Warren Buffett, a titan in the investment world, made waves with his recent decision to sell 116 million shares of Apple.

The renowned investor once hailed Apple as “probably the best business I know in the world” just three years ago. So, what prompted this significant divestment?

Delving into Buffett’s Strategy

Buffett’s traditional aversion to the technology sector is well-documented, with his historical investment focus on banks, insurance companies, and consumer goods.

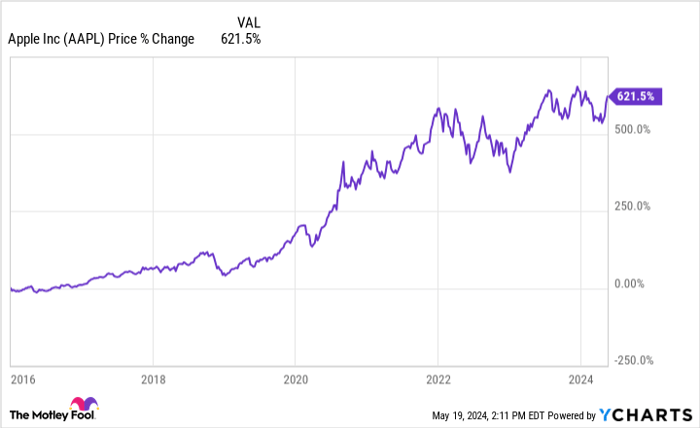

However, Buffett was drawn to Apple due to its robust cash flow generation, a criterion he values highly. His 2016 investment in Apple proved fruitful, with the stock soaring over 600% in the intervening years.

Reading Apple’s Tea Leaves

Berkshire’s recent filing revealed the shedding of Apple shares to mitigate potential future capital gains taxes. Despite reducing his holding by 13%, Apple still constitutes a substantial 41% of Berkshire’s portfolio.

Assessing Apple’s Prospects

While Apple remains Buffett’s top position, concerns linger around its future growth potential. Trading at a premium to the market with a forward P/E ratio of 28.8, the company faces challenges such as muted AI ambitions and declining revenues.

Although Buffett’s long-term investment philosophy remains steadfast, for investors seeking higher growth avenues, a cautious approach to Apple might be prudent until signs of a turnaround emerge.

Unlocking the Secrets to Stock Performance: Lessons from Nvidia’s Historic Rise

Before diving headfirst into the enticing world of Apple stock, let’s take a step back and dwell on the tales of NVIDIA, a stock that skyrocketed to unforeseen heights back in the day.

The Motley Fool’s Perspective

The heralded Motley Fool Stock Advisor analyst team has uncovered a treasure trove – the 10 best stocks destined for greatness, and surprisingly, Apple did not make the cut. These selected 10 hold the promise of delivering gargantuan returns in the forthcoming years.

If we rewind the clock to April 15, 2005 – an epoch marked by Nvidia’s grand entrance onto this list – ponder this: an investment of $1,000 at the time could have morphed into a jaw-dropping $635,982! A testament to the euphoric heights that NVIDIA ascended back then!

Stock Advisor’s Track Record

The Stock Advisor service is a beacon of hope for novice and seasoned investors alike, offering a roadmap to financial triumph. From crafting a diversified portfolio to receiving regular insights from esteemed analysts and unveiling two new stock picks each month, this service has outshone expectations. It has not only quadrupled but dwarfed the S&P 500’s returns since its inception in 2002, painting an awe-inspiring picture of its impact.

For those yearning for a peek behind the curtain and a chance to explore the top 10 stocks that the Stock Advisor team vouches for, let curiosity be your guide. The allure of uncovering hidden gems in the stock market is a quintessential thrill that can lead to incredible rewards.

Past Performance as a Glimpse into the Future

As we unravel the historical tapestry of NVIDIA’s meteoric rise, there’s a lesson to be learned – the stock market is brimming with opportunities for those daring enough to seize them. Stock Advisor‘s meticulous methodology and track record showcase that success in the stock market is not merely a fleeting dream but a tangible reality for those who dare to tread the unconventional path.

Though the landscape may shift and the winds of change may blow unpredictably, the fundamentals of smart investing remain constant. NVIDIA’s unprecedented surge stands as a reminder that with diligent research, prudent decision-making, and a dash of luck, the stock market can be a realm where dreams are not only envisioned but realized to their fullest extent.

Let the ghosts of Nvidia’s past guide your present decisions, steering you towards a future where smart investments pave the way for financial prosperity.