Favorable Trends Signal Steady Growth

The Q1 earnings season unveiled a resilient profitability landscape, showcasing a blend of growth rate and evolving revision trends. While positive revenue surprises were less frequent, margins exhibited stronger-than-anticipated expansions.

- Statistics indicate a 4.8% rise in earnings for the 461 S&P 500 members who reported Q1 results, accompanied by a 4.1% increase in revenues. Notably, 77.4% surpassed EPS estimates, with 59.7% beating revenue estimates.

Comparatively, the pace of earnings and revenue growth for these 461 index members shows a slight uptick from previous periods. The initial +4.8% growth accelerates to +11.4% after accounting for the Energy sector and Bristol Myers’s one-time charge.

- Looking ahead to 2024 Q2, S&P 500 earnings are projected to soar by +9.1% from the corresponding period in the previous year, on the back of a +4.5% increase in revenues. Estimates have been on an upward trajectory since early April, with current growth reaching +9.1% compared to +8.7% at the start of the month.

In recent weeks, revisions in estimates have shown an upward swing for both the current quarter (2024 Q2) and full-year 2024 projections. This optimistic trajectory began with the onset of Q1 earnings reports, with sectors like Tech and Retail experiencing prolonged positive estimate revisions.

Charting Growth Trajectory

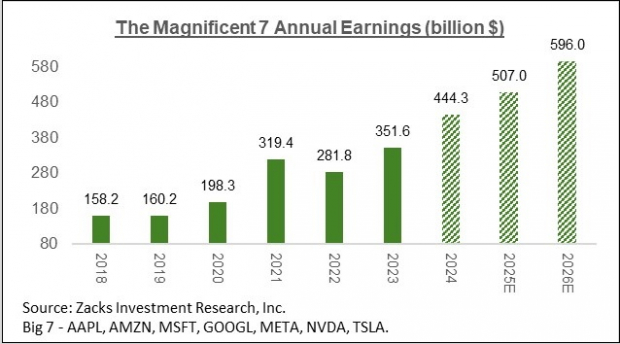

Focus is now on the ‘Magnificent 7’ stocks, with an aggregate earnings forecast depicted below:

Aggregate earnings are forecasted to reach $444.3 billion in 2024, marking a sequential increase from $443.9 billion in the prior week and $438.1 billion two weeks prior. Notably, despite negative revision trends for Tesla and Apple, optimistic projections for the remaining five members outweigh any adverse effects.

One standout among this group is Nvidia, showcasing a unique growth trajectory:

The semiconductor sector’s full-year earnings estimate evolution over the past year is charted below:

Furthermore, the S&P 500’s aggregate earnings estimates for full-year 2024 are visualized here:

An overview of quarterly earnings trends is captured in the following chart:

Lastly, the annual aggregated earnings perspective for the S&P 500 index can be seen below:

An important driver of this year’s earnings upswing is the anticipated reversal in margins to pre-pandemic levels, with the Tech sector spearheading the gains.

It is crucial for investors to stay informed about the latest market trends and earnings insights for making well-informed decisions.