The impending election season, akin to a fierce storm brewing on the horizon, has invigorated a political battleground as incumbent Joe Biden faces off against the former President Donald Trump in a bid for the White House. As the much-anticipated debate looms on the calendar for Thursday, June 27, citizens are poised to witness the clash of the titans as the candidates articulate their stances on critical matters ahead of the November elections.

Amidst the divergent ideologies driving the nation, a plethora of industries and stocks stand on the precipice, poised to sway in response to the forthcoming presidential outcome. One contentious topic that has garnered relentless attention, echoing like a clarion call across the years, is the issue of gun control, a subject that kindles fervent debates across the political spectrum.

In the midst of forecasts heralding a neck-and-neck race in the electoral run-up, a renowned legacy player in the firearms realm, Smith & Wesson Brands (SWBI), forecasts a surge in demand for its product lineup in the lead-up to the election. Speaking at the latest earnings call, CEO Mark Smith alluded to this electoral tailwind, underscoring, “We definitely expect a tailwind from the election as the election campaign really kicks into high gear usually towards late summer or early fall through the election period. So, certainly, there will be a tailwind to our usual busy season.”

With anticipation building for heightened demand, discerning investors are left pondering whether to align with this dividend-yielding stock as the campaign fervor escalates. Here’s an insight into the fundamentals at play.

A Glimpse into Smith & Wesson Brands

Established in the annals of history back in 1852 and rooted in Springfield, Mass., before transitioning to Tennessee, Smith & Wesson Brands (SWBI) stands as one of the oldest firearms manufacturers in the United States. The company boasts a diverse portfolio of firearms under renowned brands such as Smith & Wesson, M&P, Thompson/Center Arms, and Gemtech, commanding a market capitalization of $667.45 million.

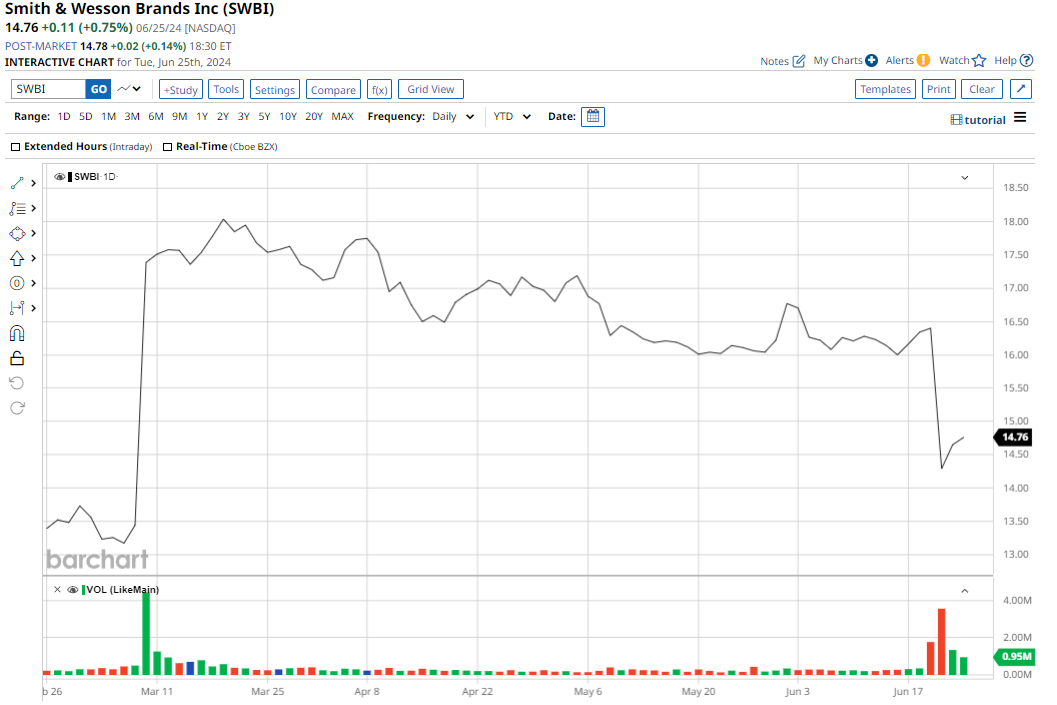

Yielding an 8.7% uptick on a year-to-date basis, SWBI offers investors a dividend yield of 3.52%, emanating from its quarterly $0.13 per share dividend.

Though not at the pinnacle of Wall Street’s highest yields, it stands above the consumer discretionary sector median, hovering around 2.2%. Despite a relatively short dividend growth track of 4 years, a manageable payout ratio of 52.3% suggests that earnings abound, paving a pathway for capital preservation and future growth ventures.

Robust Performance in Q4

Sailing through the fiscal year 2024 on a steady keel, Smith & Wesson closed its fourth quarter with a notable performance that outshone Wall Street’s projections, flaunting revenues and earnings that surpassed expectations.

Racking up revenues totaling $159.15 million for the quarter, translating to a robust 9.9% annual surge, the Q4 EPS of $0.45 showcased a noteworthy 40.6% escalation from the preceding year, elegantly eclipsing the consensus estimate of $0.35. Notably, throughout the past five quarters, SWBI’s earnings only stumbled short of expectations on a solitary occasion.

In a turn of events that bolstered cash flow metrics, the company reported a substantial surge in net cash from operating activities, amassing $106.74 million and freeing up $38.04 million in cash flow, far exceeding the precedent year’s levels of $16.73 million and $13 million, correspondingly.

Culminating the quarter with a cash reserve of $60.84 million, an amelioration from the previous year’s $53.56 million, Smith & Wesson exhibits financial fortitude.

Market Dominance of Smith & Wesson

Ranking high among the echelons of firearm manufacturers in the United States and globally, Smith & Wesson hails from a market valued at approximately $5 billion, with anticipations of burgeoning demand in the upcoming years. The brand’s sturdy market presence bodes well for amplifying revenue streams and boosting profitability.

Elevating to meet surging demands, the company has stationed its ultramodern Tennessee headquarters to cater to this upsurge, ensuring the perpetual manufacturing of premium goods against an increasingly favorable landscape for firearms manufacturers. Mirroring this move, with the relocation underway, SWBI flaunts a robust balance sheet that complements operations at this state-of-the-art facility.

Analysts Envision Lucrative Growth Opportunities

In light of scant analyst coverage, all three market watchers fluttering around SWBI have unanimously endorsed the stock as a “Strong Buy,” pegging the mean target price at $18.67. Such projections herald a tantalizing upside potential of approximately 26.6% from prevailing levels.