The Phenomenon

Stride (LRN) climbed a remarkable 20% post its Q1 report, soaring to unprecedented heights. Over the past three years, this digital education powerhouse has escalated by an impressive 135%, outstripping the S&P 500 in the last decade.

Stride, renowned for its Zacks Rank #1 (Strong Buy), beckons investors with its undeniably alluring value proposition.

The Foundation

Stride’s digital education services cater to a diverse demographic, encompassing students of all age groups within the U.S. and abroad. Its expanding portfolio caters to K–12 students, adult learners, schools, businesses, the military, and beyond.

As the realm of digital education gains momentum and individuals rethink the exorbitant costs of traditional college education, Stride stands out. Particularly, the firm is making substantial progress in its career learning vertical, notably with its Middle-High School segment.

Moreover, Stride is capitalizing on the digital transformation of the U.S. economy by offering specialized courses such as MedCerts, facilitating career transitions in healthcare or IT, and Tech Elevator, a program boasting the ability to mold proficient coders in just 14 weeks.

The Trajectory

From a revenue of $400 million in 2010, Stride has catapulted to $1.84 billion last year. Witnessing a 9% surge in FY23 and a further 10% uptick in FY22, notably after a staggering 48% climb in FY21 driven by the lasting impacts of the Covid pandemic, which permanently altered education and work dynamics.

Projections suggest a robust 11% revenue growth in FY24 and a solid 7% in FY25, propelling Stride towards the $2.2 billion milestone from pre-Covid figures of $1.0 billion in FY19.

The Winning Streak

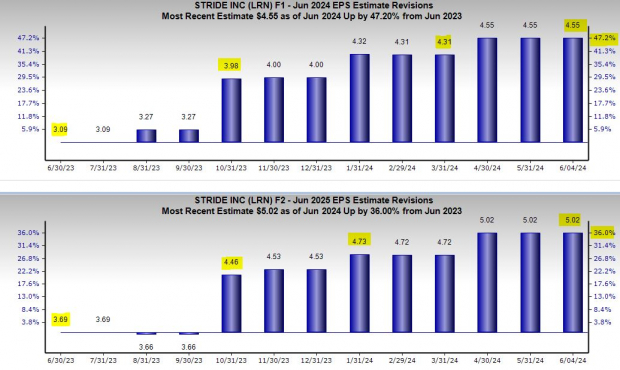

Stride surpassed estimates for Q1 FY24 EPS and raised its earnings guidance, solidifying its position. Witnessing a staggering 47% surge in the 2024 adjusted EPS estimate over the past year, with a further 36% increase expected in 2025. The optimistic bottom-line outlook is a testament to its Zacks Rank #1 (Strong Buy) status.

Anticipated growth in LRN’s adjusted earnings includes a 53% upswing in FY24 and a subsequent 10% rise in FY25, driven by better sales performance and enhanced margins.

The Robust Foundation

Over the past three years, Stride’s stock soared by an astounding 133%, overshadowing the benchmark’s 25% climb, notably surging by 63% in the last 12 months and outperforming its highly-ranked Schools industry’s 40% rise.

This trend is not merely post-Covid success; LRN has risen by a remarkable 187% in the last decade, slightly edging past the S&P 500 and outperforming its industry’s 26% growth.

Despite the recent surge following its stellar earnings, Stride stock remains around 6% below its peak and 7% under its average Zacks price target. Trading at neutral RSI levels, investors might seize opportunities arising from potential pullbacks to its 50-day or 200-day moving averages.

With a soaring earnings outlook, LRN currently trades near all-time lows at 13.8X forward 12-month earnings while hovering close to its peak levels. Stride trades at a substantial 75% discount from its highs, 50% below its 10-year median, and 30% lower than its highly-ranked industry.

The Verdict

Amidst an evolving landscape of education where digital platforms are gaining traction across demographics, Stride continues to expand its horizons with innovative offerings. Investors would be prudent to mull over the prospects of investing in LRN, backed by a solid financial standing.