Decoding Brokerage Recommendations for BKNG

Before diving into the reliability of Wall Street whispers, let’s see what the market mavens have to say about Booking Holdings (BKNG).

Brokerage Recommendations for BKNG

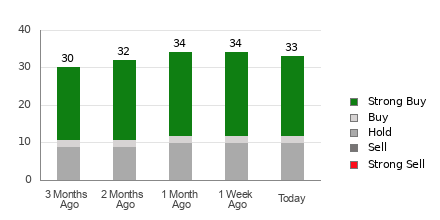

Booking Holdings boasts an average brokerage recommendation (ABR) of 1.67 out of 5, reflecting a nod between ‘Strong Buy’ and ‘Buy’ based on inputs from 33 brokerage firms.

Among the recommendations driving the score, 21 stand firm as ‘Strong Buy,’ while two lean towards ‘Buy,’ making up a majority of 69.7%.

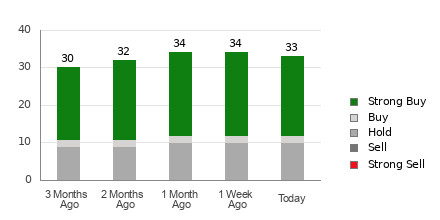

Brokerage Recommendation Trends for BKNG

The ABR shines a modest light on BKNG, but is it a reliable compass for investors navigating choppy market waters?

Research shows that the optimism of brokerage firms often taints their recommendations, with a festivity of ‘Strong Buy’ badges compared to ‘Strong Sell’ warnings.

Guidance rooted in self-interest may not serve the average Joe well. A sprinkle of skepticism might be prudent when gazing through Wall Street’s rose-tinted glasses.

A Tale of Two Ratings: ABR vs. Zacks Rank

Confusion may loom between the ABR and the Zacks Rank; however, these two metrics traverse distinct avenues

While the ABR dances on half-steps between ratings, swayed by brokerage whispers, the Zacks Rank treads on whole numbers, relying on the mettle of earnings estimate revisions.

The song sung by analysts often carries a tune of ‘buy, buy, buy,’ while the Zacks Rank hums a melody of merit, backed by empirical chords of earnings forecast accuracy.

Navigating the Investment Landscape

As the market orchestra plays on, Booking Holdings (BKNG) finds itself in the ‘Hold’ patch, following a steady course forecasted by an unchanged consensus estimate.

Analysts’ tempered expectations may herald a period of equilibrium for BKNG’s stock amid the boisterous market cacophony.

If you fancy a cautious wade into the BKNG waters, the current ABR offers a signpost – a suggestion, not a gospel.