Elon Musk’s Mega Payday Inches Closer to Reality, Bolstering Tesla Stock

In 2018, Tesla board members greenlit a lucrative performance-based compensation package that could potentially lavish Elon Musk with a staggering $56 billion in company shares. However, a wrench was thrown into the works when a Delaware judge invalidated the pay package early this year, citing concerns over fairness and satisfactory negotiation proof by the board. Investors have since been mulling over whether to reinstate the deal.

Most of the votes on Musk’s compensation package were accounted for yesterday, with a trickle still expected today. While the green light appears imminent, legal pundits speculate that the controversial package may once again be mired in courtroom battles.

Future Projections for Musk and Tesla Stock

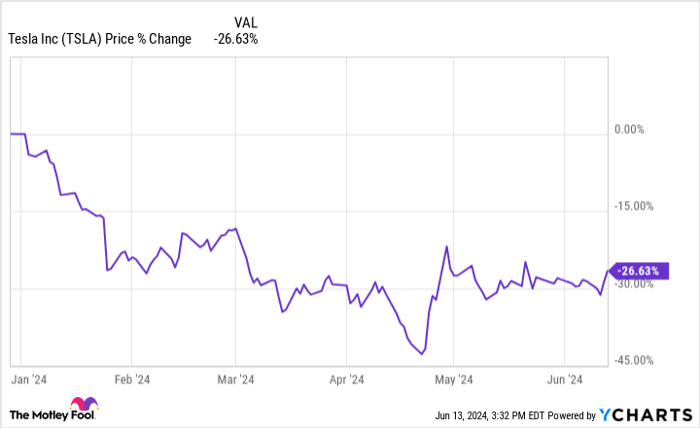

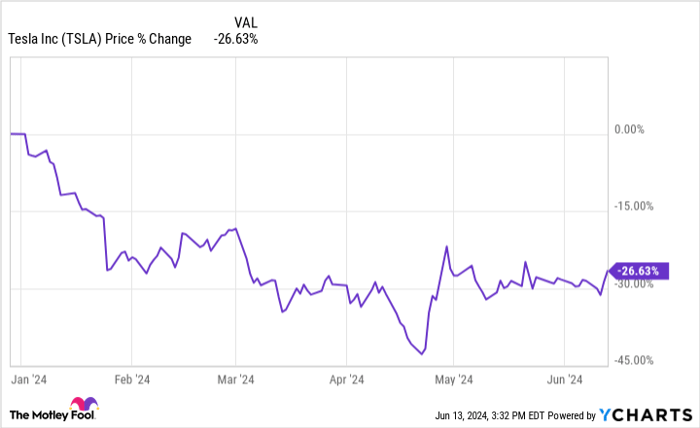

Elon Musk’s leadership has undeniably underpinned Tesla’s meteoric ascent and stock market trajectory. Conversely, the EV giant has been grappling with formidable challenges of late. The labyrinth deepens concerning Musk’s compensation, as Tesla stock, despite an overall bullish market ambiance propelling tech stocks to dizzying heights, has witnessed notable sell-offs this year.

Trading at approximately 72 times the anticipated earnings for this year, Tesla’s valuation continues to cling to growth-dependent ratios amid somewhat tepid business performance. With the proliferation of Chinese EV competitors and other contenders on the horizon, justifying Tesla’s standing in the automotive sphere is increasingly arduous. However, buoyed by Musk’s vision, substantial investments in innovation, and a history of disruptive achievements, some investors remain unwavering in their willingness to attach a premium to Tesla stock.

Is Now the Time to Invest in Tesla?

Before diving into Tesla stock, contemplate this:

The analyst team at Motley Fool Stock Advisor identified the top 10 stocks primed for investor portfolios… and Tesla missed the cut. These selections are projected to yield colossal returns in the imminent years.

Recall when Nvidia cracked this list back on April 15, 2005? An initial $1,000 investment in their recommendation could have burgeoned to a staggering $767,173!*

Stock Advisor’s straightforward blueprint for investment prosperity encompasses portfolio construction tips, regular analyst updates, and bi-monthly stock picks. Since 2002, the

Stock Advisor service has catapulted returns beyond the S&P 500 index by more than fourfold.

Wondering which 10 stocks made the cut?

These tempting investment figures were recorded as of June 10, 2024.*

Conflicts of interest aside, Keith Noonan boasts no stake in the abovementioned stocks. While The Motley Fool wields positions in and endorses Tesla, it maintains a stringent disclosure policy.