Amidst the roaring bull markets, investors often find themselves gravitating towards benchmarking, a practice involving comparing their portfolio’s performance against a key index, typically the S&P 500. While heavily promoted by Wall Street and the media, benchmarking may not always be the right path for every investor.

Comparing to Compete: Wall Street’s Foray

The tendency to compare breeds discontent and insecurity, evident in the myriad of marketing gimmicks promising better results in various fields. The financial realm is no exception to this culture of competition.

Investors frequently get sidetracked by benchmarking, hindering their ability to remain patient and steadfast in their chosen investment strategies.

Furthermore, the financial services industry thrives on unsettling its clients by juxtaposing their returns with broader market indices, goading them to make hasty decisions.

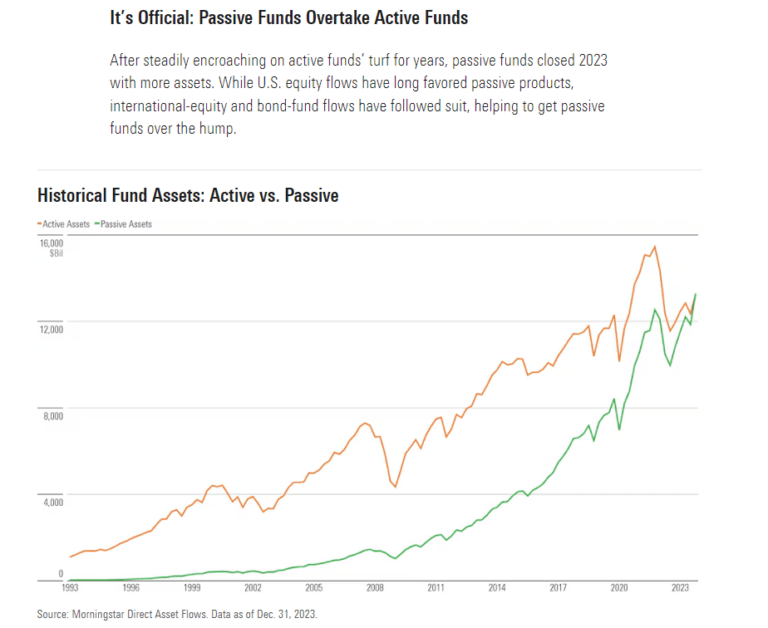

This relentless comparison culture has led to a surge in indexing recommendations by financial advisors. As active fund managers struggle to outperform benchmark indices consistently, the popularity of passively managed funds has soared, contributing to reduced market liquidity.

However, this shift towards indexing has sparked a concerning trend of asset concentration. The top seven companies in the S&P 500 now command a market capitalization of over $12.3 trillion, overshadowing the $3 trillion market cap of the Russell 2000 index, comprising 2,000 small-cap stocks.

While this data may shock many, it underscores a critical risk associated with benchmarking portfolios.

Unveiling the Peril: Market Cap Weighting

Modern portfolio construction often involves aligning investments with personal preferences and subsequently measuring performance against an index. However, this benchmarking practice has become substantially riskier in recent times.

The rising dominance of passive index investing has exacerbated the issue of asset consolidation. With each inflow into indexed funds, a proportionate chunk of the investment flows into the top market capitalization-weighted companies, skewing the market further.

Investors benchmarking their portfolio against such indices face heightened risks, particularly if a significant portion of their holdings align with the top 10 stocks in the index. This market cap concentration amplifies the portfolio’s risk profile beyond investors’ expectations.

Efforts to consistently outperform the index pose an even greater challenge.

History serves as a stern reminder of the perils of relentless benchmark-beating pursuits. Notable names like Bill Miller and Peter Lynch, who enjoyed periods of outperformance, eventually succumbed to market forces.

The stark reality is that achieving 15 consecutive years of beating the S&P 500—the extraordinary feat accomplished by Bill Miller—is a rarity, with odds estimated at 1 in 2.3 million.

Achieving Long-Term Success: Strategic Portfolio Management

Mainstream benchmarking analyses often emphasize short-term performance, overshadowing the value of long-term strategic investment strategies. While passive index investments may lag due to operating fees, a well-managed portfolio can outperform over extended periods.

While fund managers may not consistently beat the index annually, diligent investment strategies can yield significant outperformance with lower risk over time.

A comparison of long-term track records of renowned mutual funds against the S&P 500 index highlights the potential for quality actively managed funds to outperform consistently without relying on concentrated holdings in a few stocks.

For investors aiming to surpass average returns over extended periods, the cumulative benefits of slightly above-average returns annually can catapult them ahead of a vast majority of their peers, an achievement far more significant than fleeting short-term victories.

The Only Question That Matters

Investors seeking the secret to picking the top-performing funds for the year are in for a harsh reality check. There are no shortcuts, no magical formulas that will lead to extraordinary gains. The quest for elusive strategies often ends in frustration and disappointment for those who chase after them.

It is tempting to compare your investment portfolio to the S&P 500, a widely used benchmark. However, such comparisons are akin to comparing “apples to oranges.” The unique advantages enjoyed by the index, such as share buybacks, tax benefits, and low trading costs, give it a significant edge over individual investors.

Furthermore, traditional performance reviews often overlook the crucial element of risk adjustment. Failing to consider the right way to quantify risk can lead to misguided investment decisions and unrealistic expectations. It is essential to approach benchmark comparisons with caution and a critical eye.

“But it gets worse. Often times, these comparisons are made without even considering the right way to quantify ‘risk’. That is, we don’t even see measurements of risk-adjusted returns in these ‘performance’ reviews. Of course, that misses the whole point of implementing a strategy that is different than a long only index.

It’s fine to compare things to a benchmark. In fact, it’s helpful in a lot of cases. But we need to careful about how we go about doing it.” – Cullen Roche

The pivotal question in the active versus passive investing debate boils down to a fundamental choice: Is it more crucial to match an index’s performance during a bull market, or to safeguard your capital during a bear market?

“What’s more important – matching an index during a bull cycle, or protecting capital during a bear cycle?”

It’s an either-or situation. Those who strive to mimic an index’s performance in a bull market are likely to suffer equal losses when the market turns bearish. On the other hand, actively managing your investments with a focus on risk mitigation may lead to underperformance in a bull market, but it can shield your capital during downturns, preserving your long-term financial objectives.

Investing should not be treated as a competition but as a means to achieve personal financial goals. Instead of fixating on daily market fluctuations or benchmark movements, align your portfolio with your unique objectives, time horizon, and risk tolerance.

While you may not outperform the index in the long run, staying true to your investment goals is a more reliable path to financial success. History is replete with examples of the perils of chasing benchmark performance without considering individual circumstances and objectives.