Shifting Tides in the AI Chip Market

Advanced Micro Devices (NASDAQ:AMD) has faced a cooling trend in bullish sentiment lately, but one investor sees a silver lining amidst the clouds. While the chip giant has not fully capitalized on the AI boom as anticipated, there are promising signs of growth on the horizon, according to investor Insight Analytics.

InSight highlights the data center GPU space as a prime area for AMD to flex its muscles and gain market share. Nvidia currently reigns supreme in this arena, but the landscape is evolving towards AI inference, where AMD’s MI300X shows superior performance compared to Nvidia’s Hopper. Rumored to be priced significantly lower than its competitor, the MI300X not only offers prowess in memory-intensive tasks but also a competitive total cost of ownership advantage.

With projections suggesting a potential for AMD to capture up to 10% of the data center GPU market share by 2027, the company’s data center segment could experience significant growth above the industry’s implied 38% CAGR.

Prospects in the Gaming and CPU Markets

Besides the data center space, AMD is also poised to challenge Nvidia in gaming and capitalize on the growing trend of AI-capable PCs. With an expected 50 million AI-capable PCs set to be shipped by 2024, InSight sees this as a solid opportunity for AMD’s expansion.

InSight’s outlook is indeed bullish on AMD’s potential, with expectations of a 50% surge in the stock value as enterprises ramp up their adoption of AI technologies for commercial purposes.

Analyst Consensus and Market Outlook

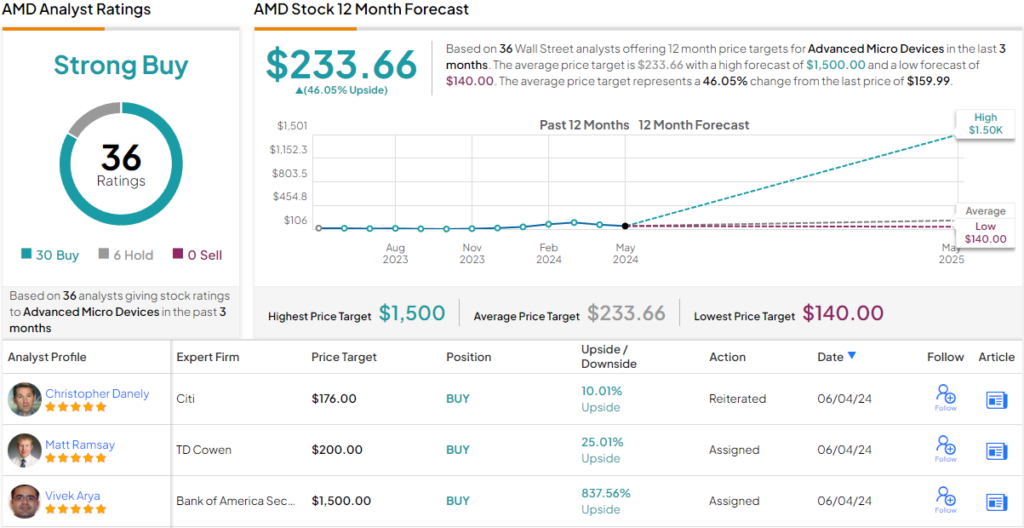

Backing InSight’s positive sentiment, the majority of Wall Street analysts also hold a bullish view on AMD. With a Strong Buy consensus rating based on 30 Buy recommendations versus 6 Holds, the stock carries an average price target of $233.66. This forecast implies a potential 46% upside over the next 12 months.

As the scene is set for AMD to potentially shine brighter in the coming years, the company stands at the cusp of a transformative period where seizing the right opportunities could propel its growth significantly.

To discover promising stock picks at compelling valuations, investors can explore TipRanks’ Best Stocks to Buy tool, offering a consolidated view of equity insights.

Disclaimer: Views expressed in this article represent the opinions of featured analysts and are intended for informational purposes. Investors are encouraged to conduct their own due diligence before making any investment decisions.