Breaking Out into New Heights

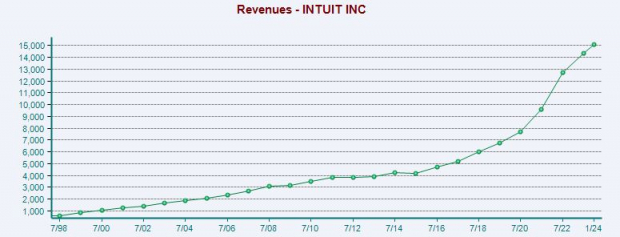

The emblematic saying ‘Death and taxes’ resonates for eternity. Intuit, a financial software powerhouse, epitomizes sustained growth with figures ballooning from sub-billion to over $14 billion in the fiscal year 2023. Bolstered by the pandemic-induced surge, Intuit has seamlessly broadened its product portfolio from tax solutions to varied consumer financial services, email marketing, and digital advertising realms.

Positioned for Growth

Intuit’s roster of over 100 million customers spans TurboTax, QuickBooks, Credit Karma, and Mailchimp, tapping into thriving market segments poised for perpetual relevance. While TurboTax commands consumer visibility, only constituting 29% of 2023 revenues, Credit Karma’s personal finance vertical stood at 11%. Small business and self-employed services made up the lion’s share, accounting for 56% of fiscal 2023 sales.

Financial Fortunes Ahead

Forecasts predict Intuit’s revenue to surge by 12% in both FY24 and FY25, accentuating a decade-long streak of double-digit sales expansion culminating in a leap from $14.37 billion in FY23 to a projected $18.00 billion in FY25. Enhanced by a Zacks Rank #2 (Buy), Intuit’s consistent earnings growth is anticipated to escalate by 14% for FY24 and a further 15% beyond.

Performance Prowess and Valuation

Intuit has dismantled the Zacks Tech sector over the past two decades, trumping Microsoft by an astounding 3,300% and eclipsing its own prior records by a soaring 740% despite trading at 51.7X forward 12-month earnings. Its impressive growth trajectory, reinforced by robust analyst endorsements and a 15% increase in the FY24 dividend, signifies a compelling investment proposition.

The Final Verdict

Intuit’s buyback initiatives, coupled with a shareholder-friendly dividend policy, underscore a company that continues to innovate and propel itself to new heights. With a resounding vote of confidence from the brokerage sphere and an unyielding appetite for growth, Intuit stands out as a beacon of success in the tech sector.