- The S&P 500 defied May’s historical trends with a strong 4.8% gain.

- Despite this, worries persist about narrowing market breadth indicating possible bearish signals.

- Investors are pondering the potential impact of a Fed rate cut in September on the current bull market trajectory.

May’s unexpected 4.8% surge was the best performance seen in 15 years, bucking historical trends.

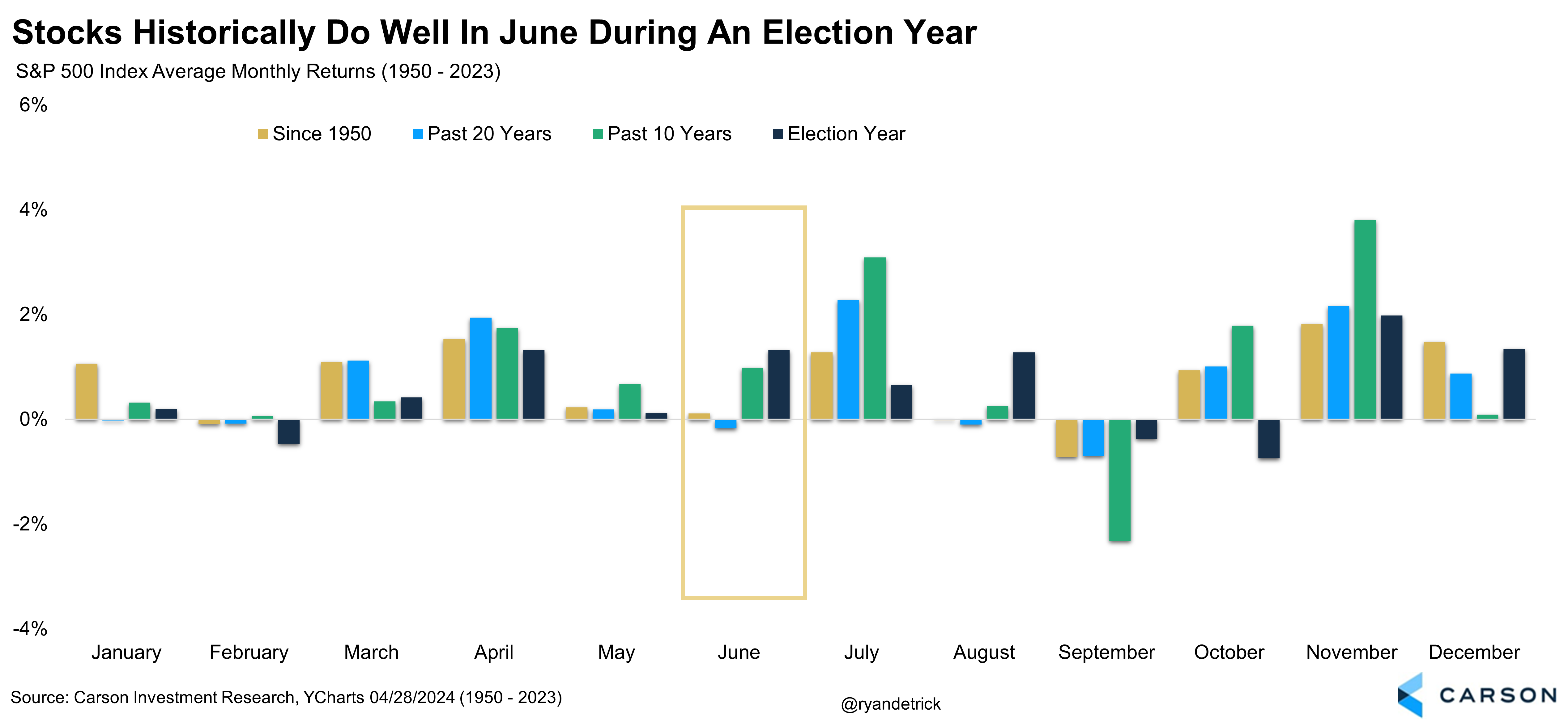

But what can we expect from June?

June has typically been more consistent, with an average return of 0.1% since 1950.

Moreover, on 55% of occasions, June has delivered a more robust 0.7% monthly gain. In election years, averages have surged by 1.3%.

Concerns Persist with Narrowing Market Breadth

Notwithstanding record highs for the S&P 500 in 2024, a troubling sign looms in the form of decreasing market breadth.

While the index climbs, the gains seem concentrated in a select few large-cap stocks.

Recent data showed around 20% of large-cap stocks hit 3-month lows, a scenario not witnessed since October 2023.

