In the high-stakes world of the gaming industry, Las Vegas Sands Corp. stands to gain as travel and tourism make a roaring comeback in Macao and Singapore. The company’s strategic capital investment plans at Marina Bay Sands paint a promising picture for future growth.

With the dawn of 2024, Las Vegas Sands witnessed a remarkable resurgence in Macao, marking impressive growth in various key performance indicators such as property visitation, gaming volumes, retail sales, and hotel occupancy rates in the region.

Despite facing high debt levels, this Zacks Rank #3 (Hold) company is predicted to witness a hefty earnings growth of 39.2% in 2024 compared to the previous year, with a 14.2% revenue increase. Bolstering this positive outlook is its VGM Score of A, a testament to strong analyst sentiment and robust fundamentals propelling it toward continued success in the short term.

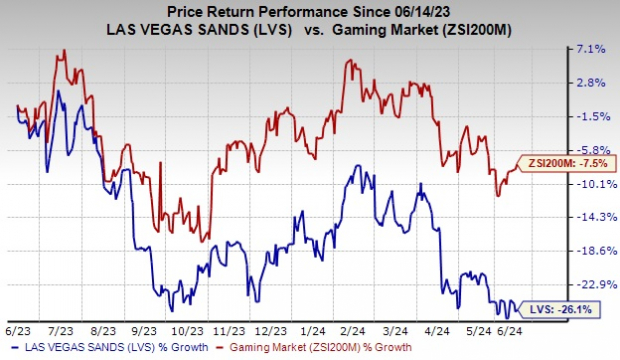

However, amidst these favorable prospects, concerns linger over the burden of high debt and escalating competition within the industry. Las Vegas Sands’ stock saw a 26.1% decline over the past year, outpacing a 7.5% fall in the broader Zacks Gaming industry.

Image Source: Zacks Investment Research

Let’s delve into the factors shedding light on why investors should consider holding onto this stock for now.

Driving Forces for Growth

The Macao Mirage: Las Vegas Sands draws a substantial chunk of its revenue from Macao. The company’s steadfast commitment to a $3.8 billion investment in Macao until 2032, focusing on non-gaming initiatives, positioned it excellently for a stellar performance in the first quarter of 2024 and beyond. A surge in market visitation, coupled with the revival of travel and tourism, fueled the growth story.

Visitation in Macao rebounded to nearly 89% of 2019 levels in the first quarter of 2024. Additionally, with about $4.5 billion earmarked for capital and operating investments over the span of a decade in Macao, Las Vegas Sands is strategically poised to unlock value and drive further growth.

Singapore’s Silver Lining: The revival of travel and tourism in Singapore painted an optimistic outlook for Las Vegas Sands. The management’s commitment to ongoing investments in Marina Bay Sands paid off handsomely, with robust growth witnessed in both gaming and non-gaming segments during the first quarter of 2024. This growth narrative was buoyed by improved airlift capacities and a resurgence in travel and tourism spending, primarily originating from China.

Enhanced service offerings, in addition to the introduction of new suite products, further propelled the positive trajectory. Noteworthy figures included a 15.5% year-over-year increase in rolling volumes totaling $8.2 billion and a 25.1% growth in mass gaming wins at MBS to $687 million.

Marina Bay Sands Makeover: The capital investment program at Marina Bay Sands gained momentum, fueling the company’s growth trajectory. The upcoming $750 million renovation, inclusive of Tower 3, set for completion by the second quarter of 2025, will usher in 550 refurbished rooms, including 380 new suites. Upon the culmination of both phases, the resort will sport a total of 1,850 revamped rooms, incorporating 770 suites. This expansion paves the way for sustained growth in 2025 and beyond.

Challenges on the Horizon

The Weight of Debt: Las Vegas Sands grapples with a substantial debt load as of March 31, 2024, with total outstanding debt amounting to $13.94 billion, down marginally from $14.01 billion as of December 31, 2023. While unrestricted cash balances in the first quarter of 2024 came in at $4.96 billion, a decline from $5.11 billion in the previous quarter, the debt levels remain relatively high compared to the company’s cash reserves.

Competitive Tides: Intensifying competition, characterized by the surge in hotel openings and promotional activities, poses a challenge in both the Las Vegas and Macao markets. Macao, in particular, faces the risk of market share erosion due to excess supply. The landscape is further muddled by the debut of The Parisian Macao and forthcoming resorts at the Cotai Strip, heightening competitive pressures emanating from Chinese casino operators and U.S.-based counterparts.

Top Choices for Investors

For investors seeking more favorable alternatives within the Consumer Discretionary sector, here are some top-rated picks:

Strategic Education, Inc. (STRA) presently boasts a Zacks Rank #1 (Strong Buy) and has delivered an average earnings surprise of 36.2% in the trailing four quarters. The stock garnered a 46% uptick over the past year, with estimates pointing to a 6.4% rise in sales and a substantial 33.3% surge in EPS for 2024.

Netflix, Inc. (NFLX) is another gem, holding a Zacks Rank of 1. With a commendable four-quarter earnings surprise average of 9.3%, the stock witnessed a robust 47.5% climb in the previous year. Forecasts hint at a 14.8% increase in sales and an impressive 52.2% surge in EPS for 2024.

Lastly, Royal Caribbean Cruises Ltd. (RCL) rounds off the list with a Zacks Rank of 1. Delivering an average earnings surprise of 18.3% in the trailing four quarters, the stock soared by 66.3% over the past year. Estimates project a hefty 16.8% upswing in sales and an impressive 63.8% jump in EPS for 2024.