An Apple a Day Keeps the Investors in Play

Investors have been eyeing Apple Inc. (AAPL) as a top contender on Zacks.com, reflecting a surge of interest in this technology giant. With a solid reputation for innovation and cutting-edge products, Apple’s stock performance has been outshining the broader market, with a remarkable return of +13.7% over the past month, compared to the Zacks S&P 500 composite’s +5% change. Within the Zacks Computer – Mini computers industry, Apple has also held its ground with a gain of 12.1%. As investors flock towards this tech titan, it begs the question: What lies ahead for this corporate force?

Earnings Projections: Peering into the Crystal Ball

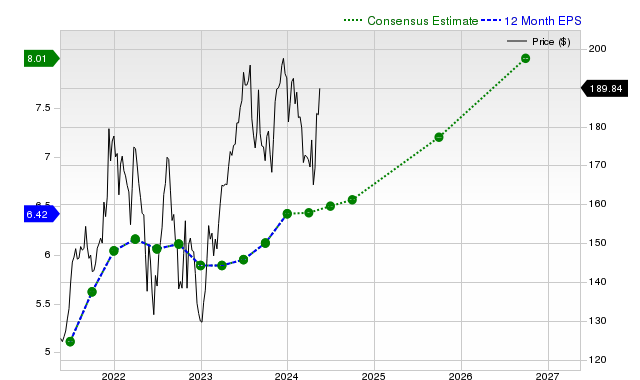

At the heart of any investment strategy lies the prediction of future earnings. At Zacks, we closely monitor earnings estimate revisions as a compass guiding us through the murky waters of stock performance. Analysts painting a brighter picture for a company translates into an uptick in its stock value. Apple is anticipated to deliver earnings of $1.33 per share for the current quarter – a modest year-over-year change of +5.6%. As the Zacks Consensus Estimate takes flight with a +1.4% change over the last 30 days, all eyes are on the projection of $6.57 for the current fiscal year, signaling a growth of +7.2%. Looking ahead, the consensus earnings estimate for the next fiscal year stands at $7.20, marking a notable +9.6% variance from the previous year’s performance.

Revenue Growth: Fueling the Future

Earnings growth may be the sweetheart of the stock market, but revenue is the sturdy backbone that underpins it all. Apple’s future revenue estimates paint a picture of steady growth with a +1.7% year-over-year change totaling $83.16 billion for the current quarter. Looking further ahead, the estimates for the current and next fiscal years stand at $384.62 billion and $405.72 billion, showcasing changes of +0.4% and a promising +5.5%, respectively.

A Glimpse at Past Performance and Valuations

Reflecting on Apple’s recent past reveals a pattern of triumph, with impressive revenue figures and consistent EPS surprises. Beating consensus estimates in each of the trailing four quarters, Apple is striking a chord with investors. However, a critical look into the valuation metrics may sound a note of caution. Comparing Apple’s current valuation multiples to its historical values and industry peers, the Zacks Value Style Score gives Apple a ‘D’, indicating that it is trading at a premium compared to its peers. Cautious optimism is the mood of the day.

Wrapping Up: Investing In App(le)tizing Prospects

In the tumultuous arena of the stock market, Apple remains a star player, attracting investors with its innovative prowess and solid financial track record. While the Zacks Rank #3 (Hold) suggests a balanced performance in the near term, investors are advised to tread carefully and keep a close eye on the evolving landscape of this tech giant. The future holds promise, but careful navigation is the name of the game.