Apple’s (NASDAQ:AAPL) iPhone shipments showed a remarkable 40% year-over-year increase in May, marking a continued revival in smartphone shipments following positive figures in April, as reported by the China Academy of Information and Communications Technology (CAICT), affiliated with the Chinese government.

The Rising Tide: Insights from the Data

Foreign-branded phone shipments in China soared to 5.028 million units in May, up from 3.603 million a year earlier. Although the CAICT data did not explicitly mention Apple, the tech giant from Cupertino is a prominent foreign player in the Chinese smartphone market.

According to a Bloomberg report, while overall smartphone shipments increased by 13% in May, shipments of smartphones from foreign brands, with Apple being a significant contributor, witnessed nearly a fourfold growth.

Navigating the Waters: Apple’s Sales Rebound in China

Apple’s iPhone shipments began a steady rebound in March, attributed in part to aggressive price cuts by the company and its Chinese resellers since the beginning of the year. These pricing strategies extended into the Chinese shopping festival on June 18. Prior to this resurgence, Apple faced fierce competition from local Chinese competitors like Huawei Technologies in the Chinese market, an essential segment for the tech giant.

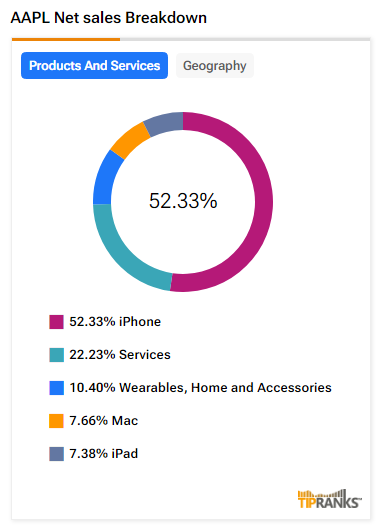

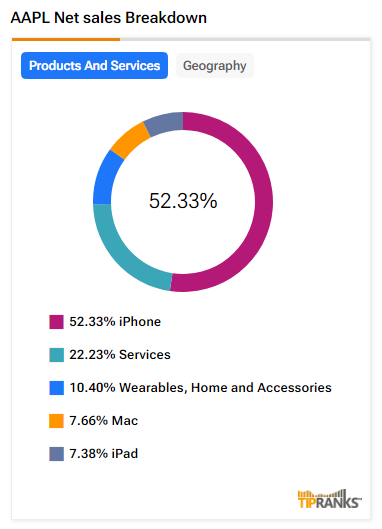

Apple heavily relies on iPhone sales for the majority of its revenue. The company reported a substantial $51.33 billion in iPhone sales in the March quarter, representing over 50% of its total revenues of $94.84 billion.

A Closer Look: Apple’s Stock Performance and Analyst Rating

Analysts maintain a cautious yet optimistic view on AAPL stock, reflected in a Moderate Buy consensus rating comprising 24 Buys, 10 Holds, and one Sell. Over the past year, Apple’s stock has shown an increase of more than 10%. The average price target for AAPL stands at $217.19, indicating a potential upside of 1.4% from current levels.