Market Positivity Emerges After April Turmoil

Since the April Federal Reserve meeting, markets have shifted to an “increasingly positive mood.” While obstacles remain, there are favorable factors on the horizon following last month’s downturn, according to Deutsche Bank.

Recent Market Resilience

The S&P 500 demonstrated its best four-day performance of the year in early May. This surge was supported by the 10-year yield falling for five consecutive sessions for the first time since August, as noted in a research report by Deutsche Bank (DB) Macro Strategist Henry Allen.

Reasons for Market Optimism

DB highlighted “5 reasons to be positive” about the stock market:

- Data releases globally are showing increasing positivity.

- Fed Chair Powell’s comments and recent data reduce near-term rate hike concerns.

- Declining oil prices are easing inflation pressures.

- The global economy is proving resilient to higher rates.

- No recession has surfaced despite periodic data fluctuations.

Global Economic Landscape

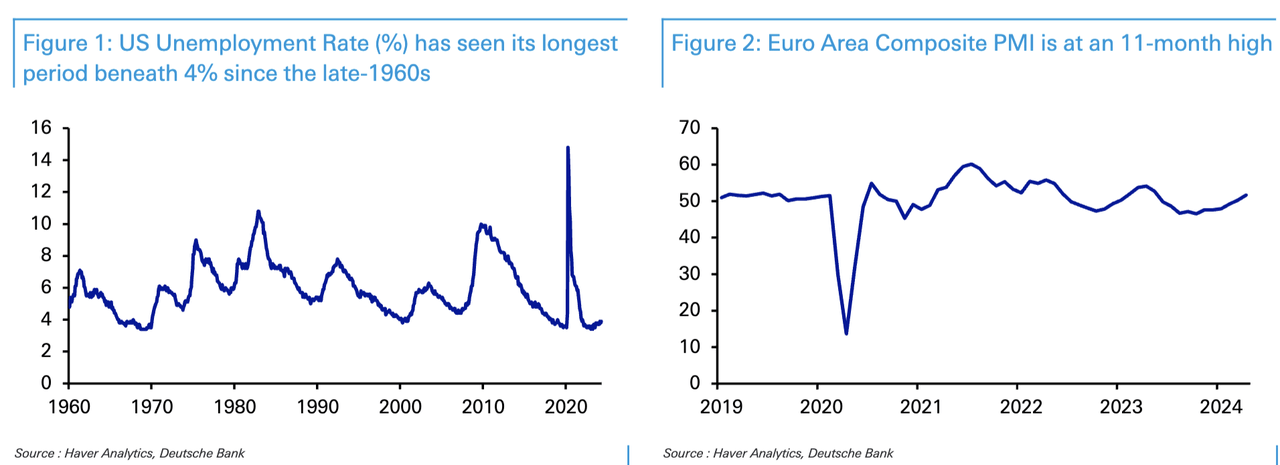

According to Allen, the U.S. economy remains strong, with unemployment staying below 4%. Euro-area growth is on the rise after a stagnant period, and China’s Q1 GDP growth stood at 5.3%, surpassing expectations.

Impact of Federal Reserve Comments

Following the April meeting, Powell’s statement that a rate hike is unlikely diminished market concerns after alarming inflation data. Consequently, investors adjusted rate cut expectations, reflecting a positive market sentiment.

Oil Price Trends

Brent crude at approximately $83/barrel reached its lowest level in nearly two months, attributing the decrease to geopolitical tensions easing. This development has helped push down inflation expectations, a positive sign for the market.

Resilience to Rate Hikes

Despite quick rate increases, the global economy has not experienced a significant downturn. Challenges like the Silicon Valley Bank collapse have been contained. The economy has been gradually adapting to the current rate environment, indicating resilience.

Absence of Recession Indicators

While certain indicators, such as the 10-year yield falling below the 2-year yield, have historically signaled recessions, the extended inversion since July 2022 has not yet led to a recession. Despite some negative signs, a recession has not materialized.