhibit an optimistic bias, leading to inflated ratings.

The disparity is glaring: for every “Strong Sell” recommendation, you could find five “Strong Buy” endorsements. This misalignment of interests between brokerage firms and retail investors clouds the reliability of such recommendations in predicting stock movements accurately.

Here’s where our in-house Zacks Rank model shines. Backed by meticulous external audits, this tool classifies stocks on a scale of 1 (Strong Buy) to 5 (Strong Sell) based on earnings estimate revisions. Combining the ABR with Zacks Rank can be a prudent move for discerning investors seeking profitable opportunities.

Unpacking the ABR vs. Zacks Rank Dilemma

While both ABR and Zacks Rank may present scores on a 1-5 scale, they couldn’t be more different. The former leans heavily on brokerage inputs, often steeped in biased optimism, whereas the Zacks Rank derives strength from earnings estimate revisions, a more objective measure.

Empirical evidence supports the correlation between stock price movements and earnings estimate trends, validating the efficacy of the Zacks Rank. The model ensures fairness by evenly distributing its ranks across all eligible stocks, leaving no room for skewed recommendations.

The timeliness factor is crucial here — while ABR may lag in updates, Zacks Rank responds swiftly to evolving earnings forecasts, rendering it a potent tool for predicting stock price dynamics.

Is RIOT Worth Your Investment?

Recent data spells optimism for Riot Platforms, Inc., with the Zacks Consensus Estimate for the current year climbing a staggering 200.4% month-over-month to $0.42. Such fervent analyst agreement on the company’s bright earnings prospects could foreshadow a bullish trajectory for the stock.

The Zacks Rank #2 (Buy) given to RIOT reflects this bullish sentiment, further bolstering the case for considering an investment. With such promising outlook aligned with Zacks Rank endorsement, investors might find the ABR a guiding light in navigating the investment landscape.