On a significant note, Nvidia, under the ticker symbol NVDA on the NASDAQ, has surpassed Microsoft (MSFT) to clinch the title of the world’s most valuable publicly traded company for the first time. The stunning accomplishment comes on the back of Nvidia’s stock skyrocketing by over 200% in the past year to a valuation exceeding $3.3 trillion.

Investors are left pondering whether to retain their position or consider offloading holdings. Those on the sidelines may be grappling with the dilemma – is it too late to hop on board? Perhaps a retrospective plunge into historical data can illuminate the path forward.

Staying Power at the Helm

Remarkably, Microsoft’s ascendancy to the top spot occurred on September 15, 1998, ousting long-standing leader General Electric. Notably, Microsoft basked in solitary glory atop the hierarchy for an extended period. The stock surged over the subsequent two years, more than doubling post the initial overthrow of General Electric.

The narrative doesn’t veer as Generational Electric and Microsoft experienced protracted reigns once they reached the apogee. Similarly, ExxonMobil and Apple enjoyed sustained dominance following their respective ascents. By historical precedent, the trajectory suggests that Nvidia’s stock could relish an extended spell at the zenith.

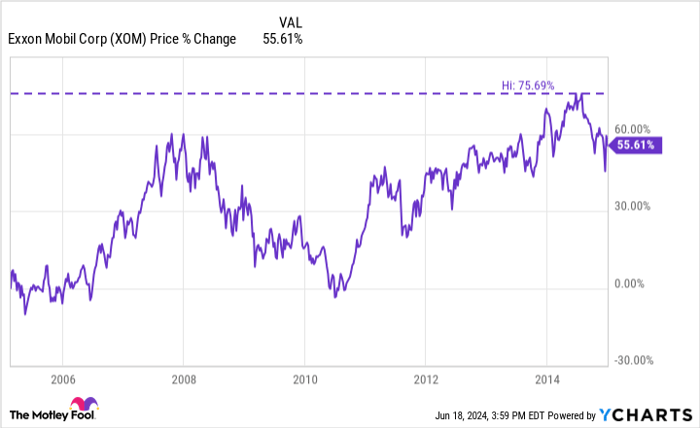

Indeed, historical patterns indicate that the apex of stock valuation marks a prelude to further appreciation. ExxonMobil’s outperformance of General Electric in February 2005 saw its stock soar by another 60% in a couple of years and 75% over the ensuing decade.

XOM data by YCharts.

Similarly, Apple’s dethroning of ExxonMobil in August 2011 saw an impressive 500% surge in the five years leading to the pinnacle. Despite investors assuming they had missed the ship, Apple’s stock doubled over the ensuing five years. Hence, if the annals of history hold true, Nvidia’s stock might enjoy a prolonged dominance and continued appreciation.

Notable Historical Performance

Surprisingly, previous top-ranking stocks exceeded S&P 500 performance over the subsequent five years post-attainment of the zenith.

| Company | Five-Year Performance After Becoming the Most Valuable Stock |

Comparable Performance of the S&P 500 |

Percentage Points of Alpha |

|---|---|---|---|

| Microsoft | 5% | (2%) | 7 |

| ExxonMobil | 11% | (8%) | 19 |

| Apple | 102% | 86% | 16 |

| Nvidia | ? | ? | ? |

Return data according to YCharts. Chart by author. *Alpha refers to a stock’s performance relative to a benchmark (in this case, the S&P 500) and is designated in terms of percentage-point difference.

Zooming out to reflect on why this trend persists unveils that a company attains the zenith by virtue of positive underlying business dynamics. Whether propelled by a technological upheaval or pricing boom, businesses at the helm display sustained profitability over years, not fleeting moments.

Nvidia is currently reaping the rewards of the AI boom. Despite the buzz surrounding AI, tangible progress in AI and its application indicates the substantial investment and commitment by numerous enterprises in delving into its potential in the foreseeable future. The upshot is continued favorable prospects for Nvidia, translating into significant market growth.

Strategically, as a value-conscious investor, Nvidia’s valuation raises cautionary flags personally. The dynamic market scenario heightens

The Unprecedented Heights of Nvidia’s Valuation

The stock market has seen its fair share of behemoths over the years, but none quite like Nvidia. With a market cap surpassing the $3 trillion mark and a staggering price-to-sales (P/S) ratio of 42, Nvidia stands as a towering figure in the financial landscape. In fact, never before in the annals of stock market history has a company of this magnitude boasted such an astronomical valuation.

For some context, consider this: Nvidia’s valuation currently sits at three times that of Microsoft, which holds the second position in the ranking of market giants.

Unprecedented Territory in Valuation

While the eye-popping valuation might raise eyebrows and stir discomfort among investors, history whispers a different tale. It suggests that Nvidia’s stock may not have reached its zenith just yet. The potential for Nvidia to retain its top spot for several more years looms large, especially as the Artificial Intelligence (AI) trend continues to unfold and shape the market dynamics.

An Investor’s Dilemma: Should You Invest in Nvidia?

Before you take the plunge and invest in Nvidia, ponder this: the analyst team at Motley Fool Stock Advisor, renowned for their keen market insights, recently unveiled their selection of the 10 best stocks worth snapping up. Surprisingly, Nvidia did not make the cut, indicating that there are other stocks poised to generate significant returns in the foreseeable future.

Reflect back to a pivotal moment in Nvidia’s history – April 15, 2005. If you had invested $1,000 in Nvidia when it graced the Stock Advisor’s list back then, you would be sitting on a staggering sum of $830,777 today! It serves as a compelling reminder of the potential power of wise stock picks and long-term investment strategies.

The Stock Advisor service equips investors with a roadmap to success, offering valuable guidance on portfolio construction, regular analyst updates, and two fresh stock picks every month. Since its inception in 2002, the service has outperformed the S&P 500 by more than fourfold, cementing its status as a beacon for savvy investors seeking to navigate the tumultuous waters of the stock market.

Curious about the 10 stocks that could reshape your investment portfolio? Take a peek and explore the possibilities.