The Vanguard Information Technology ETF (NYSEMKT: VGT) has outpaced market benchmarks, returning 1,310% in the past two decades at an annual compounded rate of 14.1%. In contrast, the S&P 500 (SNPINDEX: ^GSPC) saw a 10.2% annual compounded return during the same period, reflecting the tech sector’s dominance.

$100 monthly investment in the Vanguard ETF would now be valued at about $132,000, significantly surpassing the S&P 500’s $78,000. The enduring outperformance of the information technology sector, fueled by artificial intelligence’s integration into businesses, underscores the ETF’s allure for investors.

Artificial intelligence, the propellant behind the current S&P 500 bull market, holds the potential to further elevate the market as companies harness this transformative technology.

AI Propels Information Technology Sector to Unrivaled Heights

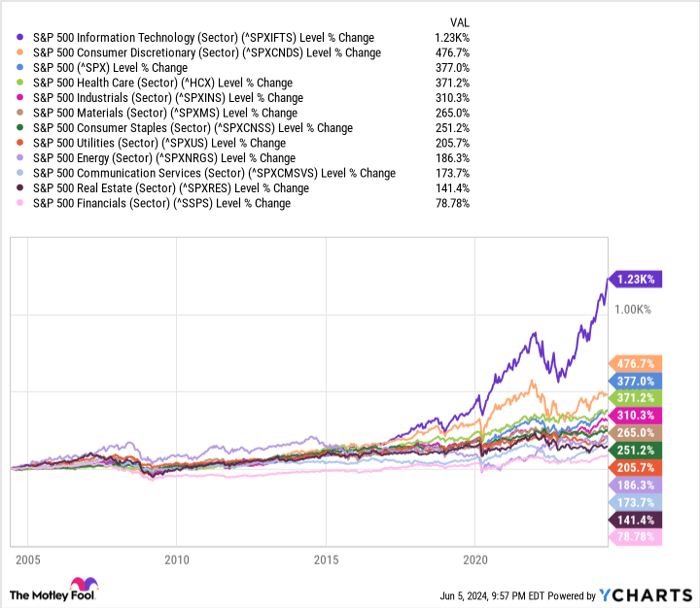

Over the last 10 and 20-year spans, the information technology sector has reigned supreme among S&P 500 sectors. It soared above the market index in the past decade, standing as one of the exclusive sectors to outshine for two decades, as depicted in the chart below.

Technological advancements like cloud computing, cybersecurity, e-commerce, and AI have been instrumental in the sector’s stellar performance, offering investors a channel to hefty returns over the years.

Vanguard ETF: Enabling Investors to Harness the AI Wave

The Vanguard Information Technology ETF tracks 313 tech stocks across three main categories: internet services, technology consulting, and semiconductor manufacturing. Splendidly positioned to ride the AI wave, the ETF’s top ten holdings include tech powerhouses like Microsoft, Apple, and Nvidia.

Moreover, the ETF boasts a meager expense ratio of 0.1%, significantly lower than similar funds on the market, making it a cost-effective option for investors to delve into the tech realm.

While the Vanguard Information Technology ETF offers a captivating gateway to capitalize on tech advancements, its high concentration risk — with five stocks accounting for half the fund — poses a notable threat. This may translate to brief market fluctuations or, in extreme cases, potential underperformance.

To mitigate this risk, investors are advised to blend the ETF with a diversified portfolio, incorporating other stocks or index funds – notably an S&P 500 index fund. Maintaining a conservative exposure to the Vanguard ETF could bolster resilience against potential market volatilities.

The Vanguard Information Technology ETF: A Journey of Risk and Reward

When pondering whether to devote a slice of your capital to Vanguard Information Technology ETF, it’s prudent to weigh the pros and cons carefully.

Missed Opportunities Amidst the Frenzy

In the realm of investment wisdom, the vaunted Motley Fool Stock Advisor analysts have recently cherry-picked the top 10 stocks they believe are primed for stellar growth. Surprisingly, Vanguard Information Technology ETF failed to make the coveted cut. The favored 10, a glitzy constellation poised for potentially astronomical returns, left many with furrowed brows. Such exclusions sow doubt in the most fervent investor’s mind.

Think back to a time when the brilliant minds at Stock Advisor bestowed their favor on Nvidia, marking its ascendancy on April 15, 2005. A mere $1,000 injected into this stock would have ballooned into a staggering $750,197. A poignant reminder that the road not taken can lead to existential fortune.

Subscribers to this financial oracle are regaled with a user-friendly roadmap to financial success. Laden with directives on portfolio architecture, periodic updates from experts, and two fresh stock recommendations every moon cycle. This offering, by the name of Stock Advisor, has done more than its fair share of heavy lifting, surpassing S&P 500 returns fourfold since its inception in 2002.

Prospects and Perils on the Horizon

Yet, before succumbing to FOMO or rushing headlong into the arms of Vanguard Information Technology ETF, a note of caution: past glories do not guarantee future triumphs. Just as a fleeting comet may mesmerize before fading into the void, so too can investment allure vanish in the blink of an eye. Assessing risk, performing due diligence, and fortifying one’s resolve against the whims of the market remain paramount.

*Stock Advisor returns as of June 3, 2024