As the world of investing races towards the shimmering horizon of artificial intelligence (AI), tech stocks like Nvidia Corporation (NVDA) have dazzled investors, claiming the throne as the most valuable company globally. Yet amidst this fervent race, one tech entity stands out not for its blinding brilliance, but for its understated elegance – Dell Technologies Inc. (DELL).

While many AI stocks flaunt exorbitant price tags akin to a designer handbag on a Paris runway, Dell quietly shines with a rare combination of robust growth potential and sensible valuation.

Basking in the warm glow of praise from Nvidia’s CEO for its prowess in constructing tailored enterprise AI systems, Dell’s expanding AI prowess and surging demand for its AI servers have propelled the company ahead of the herd, catching the eye of bullish analysts and savvy investors alike.

Dell Technologies: A Glimpse Into the Stock

With a solid market cap of around $106 billion, Dell Technologies Inc. (DELL) has been an unwavering tech beacon since its inception in 1984, offering a wide array of integrated solutions and services globally through its Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG) segments.

While the ISG segment caters to storage solutions and AI-optimized servers, the CSG segment delivers desktops, laptops, and an assortment of peripherals. Dell’s evolution into a global tech juggernaut has been marked by a commitment to innovation, including hybrid cloud solutions, high-performance computing, and a dedication to social and environmental initiatives.

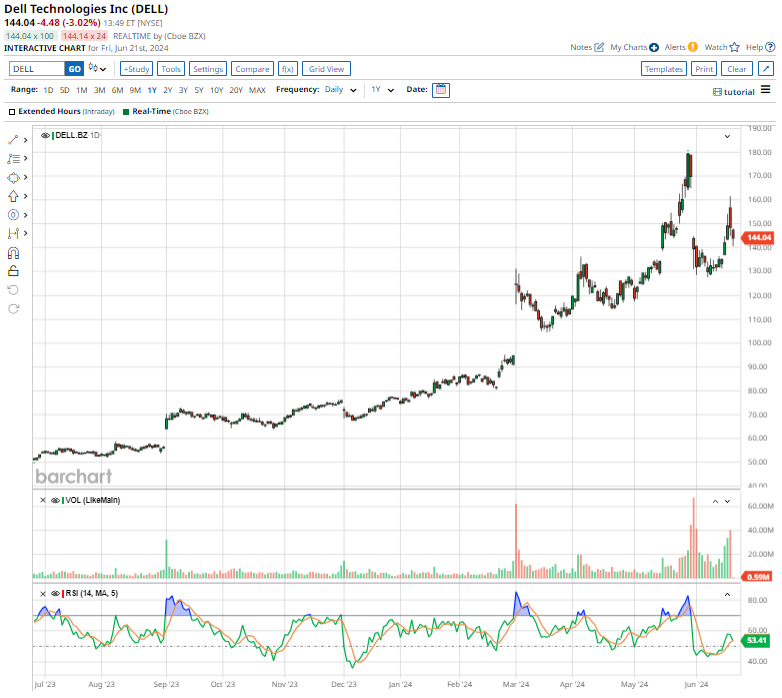

Over the past year, Dell’s stock has ascended an impressive 190%, towering above the S&P 500 Index’s modest gain of 25.3%. Year-to-date, DELL stock has soared nearly 90%, leaving the SPX in its wake with a return of about 14.7%.

Dell’s Financial Fortitude and Growth Trajectory

Not content with merely basking in its growth, Dell is also a generous host to its shareholders, having returned approximately $1.1 billion to them in Q1 through a blend of share repurchases and dividends. The company’s recent declaration of a quarterly dividend of $0.445 per share, payable on Aug. 2 with an annualized dividend of $1.78 per share boasting a 1.19% yield, demonstrates a commitment to rewarding investors.

Trading at a valuation of 21.77 times forward earnings and 1.20 times sales, Dell’s stock stands at a lower price than its industry counterparts, presenting an appealing proposition to the discerning investor.

Dell’s Earnings Performance and Wall Street’s Projection

Despite a stumble following its Q1 earnings release, where Dell reported a 6% year-over-year jump in net revenue to $22.2 billion, exceeding projections by 2.7%, the company’s adjusted EPS of $1.27 slightly dipped by 3%. Notably, Dell’s ISG segment witnessed a robust 22% annual growth in revenue, with its sales of AI servers skyrocketing by 42% to $5.5 billion, reflecting the soaring demand for its AI infrastructure.

While analysts raised concerns over the segment’s near-stagnant operating income and AI server margins hovering near zero, Dell’s management remains optimistic. The company projects Q2 revenue in the range of $23.5 billion to $24.5 billion, and for fiscal 2025, anticipates revenue between $93.5 billion and $97.5 billion, highlighting a trajectory towards sustained growth.

Analysts’ Sentiments and Stock Projections

Analysts foresee Dell’s profits reaching $6.85 per share in fiscal 2025, climbing 11.6% year over year, and accelerating further to $8.88 per share in fiscal 2026. Recent insights from Morgan Stanley have bolstered confidence in Dell’s AI server capabilities, observing potential upticks in storage demand and a resurgence in the PC market, propelling growth in the CSG segment.

Praising Dell as a top pick, Morgan Stanley underscored the company’s competitive edge and AI server momentum, recommending investors capitalize on DELL’s recent underperformance post-earnings and “buy the dip” on a leading AI player trading at a relative discount.

With a consensus “Strong Buy” rating from analysts, Dell Technologies stock holds promise for investors. The average price target of $159.53 forecasts a potential 10.8% upside, yet with a Street-high target of $186, the stock could surge by an eye-watering 29.1%, hinting at untapped potential in this tech gem.