Walmart (NYSE:WMT) shares surged after unveiling extraordinary Fiscal Q1-2025 results, igniting one of its most impressive stock rallies in recent memory. In an era dominated by technological advancements, the retail giant continues to push its boundaries with significant investments in e-commerce restructuring, Walmart+, and innovative product offerings. The market sentiment now raises the question of whether WMT stock could justify a higher valuation, akin to retail stalwart Costco (NASDAQ:COST), which trades at a substantial 50 times earnings.

At present, Walmart stock is trading at 28 times trailing price-to-earnings (P/E), a notable deviation from its historical metrics but reflective of its recent strong performance. Looking ahead, there appears to be a solid foundation for Walmart to build upon the strategies that propelled its impressive start to the fiscal year.

The Changing Demographics at Walmart: A Sign of Things to Come?

Walmart’s recent surge in market share is not the only impressive feat; the company has witnessed a rise in patronage from wealthier households, particularly those with annual incomes exceeding $100,000. This shift in consumer demographics has notably contributed to a nearly 4% increase in U.S. comparable store sales in the previous quarter, a segment traditionally associated more with Costco’s clientele.

While the future behavior of affluent customers remains uncertain, Walmart has the opportunity to enhance its appeal as a more upscale shopping destination, aiming to retain this newfound demographic. Despite concerns raised by former Walmart U.S. CEO Bill Simon regarding consumer behavior post-inflation normalization, Walmart seems well-equipped to cater to the evolving preferences of its clientele.

With a focus on improving product quality through initiatives like the introduction of its new private-label brand, Bettergoods, Walmart aims to provide a diverse product offering that resonates with consumers seeking both value and quality.

Bettergoods: Elevating Walmart’s Product Portfolio?

Introducing over 300 new Bettergoods products, Walmart seeks to provide unique offerings at an affordable price point, appealing to customers willing to explore beyond the bargain items. While comparisons to Costco’s signature Kirkland products emerge, the success of Bettergoods may hinge on its ability to attract and engage Walmart’s wealthier customer base.

Moreover, Walmart’s strategic initiatives, including enhanced grocery delivery services, Walmart+, and a wide selection of competitively priced products, form a cohesive strategy to drive customer engagement and loyalty across diverse consumer segments.

As Walmart continues to enhance its e-commerce platform, leveraging the expertise gained from its Jet.com acquisition, the company aims to bridge the gap with industry leader Amazon, particularly in the realm of grocery deliveries. Walmart’s evolution towards a hybrid model combining digital capabilities with its extensive brick-and-mortar presence signals a proactive approach to adapting to changing consumer preferences.

Exploring the Investment Potential of WMT Stock

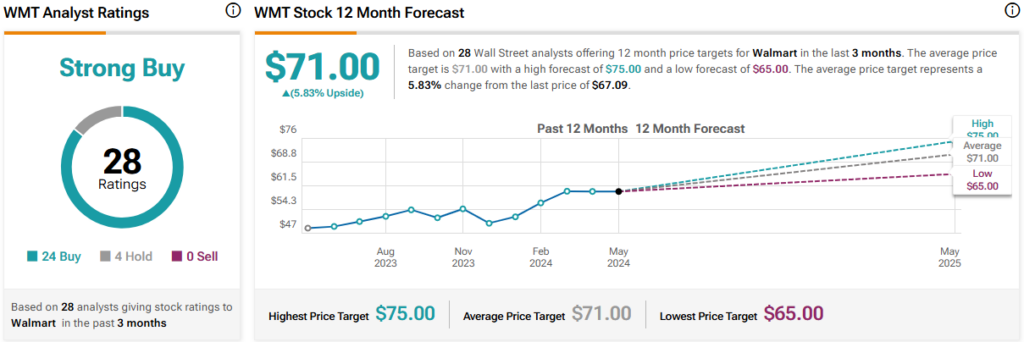

When it comes to the financial forecast of WMT stock, TipRanks paints a bullish picture. The rating stands strong at a Strong Buy, with a total of 28 analyst ratings comprising of 24 Buy recommendations and four Hold recommendations. The average WMT stock price target is estimated at $71, signaling a potential upside of 5.8%. Analysts’ price projections for WMT stock range from a low of $65.00 per share to a high of $75.00 per share.

Uncovering the Competitive Edge

Amidst the bustling landscape of middle-to-high income consumers, Walmart’s offerings shine with products like Bettergoods. These products, though slightly pricier than the Great Value brand, are gaining traction for their perceived value. Pairing these with Walmart’s strong e-commerce infrastructure and reliable delivery services, the retail giant stands poised to challenge the likes of Costco and other competitors popular among affluent consumers.

With inflation driving hordes of shoppers to local Costcos, navigating the crowds for bulk deals has become a chore. This is where Walmart’s ace in the hole lies – convenience. Making the switch to Walmart from Costco has proven to be a more convenient option for many, particularly as weekends become synonymous with overwhelming shopping trips at bulk retailers.

Despite the traditional view of Walmart as a discount retailer, the landscape is evolving. New customers, including those from higher income brackets, are recognizing the allure of the enhanced deals, improved convenience, and elevated quality standards that Walmart now offers.