-

The stock market reached record highs with Nvidia surpassing a $3 trillion market cap.

-

Speculations of a Federal Reserve interest rate cut have fueled bullish sentiments amid weaker economic data.

-

Amidst the market rally, tools like the InvestingPro fair value index can guide investors towards potential lucrative stocks.

The U.S. stock market witnessed a significant surge yesterday, notably with the and shattering previous records. The spotlight was on Nvidia (NASDAQ:), propelling itself to a remarkable $3 trillion market cap, entering an elite league with Apple (NASDAQ:) and Microsoft (NASDAQ:).

This bullish momentum is primarily underpinned by expectations of an imminent interest rate reduction by the Federal Reserve. Recent economic indicators pointing towards a possible September rate cut have solidified with current odds standing at over 50%.

In navigating this bullish period, it becomes imperative to uncover companies with substantial growth potential. Utilizing tools like the InvestingPro fair value index can aid in uncovering undervalued investments with significant room for growth.

Rio Tinto – Seizing the Opportunity in Copper Price Surge

Copper prices have demonstrated a robust uptrend in recent months, benefiting large mining corporation Rio Tinto (NYSE:). As a major player in the mining sector with copper as a core focus, Rio Tinto’s stock witnessed a surge in April and May, mirroring the ascent of copper prices.

Despite a slight correction in recent pricing, the outlook for copper remains optimistic for sustained growth in the medium to long term. Anticipated spikes in demand from renewable energy, electric vehicles, and traditional sectors further bolster this positive prognostication.

Rio Tinto’s strategic positioning to leverage this trend is evident. The company is actively strategizing for increased production from existing mines, as highlighted by Director Bold Baatar during the World Copper Conference. Moreover, analysts foresee a potential 22% uptick in Rio Tinto’s value based on fair evaluations.

JP Morgan Chase – Embracing Stability Through Dividend Performance

JPMorgan Chase & Co (NYSE:), a dominant force in U.S. banking with a market cap exceeding $4.1 billion, thrives on its scale advantages and diversified product range. This agility allows the company to pivot adeptly in response to market dynamics.

Source: InvestingPro

JPMorgan Chase’s resilience shines through its adept crisis management capabilities. Beyond this, the company boasts an unparalleled track record of consistent dividend payouts spanning over five decades, alongside a consistently strong fair value ratio signifying its financial robustness.

Johnson & Johnson – Unveiling Hidden Potential

Johnson & Johnson (NYSE:) has recently lagged on the stock market performance scale. However, this slump could unveil an investment opportunity for those seeking a stable venture with potent growth possibilities.

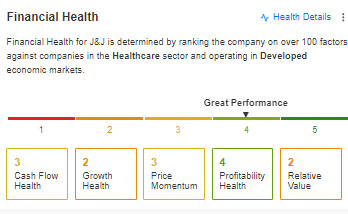

The company showcases impressive fundamentals surpassing industry standards, notably evidenced through its high Return on Equity (ROE) ratio, indicative of efficient management and robust profitability. Additionally, boasting a solid financial health score of 4 out of 5 affirms its financial stability.

Source: InvestingPro

A technical breakout above $155 per share could symbolize a potential trend reversal, indicating a probable uptrend in stock prices. Conversely, sturdy support levels rest near prior-tested lows of $143.

Considering the company’s solid underpinnings, robust financial state, and prospects for a possible upturn, the recent downturn might present an appealing entry position for investors eying long-term value.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.