The Weight of Wall Street Recommendations

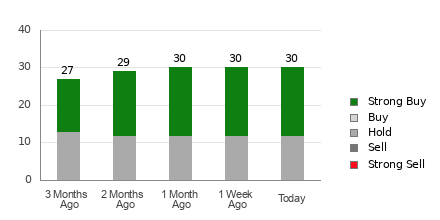

Brokerage recommendations hold a considerable sway over investor decisions, often nudging the needle of a stock’s fortune. Oracle (ORCL) currently stands at an Average Brokerage Recommendation (ABR) of 1.80, reflecting a sweet spot between a Strong Buy and Buy, based on the input of 30 brokerage firms. This translates into 60% of recommendations being Strong Buy for the tech giant.

Behind the Brokerage Curtain

Diving into the realm of brokerage advice, one must exercise caution. Studies suggest that while ABR might point you towards Oracle, relying solely on these ratings could steer your investment ship astray. Analysts, driven by their firms’ interests, tend to adorn stocks with a rosy hue, with five Strong Buy ratings to every Strong Sell.

Unveiling the Zacks Rank

The Zacks Rank emerges as a beacon amid the brokerage fog, offering a sound compass for investors. Categorized from Strong Buy to Strong Sell, this tool hinges on earnings estimate revisions, a tried-and-tested method in predicting stock movements.

Deciphering the Oracle Dilemma

Oracle’s Zacks Consensus Estimate for the current year stands at $5.58, signaling a steady ship amidst market volatility. With a Zacks Rank #3 (Hold) in hand, it may be wise to tread lightly on the Buy-worthy ABR for Oracle, keeping a keen eye on the horizon for future shifts.