With a market cap valued at $9 billion, Astera Labs (ALAB) went public in March 2024, soaring an impressive 72% on its trading debut. Astera Labs is a player in the fabless semiconductor realm, specializing in offering connectivity solutions for data-centric systems. The company’s product line spans semiconductor integrated circuits, boards, and services tailored to facilitate PCIe (peripheral component interconnect express) connectivity. Astera Labs has solidified collaborations with processor vendors, cloud service providers, and manufacturing firms, aiding businesses in eradicating performance constraints in compute-intensive workloads.

Investor sentiment surrounding Astera Labs is notably optimistic, fuelled by its positioning to capitalize on the sweeping wave of artificial intelligence (AI). An illustrative example lies in a report by Jefferies, outlining how Nvidia’s GB200 product is integrated with “retimers” from Astera Labs. Furthermore, speculation suggests that Astera’s PCIe switch may feature in forthcoming Nvidia offerings like the GB200, amplifying its allure as an investment prospect today. Alongside Nvidia (NVDA), Astera counts other major players such as Advanced Micro Devices (AMD) and Intel (INTC) among its client base.

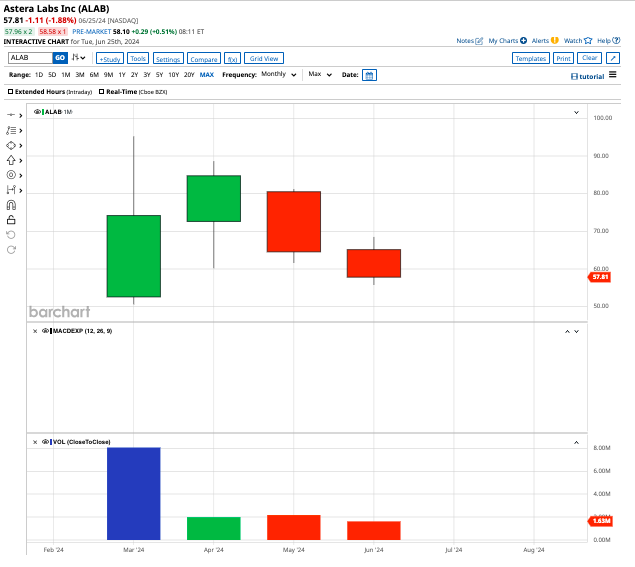

As of now, Astera Labs stock is trading 37% below its peak, presenting an enticing opportunity for investors to ‘buy the dip’

Delving deeper into whether this semiconductor stock is a promising buy at this juncture.

Amazon’s Investment in Astera Labs

Established in 2017, Astera struck a deal with tech titan Amazon (AMZN) two years ago. The agreement accorded Amazon the rights to procure up to 1.5 million Astera shares at $20.34 per share. Following a revised agreement in 2023, Amazon gained the option to purchase an additional 830,000 shares of Astera. SEC disclosures outline that Amazon concluded 2023 with 232,608 Astera shares, presently valued at $134.47 million. It’s crucial for investors to note that Amazon needs to procure approximately $650 million in Astera products to fully vest its holdings. Considering that Astera’s 2023 total sales amounted to $116 million, Amazon could potentially maintain a prolonged stake in ALAB stock.

Performance Evaluation: Q1 2024 Insights

During Q1 of 2024, Astera Labs declared revenue figures of $65.3 million, marking an impressive 269% surge from the previous year. The quarter came to a close with an adjusted gross margin of 78.2%, an operating income of $15.9 million, and a net income of $14.3 million or $0.10 per share. CEO Jitendra Mohan expressed, “Astera Labs embarked on a robust start to the year, achieving record-breaking revenue during the first quarter, driven by the increasing integration of AI infrastructure. As hyperscalers undertake extensive data center overhauls to accommodate AI applications through escalated capital infusion, we are witnessing the dawn of a multi-year growth phase.”

Target Price Projections for ALAB Stock

Market analysts anticipate Astera Labs to double its revenue, reaching $304 million in 2024, with forecasted adjusted earnings per share at $0.44. Presently priced at 131.8x forward earnings, ALAB stock seemingly commands a premium valuation, juxtaposed against its peer group’s significantly lower earnings multiple of 25x.

Among the 11 analysts monitoring ALAB stock, nine advocate a “strong buy,” one suggests a “moderate buy,” and one advises a “hold.” The average target price for ALAB stock hovers at $87.91, showcasing an upside potential of 58.1% from the current valuation.