The U.S. economy continues its steady pace, slightly slowing down under the Fed’s tightened monetary policy. Anticipation of rate cuts was dampened by inflation spikes earlier this year. The job market remains robust, sustaining consumer spending despite the depletion of Covid savings.

Consumer Spending Amidst Economic Shifts

While overall consumer spending remains stable, preferences have shifted post-Covid towards services like leisure and away from physical goods. This change impacts companies like Walmart and Target differently, with Walmart’s focus on groceries catering well to the current market.

Q1 Retail Earnings Season Analysis

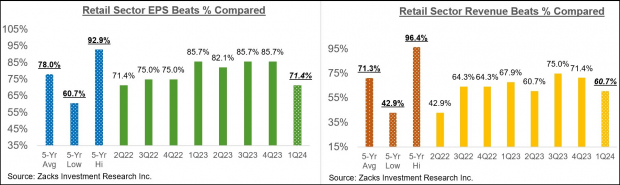

As 28 of the 34 S&P 500 retailers have reported Q1 earnings, results indicate a 32% earnings increase compared to the previous year, with a 5.6% rise in revenues. The sector showcases a mixed performance, with notable figures like Amazon significantly outperforming expectations.

The Impact of Amazon and Evolving Retail Landscape

The merging of digital and physical retail is exemplified by Amazon’s substantial growth and traditional retailers adapting to online platforms. This trend, accelerated by Covid lockdowns, reshapes the retail sector.

Current Economic Landscape and Future Projections

While lower-income brackets experience some financial strain due to inflation outpacing wage growth, the overarching labor market strength and rising wages provide a cushion. However, the uncertain economic climate warrants caution.

Analysis of Q1 Earnings and Future Outlook

With a majority of S&P 500 companies having released their Q1 results, a 7% earnings increase from last year is evident. Despite challenges like energy sector declines, the overall trend showcases a positive trajectory.

Long-Term Growth Expectations

2024 Q1 earnings are projected to rise by 6.8%. This growth, alongside a 4.3% revenue increase, demonstrates a steady momentum in line with previous quarters. Market analysts focus on sustained growth for the upcoming periods.

Unpacking the Earnings Landscape: A Comprehensive Analysis of Q1 and Q2 Projections

Contrasting Effects of Tech and Energy Sectors on Growth Outlook

When analyzing the current earnings landscape, it becomes evident that the Tech and Energy sectors are playing distinct roles in shaping the growth trajectory. Should we exclude the influence of the Tech sector, Q1 earnings for the rest of the index would reflect a concerning -0.7% decline. In stark contrast, if we exclude the Energy sector, the growth pace sees a notable improvement, standing at a promising +9.7%.

Q2 Projections: Bright Horizons Ahead

Anticipating the upcoming period of 2024 Q2, S&P 500 earnings are forecasted to surge by a significant +9%, supported by a noteworthy +4.6% rise in revenues. This positive shift in projections hints at a potentially lucrative period for investors.

Favorable Revisions Trend for Q2 Estimates

The trend of revisions for Q2 estimates has been notably favorable, portraying an optimistic outlook for the upcoming period. This trend underscores a potential upswing in performance that investors can look forward to.

Annual Earnings Forecast for 2024

Concerning the broader annual earnings forecast for 2024, total S&P 500 earnings are poised to witness a robust +9% increase, accompanied by a steady +1.6% growth in revenue. This sustained growth trajectory bodes well for market stability and investor confidence.

Navigating the Investment Landscape: What Lies Ahead?

As the market navigates choppy waters influenced by various sectors, the contrasting effects of the Tech and Energy sectors underscore the need for a nuanced investment approach. Investors must remain vigilant, leveraging insights from projections to guide strategic decisions.

The Presidential Election Factor in Market Resilience

Reflecting on historical data, it becomes apparent that presidential election years have been moments of remarkable market resilience. Despite political uncertainties, the market has historically exhibited bullish tendencies, irrespective of party wins. This historical perspective sheds light on enduring market dynamics amid political shifts.

Strategic Insights: Stocks with Potential Upside

Amid evolving market conditions, specific stocks stand out with the potential for remarkable growth:

- Medical Manufacturer: With a staggering +11,000% growth over the last 15 years, this company exemplifies long-term growth potential.

- Rental Company: Demonstrating sector dominance and outperformance, this company presents compelling opportunities for investors.

- Energy Powerhouse: Noteworthy plans to enhance dividend growth by 25% highlight potential returns for investors.

- Aerospace and Defense Standout: Securing a substantial $80 billion contract, this company showcases strong growth prospects in its industry.

- Giant Chipmaker: With ambitious plans for U.S. expansion, this company emerges as a key player in the semiconductor landscape.

This curated selection embodies potential growth avenues that investors can explore, aligning with varying market scenarios and economic shifts.