After unveiling stellar Q1 results recently, Cava Group’s trajectory of growth has ignited much excitement reminiscent of the rise of prominent restaurant chains like Chipotle Mexican Grill and Starbucks. Since Cava Group’s IPO in June 2023, the Mediterranean fast-casual food chain has witnessed a remarkable surge of almost +100%, outshining Starbucks and surpassing broader market indexes as well as Chipotle.

Given Cava Group’s status as one of the hottest IPOs in recent times, investors are now pondering if it’s the opportune moment to delve into CAVA for more substantial gains.

Image Source: Zacks Investment Research

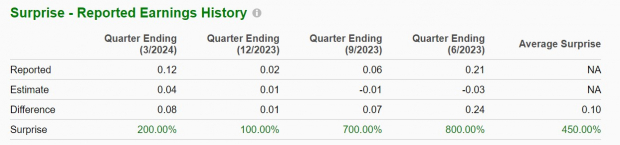

Reviewing Q1 Performance

Cava Group reported Q1 sales of $259.01 million, reflecting a robust 46% growth from the previous quarter’s sales of $177.17 million. The Q1 sales surpassed estimates by 5%. Notably, Cava Group demonstrated profitability in Q1, with an EPS of $0.12 beating expectations by 200% and showing a significant rise from $0.02 per share in Q4.

Image Source: Zacks Investment Research

Path to Growth and Company Overview

Established in 2006, Cava Group went public last year and has expanded its footprint across the United States. Its growth is fueled by a unique dining experience, akin to Chipotle, allowing customers to customize their bowls with high-quality, fresh ingredients.

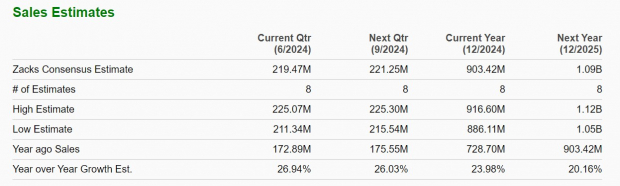

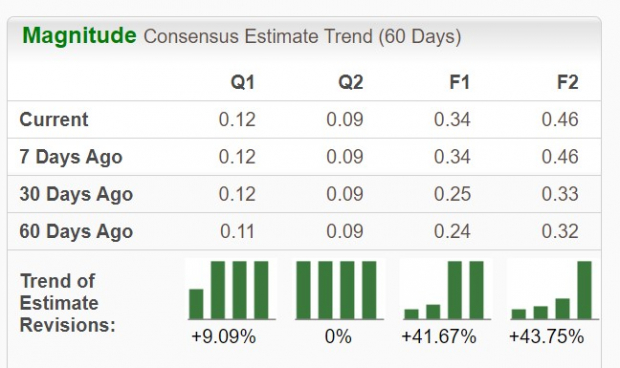

Cava Group’s total sales are anticipated to climb 24% in FY24 and are projected to increase by 20% in FY25, exceeding $1 billion in total sales. Earnings are forecasted to surge by 62% this year to $0.34 per share from $0.21 in 2023. Furthermore, FY25 EPS is expected to grow by 33% to $0.46.

Image Source: Zacks Investment Research

Revisions in earnings estimates for FY24 and FY25, escalating by over 40% in the last two months, suggest a promising outlook for CAVA, indicating that the current rally may endure.

Image Source: Zacks Investment Research

Final Thoughts

Cava Group’s stock currently holds a Zacks Rank #2 (Buy), indicating a favorable investment opportunity. With its compelling growth trajectory and a positive trend in earnings estimate revisions, it comes as no surprise that CAVA could continue its upward momentum.