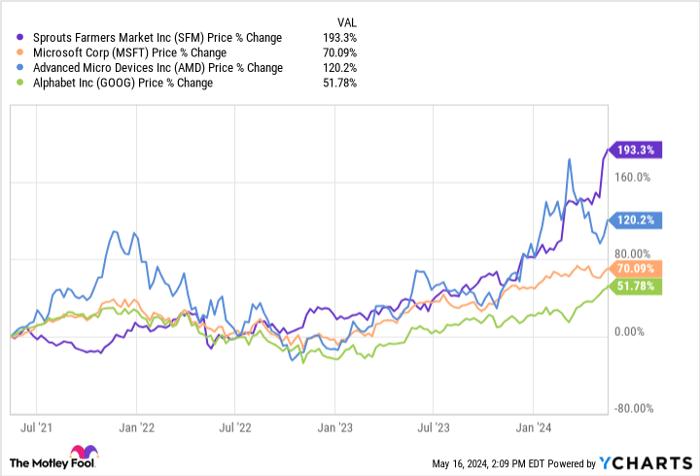

While tech leaders like Microsoft, Alphabet, and Advanced Micro Devices have been riding the artificial intelligence (AI) wave to impressive stock market gains, there’s a silent victor in the market arena. Sprouts Farmers Market (NASDAQ: SFM), a modest chain of grocery stores, has stealthily outpaced the growth of its tech counterparts with no AI connection in sight. In an era dominated by buzzwords, Sprouts Farmers Market exemplifies the age-old wisdom of unearthing undervalued companies with solid growth prospects.

Over the past year, Sprouts Farmers Market has more than doubled in value, leaving behind not only the tech giants but also boasting nearly triple the growth of Microsoft, Alphabet, and AMD over the last three years. The stock’s remarkable ascent speaks volumes about the efficacy of its unconventional strategy in the market.

Small but Mighty: Curated Store Concept

Contrary to the sprawling emporiums of major supermarket chains, Sprouts operates relatively petite stores, averaging about 30,000 square feet for older locations and even smaller footprints for newer outlets around 23,000 square feet. This distinction not only slashes construction and operational expenses but also positions Sprouts in niche neighborhoods where mammoth supermarkets would struggle to fit. The trimmed-down stores have proven to be instrumental in its agile expansion strategy.

At the heart of Sprouts’ ethos lie two core pillars: a robust focus on fresh produce and a thoughtful curation of attribute-based products. The retailer boasts an expansive produce section offering competitively priced goods, consistently undercutting competitors on price. Furthermore, approximately 70% of Sprouts’ inventory comprises attribute-based items such as gluten-free, organic, vegan, and non-GMO products. This deliberate product selection, tailored to appeal to affluent and educated consumers, allows Sprouts to carve a distinctive niche in the market.

Potential for Growth: Expansion Plans

As validated by its strong performance, Sprouts’ business model is bearing fruit. The company recorded a 4% increase in comparable-store sales in the first quarter of the year and anticipates 3% to 4% growth for the full year. Projections suggest that adjusted earnings per share will surpass $3 this year, an impressive surge from $1.25 in 2019.

In a move signaling ambitious expansion, Sprouts plans to inaugurate 35 new stores in the current year and aims for a 10% yearly growth in store count from 2025 onwards. The company eyes over 300 new outlets across its expansion markets, spanning regions like Texas, California, Florida, and parts of the East Coast. This strategic growth trajectory positions Sprouts as a formidable contender in the grocery retail landscape.

Despite its remarkable stock performance, Sprouts Farmers Market’s forward earnings multiple of about 25 reflects a reasonable valuation. With projected store expansion, stable profit margins, and envisaged double-digit annual earnings growth, Sprouts remains an attractive investment prospect. Additionally, given its distinct market positioning, Sprouts could emerge as a prime acquisition target for larger chains seeking growth avenues.

In a volatile industry characterized by shifting consumer preferences, Sprouts’ resilience and expansion plans bode well for its long-term prospects. While duplicating its meteoric rise may prove challenging, Sprouts Farmers Market stands as a sturdy investment choice in the foreseeable future.

Conclusion: Hidden Gem or Fool’s Gold?

Before diving into Sprouts Farmers Market, investors should weigh their options carefully. While Sprouts presents a compelling growth story, investment decisions should be informed by a comprehensive understanding of market dynamics and potential risks. As history has shown, prudent investments yield substantial returns in the long haul.

As we navigate the ever-evolving financial landscape, Sprouts Farmers Market’s unlikely triumph offers a poignant reminder that in the cacophony of market trends, overlooked gems can sometimes shine the brightest.