The Stormy Seas Facing Alibaba

Investors eyeing Alibaba’s stock may find themselves navigating tumultuous waters. The once high-flying e-commerce giant has stumbled in recent times, grappling with a host of challenges. Broadsided by a harsh regulatory crackdown and the lingering effects of economic sluggishness in its primary market, Alibaba has seen its shares languish near multi-year lows since 2021.

Part of the debacle can be attributed to China’s heavy-handed interventions and the tough act of following the surge in online shopping witnessed in 2020. The country’s prolonged lockdowns and tepid GDP growth of only 5.2% in 2021 have further clouded Alibaba’s prospects.

A Leadership Quandary

Alibaba’s woes were magnified by an identity crisis stemming from the departure of founder Jack Ma as chairman in 2019. The subsequent management reshuffles, including the cancellation of significant spin-off plans, reflect an aura of uncertainty within the company. The decision in March to retain its logistics arm instead of divesting it underscores the ongoing operational challenges.

The Dawn of a New Chapter

Nevertheless, there are signs that Alibaba and its operating environment have started to steer towards calmer waters. The stock, trading at a valuation of fewer than 10 times its current and projected earnings per share, may be on the cusp of a revival.

Brighter Horizons for Alibaba

Despite the lingering risks, Alibaba’s potential upside is often underestimated. China’s recovering economic trajectory, with the IMF revising the country’s growth forecast to 5%, presents a promising backdrop. Notably, Chinese consumers are showing resiliency, with retail spending registering consistent year-over-year increases since January 2023.

A Glimmer of Hope in Leadership

Under the stewardship of CEO Eddie Wu, who assumed office in September, Alibaba seems poised for a strategic resurgence. Wu’s focus on bolstering the company’s core businesses, particularly e-commerce and cloud computing, hints at a newfound clarity of vision. Chairman Joe Tsai’s endorsement of Wu’s leadership underscores a concerted effort towards technology-driven innovation.

A Turning Tide

Alibaba’s retention of its cloud business and logistics arm signifies a calculated gamble on future growth avenues, including artificial intelligence. While the operational pivot presents challenges, it could translate into significant gains by enhancing the marketability of Alibaba’s flagship platforms.

Unlocking the Potential: A Road Ahead

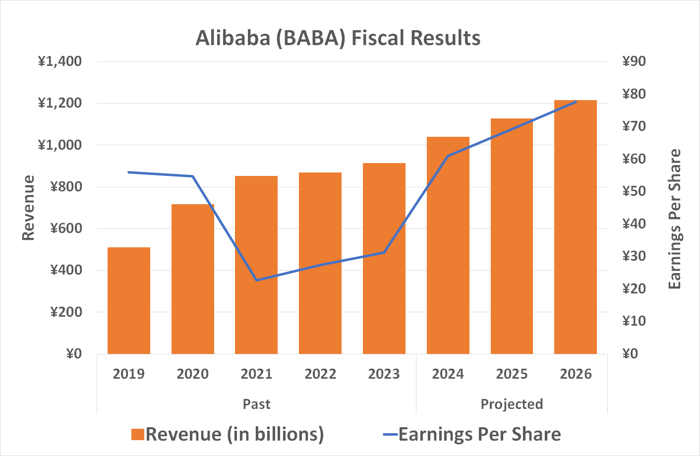

The mismatch between Alibaba’s subdued stock performance and analysts’ optimistic revenue and earnings growth forecasts for the next few years remains a puzzle. Market experts project robust top-line expansion coupled with enhanced earnings per share trajectories through 2026.

Data source: StockAnalysis.com. Chart by author. Figures are in Chinese yuan.

Analysts’ aggregate valuation of Alibaba’s ADR suggests a 40% premium over the current price, fueled by a modest price-to-earnings multiple of less than 10 for the expected 2024 earnings. So, why does the stock struggle to reflect this optimistic outlook?

Unraveling the Enigma

Alibaba’s journey back to market favor appears hindered by entrenched investor skepticism. The market’s pessimism, a consequence of the prolonged challenges faced by the company, obscures the budding recovery story at Alibaba. However, with sustained success over the coming quarters, the stock could witness a reinvigorated rally, potentially yielding substantial and enduring gains.

Reading the Tea Leaves: A Billionaire’s Bet

David Tepper’s Appaloosa Management’s substantial stake in Alibaba, with a position expansion of 6.9 million shares in the first quarter, signals a bullish outlook on the company. Tepper’s amplified confidence in Alibaba, making it the fund’s flagship holding, offers a compelling case for cautious optimism amid prevailing market doubts.

Connecting the dots, Alibaba’s resurgence might be brewing beneath the surface, awaiting a catalyst to ignite sustained market enthusiasm and unlock its latent potential.

The Investment Potential: Analyzing Alibaba Group Stock

When considering whether to invest in Alibaba Group stock, it is crucial to weigh all the factors at play. It may be tempting to jump on the bandwagon based on recommendations from various sources; however, due diligence is paramount.

Strategic Considerations for Investment

Before delving into an investment decision, investors should be aware of expert opinions in the market. The Motley Fool Stock Advisor team, renowned for their insights, recently shared intriguing information. While Alibaba Group didn’t make their elite list of top choices, it is important not to base decisions solely on such exclusions.

It’s worth recalling the historical performance of Nvidia. Back in April 2005, if one had followed a similar recommendation to invest $1,000, the return would have been a staggering $794,196. This showcases the potential power of wise investment decisions over time.

The Stock Advisor service offers investors a comprehensive roadmap for success. With features like portfolio-building guidance, regular analyst updates, and bi-monthly stock picks, it has significantly outperformed the S&P 500 since its inception in 2002.

Dive Deeper into Investment Options

While reflecting on the benefits of diversification, it’s essential to consider various avenues for investment. Exploring all angles before making a decision can lead to a more well-informed and potentially profitable outcome.

As the investment landscape evolves, keeping a close eye on market trends and expert advice can aid in making prudent choices. The historical parallels, such as the Nvidia case, provide a compelling narrative of the rewards that solid investment decisions can yield.

Always bear in mind that while recommendations and expert advice serve as valuable guides, individual research and critical thinking are equally vital in the realm of investments.

Final Thought

Investing in Alibaba Group, or any other stock, should be a conscious decision made after meticulous evaluation. By drawing insights from reputable sources like the Motley Fool alongside personal research, investors can navigate the intricate world of stocks with greater confidence and foresight.