So far this year, the world’s leading AI chipmaker – Nvidia (NVDA) – has made it abundantly clear that the AI Boom is here. And the party’s just getting started.

The tech firm reported in February that its revenues rose more than 260% in the last quarter of 2023. And management also said that revenues will rise another 230% this quarter, too.

That’s got the mainstream media and most investors obsessing over Nvidia’s hyperbolic growth.

Then, in March, the company kicked off its GPU Technology Conference (GTC) with a keynote speech from CEO Jensen Huang. Huang headlined his keynote speech with the launch of Blackwell — Nvidia’s next-gen chip architecture that will enable the creation of faster, smaller, and better AI chips.

Meanwhile, the most important players in this industry – including Nvidia itself – have already moved on to the next big thing: something we’re calling AI 2.0.

We’ve been following these developments for a while now. We’re confident it will be the next wave of major AI growth. And it seems it’s just now hitting its major inflection point.

In fact, we just learned that Nvidia itself is betting big on this next iteration.

And it isn’t alone.

Microsoft (MSFT) – the world’s largest AI company – is betting big on AI 2.0, too.

So are OpenAI, the world’s most influential AI startup, Amazon (AMZN), Tesla (TSLA), and Samsung. Not to mention the world’s richest men, Elon Musk and Jeff Bezos.

Right now, all are pouring millions of dollars into AI 2.0.

AI 2.0 Emerges: The Era of AI-Powered Robots

So, what exactly is AI 2.0?

The real-world application of AI technologies via humanoid robots.

Yes, I’m talking about AI-powered robots like the ones you’ve seen in science-fiction movies like “iRobot.”

This application may seem like a pie-in-the-sky dream. But humanoid robots are already in development. This new AI wave is here.

Don’t believe me? Well, Nvidia also recently announced the introduction of the Project GROOT Foundation AI model, designed to enhance the performance of humanoid robots, alongside a new system-on-a-chip named Thor for robotic use.

This move comes as notable companies such as OpenAI, Microsoft (MSFT), Tesla (TSLA) (more on that in a moment), Amazon (AMZN), and Intel (INTC) heavily invest in humanoid robot development. With Nvidia joining the fray, the advent of sophisticated robots appears imminent. And we’re head over heels for this compelling investment opportunity in AI robotics.

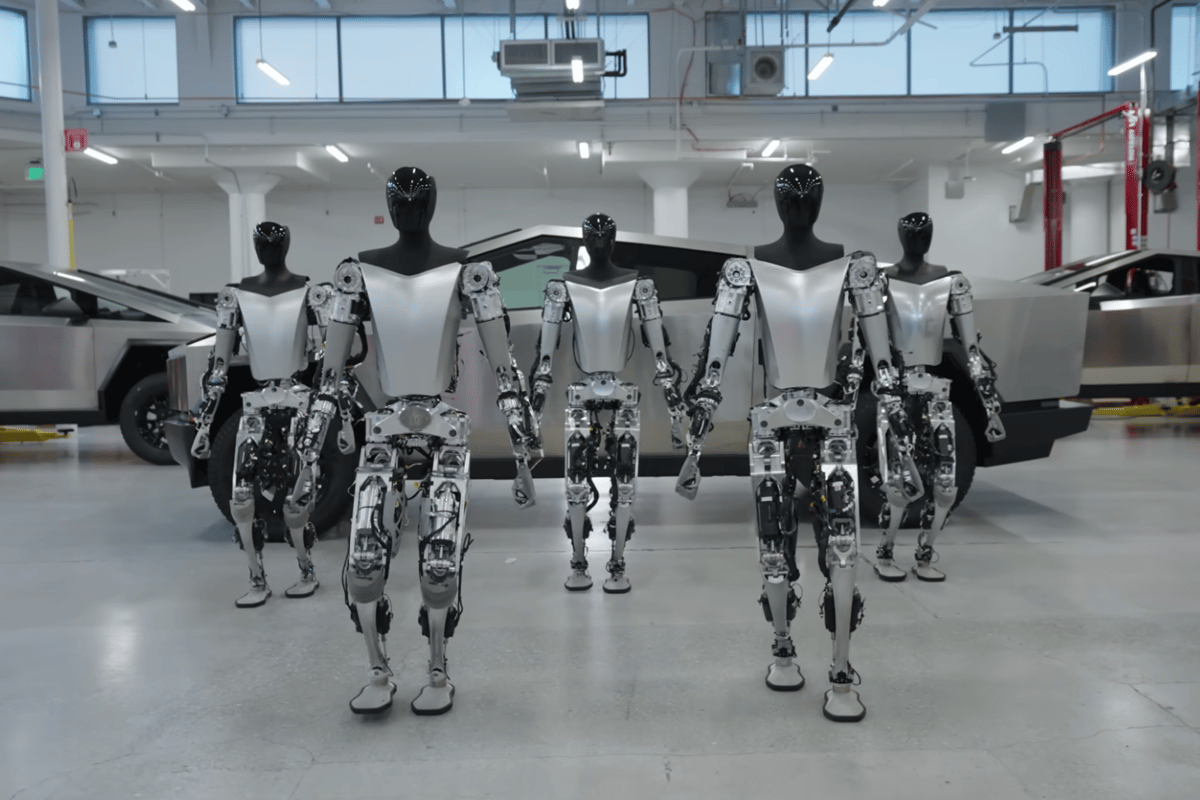

In fact, as I write, Tesla is busy developing a humanoid robot called Optimus. And already, it can do things like fold clothes, make eggs, exercise, and dance.

Tesla sees a world in the not-too-distant future where these robots are everywhere, helping people all across the globe complete menial tasks like cooking, cleaning, organizing, and more.

The Verdict

Folks, it seems the writing is on the wall.

You may think of AI-powered humanoid robots as a mere sci-fi concept.

But as with the world’s most powerful people, the foremost AI innovators clearly think humanoid robots are the next frontier, too.

They see them as AI 2.0. And they’re dedicating millions of dollars to create this tech right now.

We believe we’re seeing this boom’s next evolution unfold right now. And that means it’s time to grab your slice of the pie.