A Clash of Titans: Nvidia vs. Apple vs. Microsoft

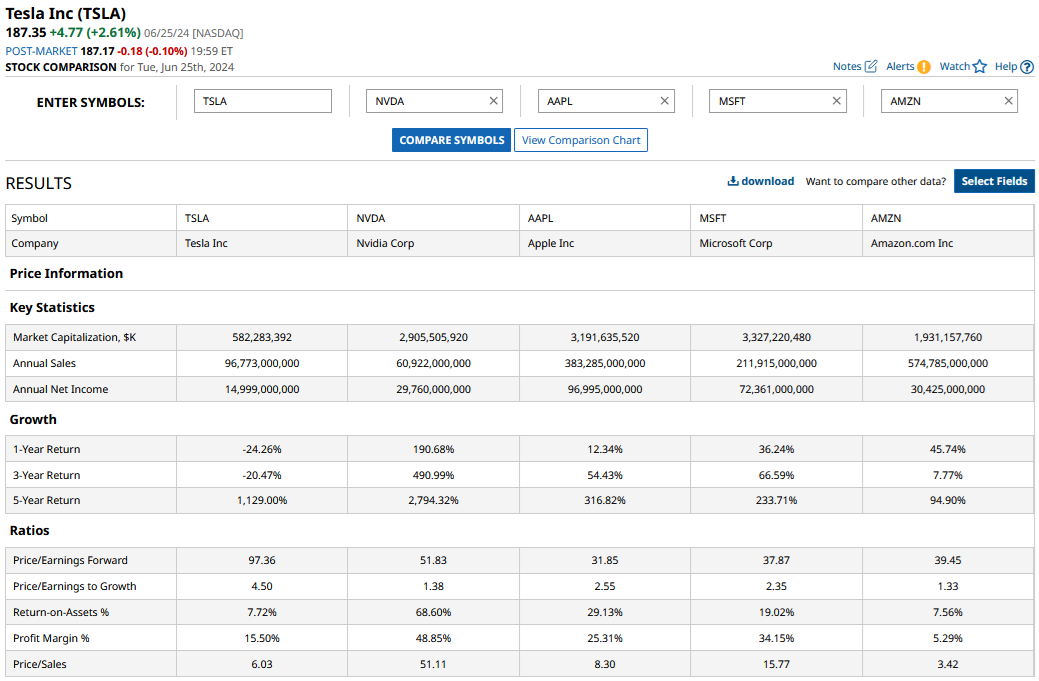

Amidst a heated battle for the title of the world’s largest company, Nvidia, Apple, and Microsoft vie for dominance. Although Apple held the crown from 2011 to 2023, Nvidia has recently surged ahead, sparking intense competition. Notably, Tesla, under the visionary leadership of CEO Elon Musk, aims to disrupt this hierarchy by envisioning a colossal future market cap, potentially dwarfing even industry giants like Nvidia.

Elon Musk’s Grand Vision for Tesla

At the helm of Tesla, Elon Musk, a self-proclaimed “pathologically optimistic” entrepreneur, foresees a future where his brainchild could soar past a $30 trillion valuation, transcending the combined worth of Apple and Saudi Aramco. Fuelled by Musk’s audacious proclamations and a fervent belief in Tesla’s capabilities, the electric vehicle (EV) leader aspires to redefine industry standards and investor expectations.

Revolutionizing the Market with Optimus

During a recent shareholder meeting, Musk unveiled Optimus, an ambitious humanoid project that he asserts could single-handedly contribute $25 trillion to Tesla’s market cap. Despite facing skepticism due to previous unrealized projections, such as the 1 million robotaxis by 2020, Musk remains steadfast in his commitment to groundbreaking innovations.

Musk’s projections extend to Tesla’s production capacities, envisioning a meteoric rise to 20 million units by 2030. However, the company’s recent delivery performance, falling short of projections, raises concerns regarding the feasibility of Musk’s ambitious growth targets.

The Resilient Faith of Tesla Enthusiasts

While skeptics question Musk’s lofty market cap aspirations, fervent Tesla supporters anticipate the company’s meteoric rise to global dominance. Esteemed analysts, including Adam Jonas of Morgan Stanley and Cathie Wood of ARK Invest, espouse bullish sentiments, foreseeing significant market cap expansions driven by Tesla’s groundbreaking innovations, notably the Dojo supercomputer.

Embracing a spectrum of target prices, ARK Invest’s revised projection of $2,600 by 2029 underscores the potential for exponential growth within the EV behemoth. Even conservative estimates paint a bullish picture, with Tesla’s bear case projections eclipsing current market valuations multiple times over.

Swings of Fortune: Tesla’s Market Cap Journey

Despite the recent resurgence of Nvidia overtaking Tesla in market cap, the latter’s historical ascendancy underscores the volatile nature of stock valuations. While Tesla once reigned supreme over Nvidia for an extended period, recent market dynamics have propelled Nvidia to astronomical valuations, breaching trillion-dollar milestones with unwavering momentum.

Although Tesla’s market cap peaked above $1.2 trillion in 2021, subsequent fluctuations have prevented a sustained climb past the trillion-dollar threshold, necessitating strategic recalibrations to regain market confidence.

Paving the Path to Prominence: Tesla’s Ongoing Evolution

As Tesla steers towards becoming an AI powerhouse, its trajectory to surpass industry giants hinges on tangible progress and operational excellence. While past promises of exponential growth and cutting-edge technologies have fueled investor optimism, recent operational setbacks prompt a recalibration of market expectations.

From diminishing operating margins to delivery shortfalls, Tesla navigates a complex landscape of challenges, compelling a nuanced reflection on its growth trajectory. Musk’s visionary endeavors, ranging from humanoid projects to autonomous driving innovations, present an avenue for Tesla to carve a distinctive path towards market preeminence.

Ultimately, while uncertainties loom over Tesla’s transformative journey, the company’s potential to redefine industry norms remains a compelling narrative. Musk’s relentless pursuit of innovation, underpinned by ambitious technological ventures and nascent market disruptions, evokes a sense of cautious optimism amid a sea of evolving market dynamics.