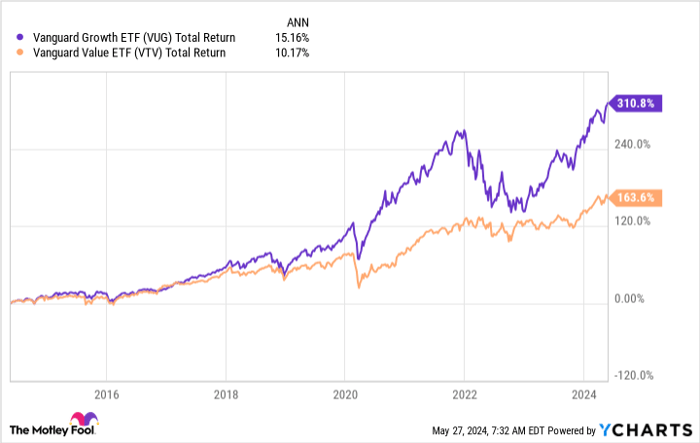

The battle between growth stocks and value stocks continues to capture investor attention. In the past decade, growth stocks have emerged triumphantly, with the Vanguard Growth ETF boasting an impressive annualized return of 15.2% compared to the Vanguard Value ETF‘s 10.2%.

VUG Total Return Level data by YCharts.

Considering this trend, let’s explore three exceptional growth stocks that show remarkable promise for delivering substantial returns in the long haul.

Image source: Getty Images.

The Trade Desk: Riding the Digital Wave

Leading the pack is the phenomenal success story of The Trade Desk (NASDAQ: TTD). This company, known for its cloud-based digital advertising platform, has witnessed its stock soar twofold in the last 18 months.

The surge in the digital advertising industry, projected to hit over $870 billion by 2027 according to Statista, underscores this growth. Notably, the shift towards ad-based subscription services in streaming giants like Netflix and partnerships with key players like Disney and Netflix positions The Trade Desk for continued success.

With a robust revenue growth rate of 28% year over year in its latest quarter, ending March 31, 2024, The Trade Desk stands out as a compelling option for investors eyeing growth-oriented ventures.

Visa: Powering Transactions, Empowering Investors

Visa (NYSE: V)anchors one of the world’s largest payment networks. Leveraging its vast network scale, Visa generates substantial revenues and profits.

In the quarter ending March 31, 2024, Visa raked in a whopping $8.8 billion in revenue and $4.7 billion in net income. The company also rewarded shareholders generously, with over $3.8 billion returned through share buybacks and dividends.

Another feather in Visa’s cap is its prudent share buyback strategy, having reduced its overall shares outstanding by 19% over the last decade, fueling value appreciation for shareholders through the basic principles of supply and demand.

Beyond its shareholder-friendly measures, Visa sustains solid growth, averaging 11% in revenue over the past ten years, with analysts forecasting a similar growth trajectory for the next couple of years.

Amazon: E-Commerce Dynamo Steaming Ahead

Closing the trio is tech behemoth Amazon (NASDAQ: AMZN), which has rebounded strongly and is nearing its historical peak following a significant slump in 2022.

Amidst its revival, Amazon’s operational efficiency shines through, particularly in its e-commerce domain. Noteworthy is Amazon’s enhanced fulfillment network post-COVID, resulting in remarkable efficiency, evident in the quote from its recent earnings call.

“In March, across our top 60 largest US metro areas, ~60% of Prime members’ orders arrived the same or next day.”

With substantial investments in e-commerce infrastructure bearing fruit, Amazon is generating unprecedented free cash flow, signaling a promising future for investors.

Amazon’s Financial Performance Signals Growth Opportunities

Amazon’s Resilience Amidst Upcoming Challenges

Management has hinted that Amazon’s free cash flow might experience a temporary decline due to substantial investments in enhancing its AI capabilities. However, fret not — these investments are strategically aimed at bolstering the market share of Amazon Web Services (AWS), the powerhouse within the cloud computing domain.

The Ascendancy of Amazon’s Revenue

Amazon’s revenue trajectory continues to spiral upwards. Over the last 12 months, the company churned out a staggering $591 billion in revenue, positioning itself right under Walmart as one of the top American revenue generators. Analysts are optimistic about Amazon’s revenue growth prospects, expecting a double-digit surge both in the current year and projected for 2025. For investors seeking a growth-oriented stock with enduring potential, it’s high time to ponder over Amazon’s merit.