Investors often seek solace in the sturdy arms of Wall Street analysts, hoping for divine insights before deciding the fate of their investments. But does this oracle truly hold the key to profitable ventures?

Before we scrutinize whether the idyllic visions of brokerage recommendations merit our faith and funds, let’s scrutinize what the illustrious Wall Street gurus opine about HCI Group (HCI).

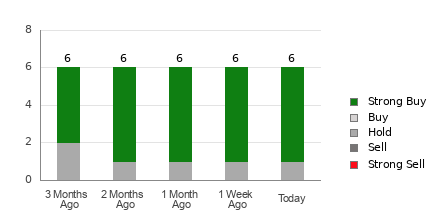

Glancing at the present scenario, HCI Group embraces an Average Brokerage Recommendation (ABR) of 1.33 on a 1 to 5 scale (ranging from Strong Buy to Strong Sell). This numerical emblem, derived from the verdicts of six brokerage firms, nestles just between Strong Buy and Buy.

Out of the half dozen pronouncements knitting this ABR tapestry, five don the mantle of Strong Buy, a resounding chorus that echoes 83.3% of all commendations.

The Curious Case of Brokerage Recommendations for HCI

The ABR tugs at our sleeve, whispering tales of a promising journey with HCI Group. But, treading solely on this mosaic may steer us to a bleak alley. Historical archives exemplify that brokerage recommendations grisly showcase a frail grip at guiding investors towards stocks on the cusp of prosperity.

What a puzzling predicament! The intrinsic allure of brokerage firms fuels a buoyant bias in favor of the stocks they cherish. Our chronicles unveil that for every “Strong Sell” prophecy, five “Strong Buy” blessings rain from their ivory towers.

Hence, the veils shrouding the intents of these institutions seldom part ways with the visions cherished by retail investors, painting a foggy canvas flirting with ambiguity. A judicious embrace of this data entails to validate own analyses or wield a reliable tool tailored to discern stock price deviations.

Unlocking the Enigma: ABR vs. Zacks Rank

Within this labyrinth of mystifying numbers lies the distinction between the ABR and Zacks Rank, akin to two diverging rivers.

The ABR, a progeny of brokerage recommendations, serenades in decimals (1.28, perchance) contrasted against the Zacks Rank, a numerical oracle donning an integer cloak (1 to 5). While sirens of brokerage houses charm these ranks with unwavering optimism, empirical relics herald the Zacks Rank, latched onto earnings estimate revisions, as a beacon illuminating price trends.

A symphony composed by the Zacks Rank spans the entire gamut of stocks graced by brokerage analysts’ earnings fortunetelling. Thus, maintaining an equilibrium among its five-tiered pantheon.

Like the relentless tide, Zacks Rank dances swiftly to the tune of ever-evolving earnings estimations, garbed in timeliness predicting the rovings of stock prices.

Is HCI a Diamond in the Rough?

In the realm of HCI Group’s earnings estimate revisions, the Zacks Consensus Estimate for the current year ascends by 13.1% in the rearview mirror, glistening at $11.68.

The swelling optimism sprouting from analysts’ fields, reflected in their harmonious melodies of revised EPS predictions, may very well fuel the prow of HCI Group to surge ahead in the nearby horizon.

The reverberation of this recent shift, interwoven with three intricate threads related to earnings estimations, unfurls HCI Group to a sanctified pedestal of Zacks Rank #1 (Strong Buy). Your eyes can meander upon today’s Zacks Rank #1 (Strong Buy) roster here.

Hence, the ABR draped in Buy’s raiment for HCI Group may beckon as a trusty lookout post for investors on this tempestuous voyage.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of

course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

HCI Group, Inc. (HCI) : Free Stock Analysis Report