Intriguing Investment Options on the Horizon

Brace yourselves, investors, for two consumer discretionary stocks that have been soaring towards the Zacks Rank #1 (Strong Buy) list over the past month – none other than the esteemed cruise line operators, Norwegian Cruise Line NCLH and Royal Caribbean Cruises RCL.

As the spring and summer seasons beckon peak travel aspirations, Norwegian and Royal Caribbean’s stocks seem to be shimmering with undervalued potential at their current standing.

Post-Pandemic Recovery & Growth Trajectories

A good three years removed from the depths of the COVID-19 crisis, the cruise industry’s resurgence appears robust and vigorous.

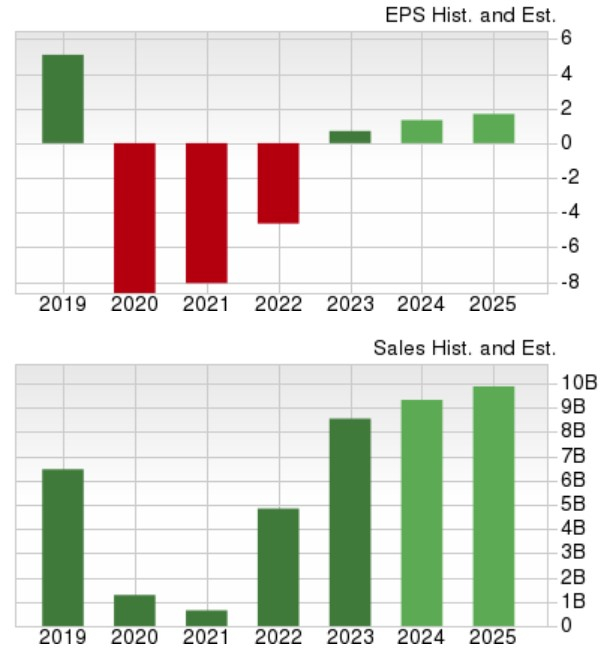

Notably, Norwegian is forecasted to witness a 9% surge in total sales in fiscal 2024, followed by an additional 6% rise in FY25 to an impressive $9.93 billion. What’s more, expectations are high for a staggering 94% spike in annual earnings for Norwegian this year, reaching $1.36 per share compared to the $0.70 per share in 2023. And looking ahead, a further 27% increase is foreseen to $1.73 per share in FY25.

While Norwegian’s profits are not yet matching the pre-pandemic glory days of $5.09 per share in 2019, the company has already surpassed the pre-COVID sales figures of $6.46 billion in that year.

Image Source: Zacks Investment Research

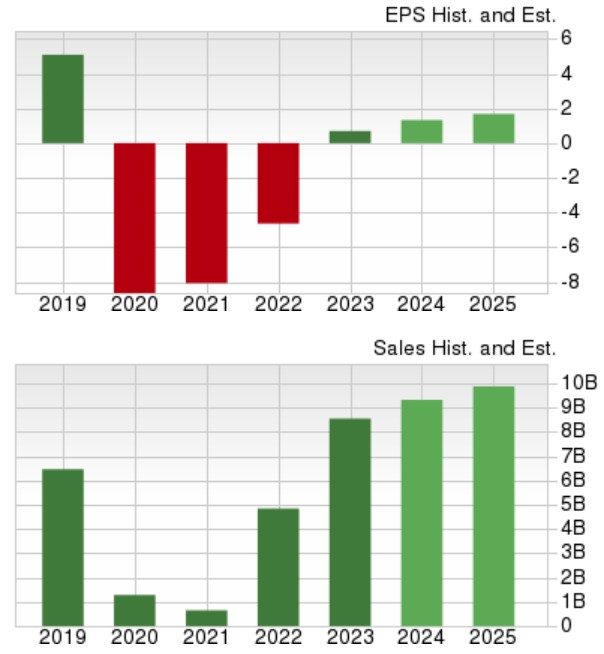

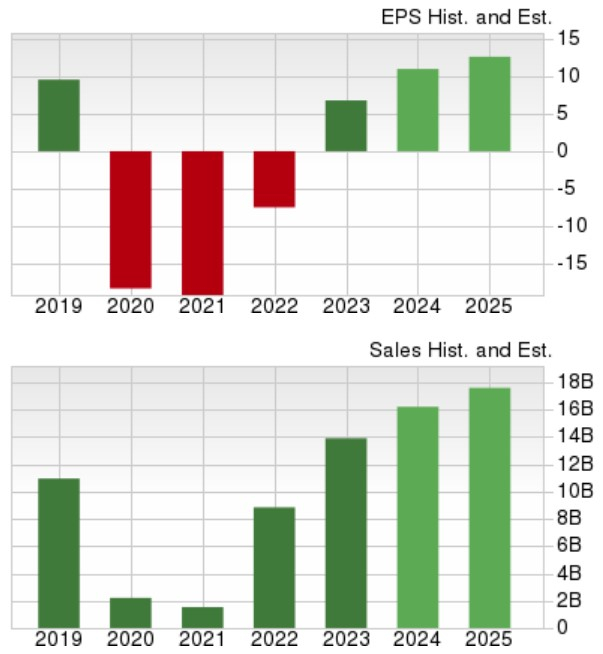

Moving on to Royal Caribbean, its revenue is anticipated to climb by 16% in FY24 and a further 9% in FY25, reaching $17.63 billion. The cherry on top – Royal Caribbean’s yearly earnings are on a growth trajectory, expected to soar by 62% in FY24 to $10.96 per share, compared to $6.77 per share the previous year. Forecasts are also optimistic for another 15% EPS growth in FY25. Remarkably, Royal Caribbean is poised to surpass its pre-pandemic earnings of $9.54 per share in 2019, having already exceeded pre-COVID sales of $10.95 billion.

Image Source: Zacks Investment Research

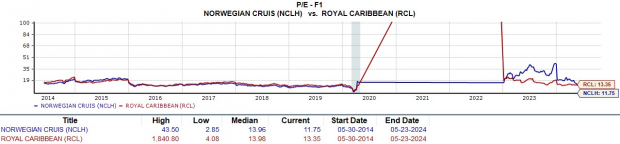

Attractive P/E Valuations

Adding allure to Norwegian and Royal Caribbean’s post-pandemic rebound journey are their inviting P/E valuations. Norwegian’s shares are priced at 11.7 times forward earnings, with Royal Caribbean at 13.3 times – a substantial markdown from the Zacks Leisure and Recreation Services Industry average of 18.7 times and the S&P 500’s 22.1 times.

Image Source: Zacks Investment Research

Bottom Line

On top of the rebound story and enticing P/E ratios, the upward trajectory of earnings estimates for Norwegian Cruise Line and Royal Caribbean in FY24 and FY25 continues to point skyward. This bolstering trend emphasizes the notion that Norwegian and Royal Caribbean’s stocks remain tantalizingly undervalued, with lingering potential to soar beyond their current heights.

Celestial Directions

Northward? Southward?

The enigmatic paths awaiting these stocks post-election are a conundrum. Through the historical looking glass, post-midterm years seldom cast a shadow on presidential election years. With citizen zeal lighting the way, the market is typically dressed in bullish hues, regardless of political attire!

i

Could it be that the meteoric rise predicted in the graphs is merely a mirage, or will these stocks indeed unfurl their full sails towards the bright horizon?