Despite surpassing revenue and earnings projections during its fiscal second quarter report, Deere & Company’s DE stock faced a 5% decline in Thursday’s trading session after lowering its fiscal 2024 net income guidance.

Given its prominent position as a pioneer in the manufactured agricultural equipment market, investors are contemplating the decision to capitalize on the recent dip in Deere’s stock, particularly in light of its robust historical track record.

Reviewing the Second Quarter Performance

Deere’s Q2 net income reached $2.37 billion or $8.53 per share, outperforming the Zacks Consensus of $7.86 per share by 8%. In terms of revenue, Q2 sales of $13.61 billion exceeded estimates by 2%, reaching $13.25 billion.

On a year-over-year basis, Q2 earnings experienced an 11% decline from $9.65 per share in the corresponding period, attributed to elevated operating costs, while sales dwindled by 15% due to reduced volumes. Remarkably, Deere has exceeded earnings projections for the last seven quarters and sales estimates for eight consecutive quarters.

Image Source: Zacks Investment Research

Insights on Guidance and Outlook

Deere adjusted its forecast for fiscal 2024 net income downward, now estimating it at $7 billion compared to the previously provided range of $7.5-$7.75 billion in February.

This revision is primarily due to a projected 15% decline in the large agriculture sector in the U.S. and Canada, with the small agriculture and turf sales expected to drop by 20%.

Tracking Deere’s Growth and Valuation

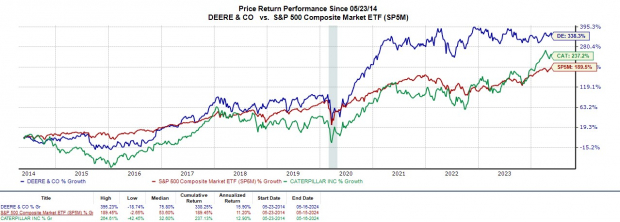

Deere’s stock has observed a 1% decline year-to-date, yet shows a 7% increase over the past year, albeit trailing behind the S&P 500 at 28% and notably lagging behind Caterpillar’s CAT at 65%. Over the past five years, Deere’s 192% growth slightly surpasses Caterpillar’s 186% and significantly outperforms the S&P 500’s 89%.

Furthermore, in the last decade, Deere’s stock surged by 338%, impressively outpacing Caterpillar’s 237% and the benchmark index’s 189%.

Image Source: Zacks Investment Research

The Verdict on Price and Potential

Currently valued at $394, Deere’s stock is trading at 15.1 times forward earnings, slightly below its five-year median of 16.1X and significantly lower than its peak of 33.1X. This represents a notable discount compared to the S&P 500’s 22.2X and is closer to Caterpillar’s 16.5X.

Image Source: Zacks Investment Research

Final Thoughts

Deere’s stock currently holds a Zacks Rank #3 (Hold). While the slowdown in agricultural activities may present better buying opportunities, the company’s reasonable valuation and strong historical performance indicate that long-term investors could still benefit from the current price levels.