The percentage of stocks trading above their 50-day moving average is also declining, hinting at a potential bearish shift.

This trend is accentuated by the drop in stocks reaching new 52-week highs and trading above their 200-day moving average compared to March.

The current scenario echoes April’s decline where index growth outpaced individual stock performance, signaling a bearish undertone.

This shift from widespread market participation earlier in the year to a narrower focus now could spell trouble.

Potential Deep Correction in June?

The tranquility in 2024’s market, with only a 5.5% peak-to-trough dip, contrasts sharply with historical volatility.

Market calm is surprising, given lingering concerns about rates, inflation, and geopolitical issues, dampening reactions to news and data releases.

History shows markets typically face 14.2% annual declines, with even bullish markets experiencing 10.1% drops, highlighting the intermittent nature of downturns.

With only a 5% decline so far in 2024, further uncertainties might stir up the market, possibly leading to more fluctuations but ideally not prolonged or severe.

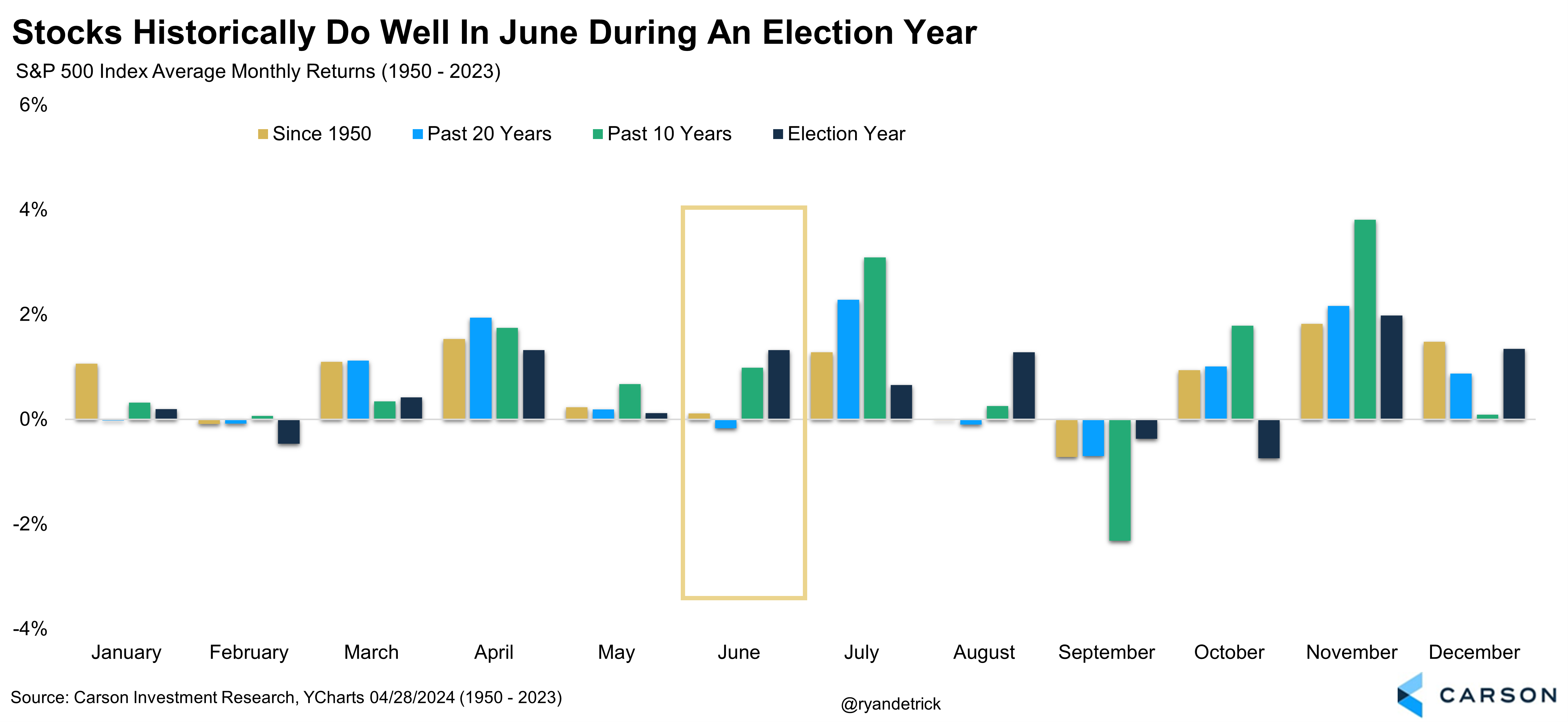

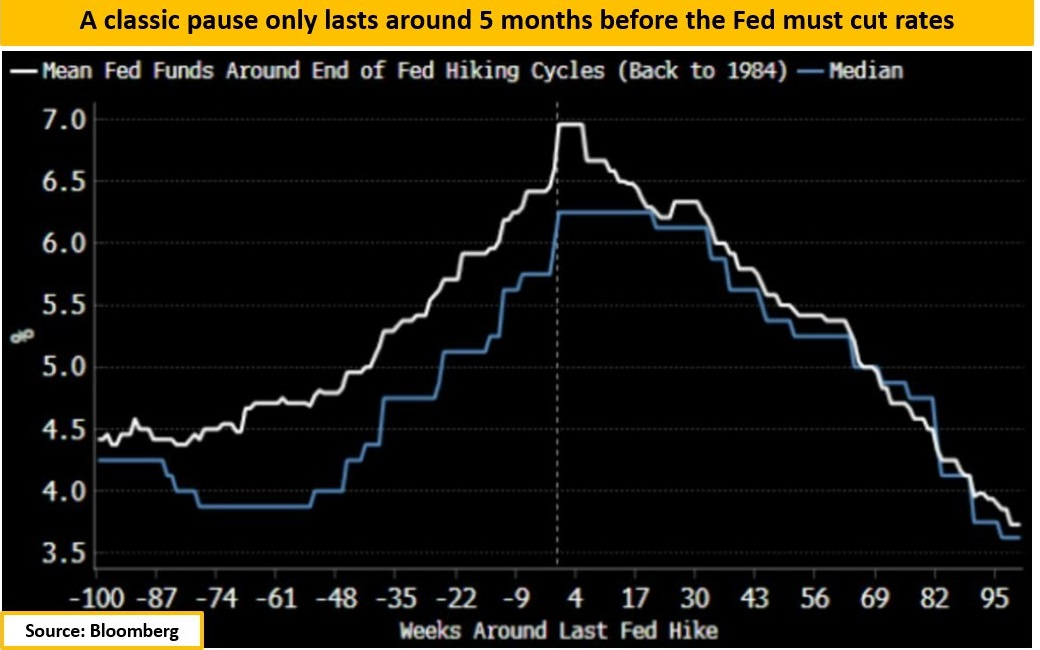

Market Anticipates a Rate Cut

Market chatter hints at a potential Fed rate cut in September.

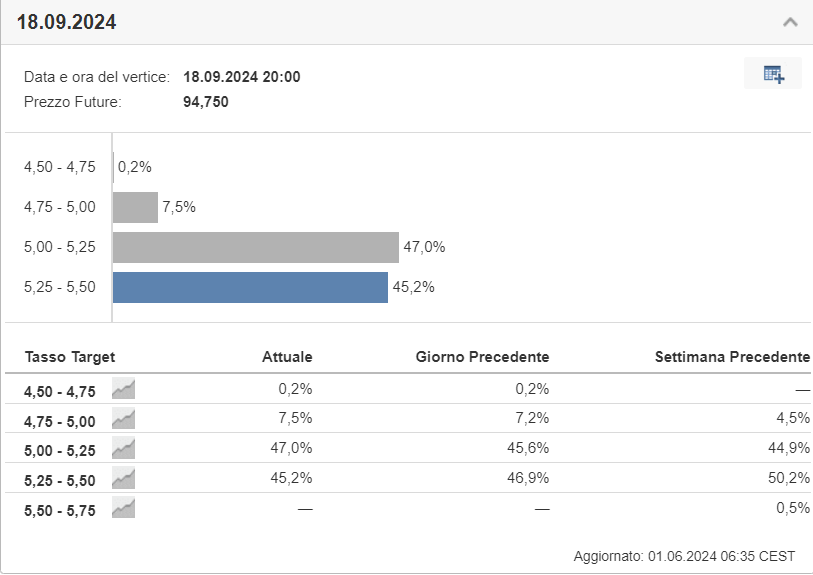

Market sentiment, reflected in Investing.com’s tool, forecasts a 47% chance of a rate cut by the September 18th meeting.

Investors eagerly await clues – could this potential cut be the stimulant that keeps the bull market charging?

***

Become a Pro: Join the PRO Community now for exclusive benefits at a significant discount.

Disclaimer: This article provides information only; it is not an offer to invest. Investment decisions should consider risks and are solely the investor’s responsibility.