Strategic Shift by Apple

Apple (NASDAQ:AAPL) navigates rough waters in the European Union as it seeks to steer clear of a massive fine amidst an ongoing antitrust investigation. The tech giant made a strategic move by offering more access to its contactless technology, particularly its near-field communication (NFC) chips, which power its mobile payments system.

The year 2022 marked a significant development as the European Commission charged Apple with breaching competition laws. The allegations centered around Apple restricting competitor access to its “tap-and-go” feature to give precedence to its own Apple Pay ecosystem.

Recent reports from the venerable Financial Times indicate that EU regulators have given the nod to the proposals tabled by the Cupertino-based company earlier this year.

Sweeping Concessions by Apple

Apple’s concessions include granting developers complimentary access to its NFC technology on iOS devices without enforcing the use of Apple Pay or Apple Wallet. Additionally, Apple has committed to offering this access for a decade. Furthermore, the company has affirmed the wide availability of its Apple Pay service, with more than 3,000 issuing banks in Europe supporting the platform.

If Apple successfully seals the deal with the EU, it could potentially swerve an astronomical fine amounting to 10% of its total worldwide annual revenue. Considering Apple’s colossal performance in its fiscal year 2023, where it raked in $383 billion, a 10% fine would translate to a staggering $40 billion penalty.

Investor Outlook: Buy, Hold, or Sell?

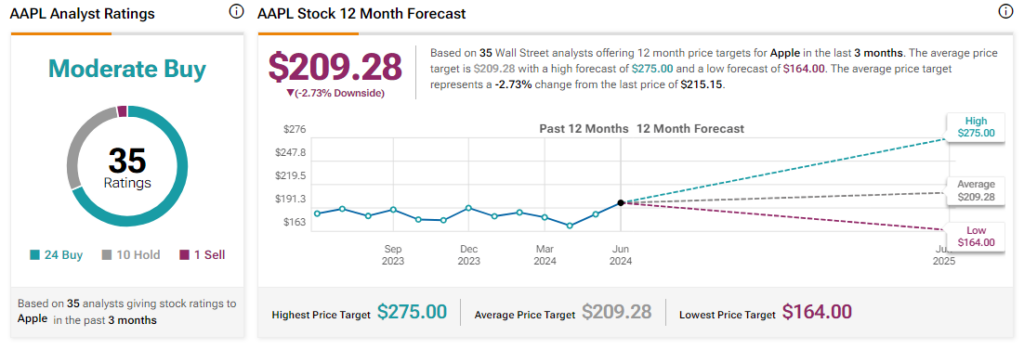

Analysts are cautiously upbeat about Apple’s stock, as reflected in a Moderate Buy consensus rating derived from 24 Buy recommendations, 10 Holds, and one Sell. Over the past year, Apple has seen its stock surge by over 10%. However, the average price target for AAPL of $209.28 suggests a slight downside potential of 2.7% from current levels.