Precarious Political Maneuvers Impact Steel Market

This month, President Joe Biden announced new tariffs targeting Chinese electric vehicles (EVs), solar cells, batteries, steel, aluminum, and medical equipment. These tariffs are a strategic move to support American industries amidst ongoing trade tensions with Beijing. The announcement has not only sparked a political clash with Biden’s predecessor but also ignited warnings from Chinese authorities, labeling the move as “bullying.”

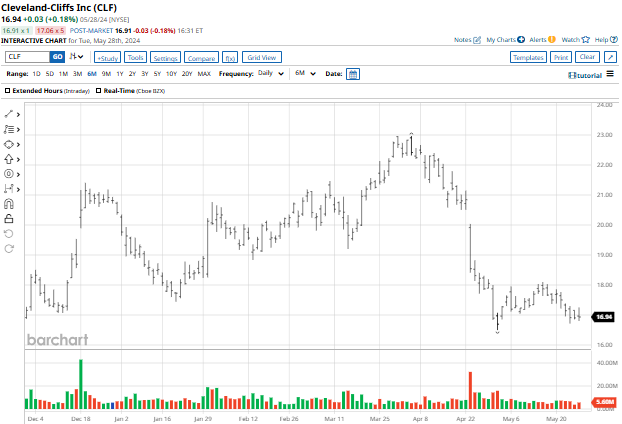

Cleveland-Cliffs Stock Underperforms

Cleveland-Cliffs Inc (CLF), a North American flat-rolled steel producer, has seen its stock plummet 17% year-to-date, lagging behind the broader market. Despite this downturn, the company’s market capitalization stands at $8.05 billion. However, with an EV/sales multiple of 0.56x and EV/EBITDA of 6.98x, analysts believe the stock might be undervalued relative to industry peers and historical metrics.

CLF Misses on Q1 Earnings, Eyes Russian Deal

In its recent Q1 financial results, Cleveland-Cliffs reported revenue of $5.2 billion, slightly below estimates, with steelmaking revenue experiencing a 2% decline. The company also announced a $1.5 billion stock buyback program. Despite missing earnings expectations, CLF’s average net selling price per ton increased 4.1% year-over-year to $1,175.

Furthermore, reports suggest Cleveland-Cliffs is in talks to acquire the U.S. assets of Russia’s Novolipetsk Steel, a move that could significantly impact its strategic direction.

Analyst Sentiment and Price Projections

Analysts have mixed views on Cleveland-Cliffs stock, with a consensus “Hold” rating among coverage analysts. Jefferies, a brokerage firm, recently initiated coverage on CLF with a “Buy” rating, highlighting it as their top pick in the steel industry. Jefferies believes the stock is undervalued and well-positioned to benefit from strong near-term demand.

Looking forward, Jefferies anticipates a decline in EBITDA and free cash flow for CLF in the coming years before a potential resurgence in 2025. The firm also suggests strategic mergers and acquisitions could be on the horizon for Cleveland-Cliffs.

Jefferies has set a price target of $22 for CLF, indicating a nearly 30% upside from current levels.