Understanding Short Straddles

A short straddle, an intricate options technique, comes into play when a trader aims to benefit from a stock trading within a confined range.

In this method, a trader concurrently sells a call and a put, subjected to specific conditions:

- Both options must pertain to the same underlying stock

- Both options must possess the same expiry date

- Both options must adhere to the same strike price

By initiating this strategy, the trader secures two up-front premiums, constituting the maximum attainable gain.

The allure of collecting these premiums lures novice traders to the technique, often concealing the inherent risks.

A short straddle exposes traders to unlimited loss potential when faced with significant market fluctuations, cautionary especially during impactful market events like earnings disclosures.

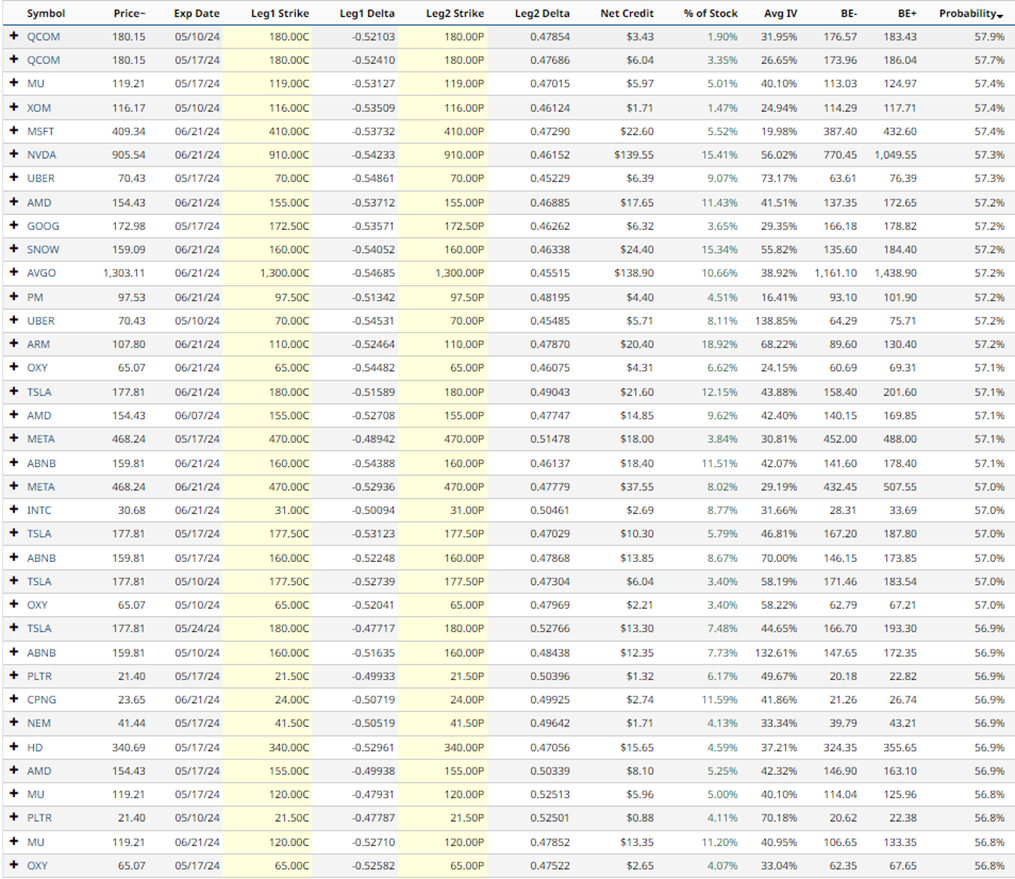

Perusing Barchart’s Short Straddle Screener

Embarking on the search, the screener, curated for May 8th, reveals intriguing short straddle trades featuring prominent stocks like QCOM, MU, XOM, MSFT, NVDA, UBER, AMD, GOOG, and SNOW.

Let’s delve into a few examples depicting the intricacies of this strategy.

MU Stock Short Straddle Example

Exploring the first listing, a short straddle is highlighted on Micron Technology.

Focused on the May 17 expiry, the trade entails vending the $180 strike call and put options, resulting in a premium of $597, also representing the maximum profit.

Theoretical unlimited loss accompanies this venture, with lower and upper breakeven prices at $113.03 and $124.97, respectively.

The premium mirrors 5.01% of the stock price, assimilating a 57.4% estimated success rate.

Nvidia Short Straddle Example

Transitioning to the subsequent entry, a short straddle starring Wells Fargo emerges.

Set for the June 21 expiry, the transaction involves selling the $910 strike call and put options, accruing a premium of $13,955, marking the maximum profit.

Analogous to the former, this pursuit entails limitless potential loss, with breakeven points at $770.45 and $1,049.55.

The received premium equates to 15.41% of the stock price, foreseeing a 57.3% probability of success.

UBER Short Straddle Example

Concluding the exploration, a final short straddle involving UBER beckons.

Scheduled for the May 17 expiry, the trade necessitates selling the $70 strike call and put options, generating a $639 premium symbolizing the maximum profit.

The accompanying unlimited loss potential positions the lower and upper breakeven prices at $63.61 and $76.39, respectively, with a received premium constituting 9.07% of the stock price.

The speculated success rate hovers at 57.3%, supported by a 100% Buy recommendation in Barchart’s Technical Opinion.

Mitigating Risk

Short straddles, inherently risky due to naked options, are deemed unsuitable for novice participants.

Prudent position sizing, restricting significant losses to a 1-2% portfolio decrement, is advised.

Exercise vigilance regarding early assignment risks and impending earnings disclosures, as these factors can propel substantial market movements post-announcement.

This educational narrative serves to enlighten, not to advocate trade decisions. Prioritize diligence and consultation with financial advisors before embarking on investments.