FedEx recently revealed their fiscal Q4 ’24 results after the closing bell on Tuesday, June 25th, 2024, causing a surge of $39 or 15% in the stock price the following day, June 26th. The company announced plans to optimize FedEx Freight operations by permanently closing 7 facilities, sparking interest in the stock as they explore unlocking sustainable shareholder value through portfolio restructuring.

Unwavering Valuation Landscape:

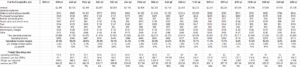

Looking ahead over the next three years, post-earnings revisions shed light on key figures:

- Fiscal ’27 EPS estimate: $26.89, with a 13% expected growth

- Fiscal ’26 EPS estimate: $23.86, with a 15% expected growth

- Fiscal ’25 EPS estimate: $20.79, showing a 17% expected growth

- Fiscal ’27 PE: 11x

- Fiscal ’26 PE: 12x

- Fiscal ’25 PE: 14x

- Fiscal ’27 revenue estimate: $99.2 billion, anticipating a 6% growth

- Fiscal ’26 revenue estimate: $93.9 billion, expecting a 4% growth

- Fiscal ’25 revenue estimate: $89.97 billion, forecasting a 3% growth

Source of estimates: LSEG.com (formerly IBES data by Refinitiv)

Despite the substantial 15% stock price uptick, FedEx maintains appealing valuations with a PE ratio aligning well with projected EPS growth trajectories. The price to sales ratio stands at a modest 0.83x post the June 26th rally.

Free cash flow (FCF) exhibited notable improvement over the past year, soaring 45% in the trailing twelve months and 18% over the last 12 quarters. Despite peaking during the pandemic at $4.25 billion (TTM) in the May ’21 quarter, FCF settled at $3.13 billion for the fiscal year ending May ’24.

With a 4% free-cash-flow yield post the Wednesday stock surge, FedEx’s financial position appears robust.

Optimistic Futures and Potential Catalysts:

Road Ahead for FedEx Freight:

FedEx anticipates $5.2 billion in capex for fiscal ’25, mirroring the ’24 expenditure, albeit 16% lower than fiscal ’23. The impact of Freight facility closures on ’25 capex remains uncertain.

Rumors of a potential Freight spinoff have stirred further interest in FedEx stock. Analysts suggest that a divestiture could value FedEx Freight at $30 billion, presenting an intriguing opportunity.

Historically contributing 10% – 11% of total revenue, Freight boasts higher margins recently following operational enhancements in the past decade.

Riding the Wave: Closing Remarks and Future Prospects

Conclusion:

Reflecting on the recent stock surge post-earnings, FedEx’s promising outlook resonates with investors. While sticking to a 10% operating margin target, the company may exceed expectations with its strategic moves.

Amidst positive revenue growth forecasts, intensified EPS on rising margins, increased free cash flow from reduced capital intensity, and enhanced capital returns, FedEx aims for a more streamlined and profitable future.

Expect a sleeker, more productive FedEx in the coming year as management navigates the company through transformative changes, aiming for heightened shareholder value and market performance.