If you’ve been following the tech industry closely, you’ve watched as artificial intelligence (AI) transitioned from a niche concept to a predominant force in business. It has become ubiquitous. Many companies have reaped rewards from the AI surge, none more so than Nvidia (NASDAQ: NVDA).

The chipmaker has seen its stock soar by over 160% this year, marking a remarkable rally that has driven its stock price up by more than 760% in the past 18 months. At one point, Nvidia even claimed the title of the “world’s most valuable public company,” surpassing tech giants Microsoft and Apple.

Origins of Nvidia’s Success

Nvidia’s claim to fame lies in its graphic processing units (GPUs) – high-speed parallel processors renowned for their superior performance in facilitating the computational power necessary for training and deploying AI models. Reports suggest that the company once boasted a 95% share of the AI chip market, underlining its pivotal role in the AI ecosystem.

Furthermore, the rise of data centers plays a crucial role in sustaining the AI infrastructure, providing the computational strength required for processing and analyzing vast volumes of data. Nvidia’s GPUs have been integral to the operations of major cloud platform providers like Amazon, Microsoft, and Alphabet, fueling an unprecedented demand for the company’s AI-centric hardware and propelling Nvidia to new heights.

Impressive Earnings in Q1

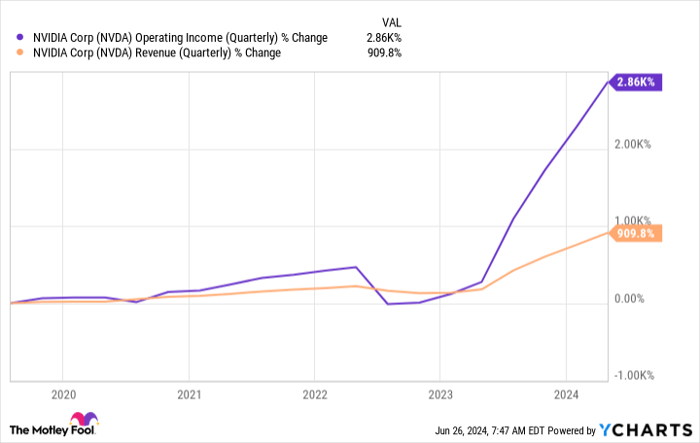

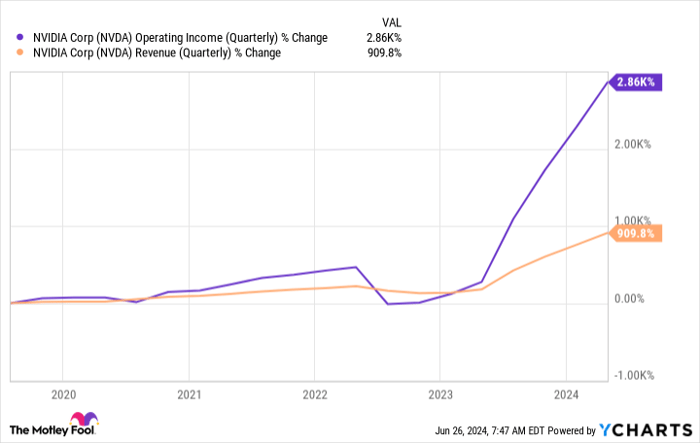

Nvidia’s financial performance has surged on the back of this soaring demand. In the first quarter of fiscal year 2025, ending on April 30, the company reported staggering year-over-year gains that many large firms could only dream of.

With its revenue skyrocketing by 262% to $26 billion, including a record-breaking 427% surge in data center revenue to $22.6 billion, Nvidia has solidified its financial standing. Of particular note is the remarkable 690% spike in operating income to $16.9 billion and an increase in gross margin from 64.6% to 78.4% – a commendable feat.

Data Source: NVDA Operating Income (Quarterly) – YCharts

Nvidia’s preeminent position in the market allows it to wield considerable pricing power. With demand consistently outstripping supply, the company can command premium prices and sustain impressive profit margins.

Valuation Concerns

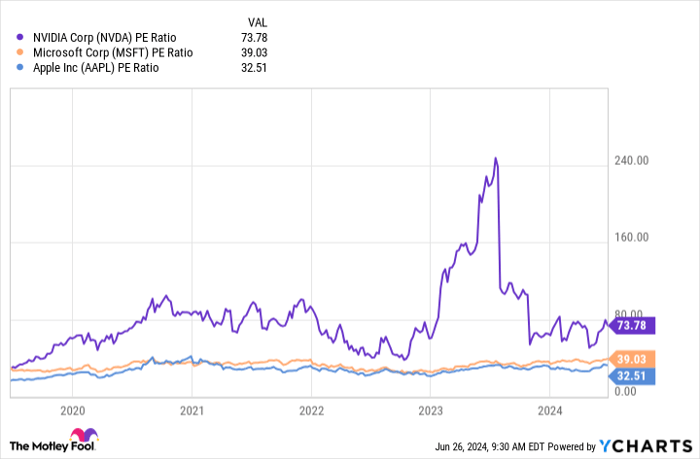

Despite its notable financial accomplishments, Nvidia’s stock stands out as one of the most expensive options available. While the surge in earnings has somewhat moderated its valuation compared to the astronomical ~240 price-to-earnings ratio of last year, it remains high. A glance at the valuation vis-a-vis industry stalwarts like Microsoft and Apple reveals the stark contrast.

Data Source: NVDA PE Ratio – YCharts

While a lofty valuation can be justified by robust growth prospects, even the most promising companies can reach valuations that outstrip fundamental rationale at some point. In Nvidia’s case, the surge in stock purchases seems fueled by a fear of missing out rather than grounded investment strategies. This speculative surge heightens the risk of a significant correction if investor expectations are not met.

Undoubtedly, Nvidia stands as an exceptional company. However, characterizing its stock as tiptoeing around bubble territory seems apt.

Slow and Steady for the Win

Predicting near-term stock market movements, especially regarding Nvidia or the broader AI sector, remains an uncertain endeavor. While historical trends can offer pointers, certainty remains elusive. Thus, adopting a dollar-cost averaging strategy to gradually accumulate holdings in Nvidia appears prudent.

By consistently investing a fixed amount at regular intervals, investors can navigate market volatility and potential corrections, ensuring a measured approach to capitalizing on Nvidia’s dominance without succumbing to speculative fervor.

The Nvidia Investment Decision: Analyzing the Pros and Cons

Creating a Consistent Investment Strategy

Embarking on an investment journey, akin to taking a leisurely stroll through a financial garden, requires not just a commitment to invest but a disciplined schedule to nurture those investments. Picture yourself tending to a flourishing orchard – committing to pouring $400 monthly into Nvidia. Once you’ve sown the seeds of commitment, the next step is deciding how to allocate these resources. Will you spread your investment like butter on toast, dividing it into four $100 weekly servings? Or perhaps opt for two $200 bi-weekly portions?

Remember, in the grand scheme of financial cultivation, the frequency is secondary to the consistency of your watering schedule.

Considering the Current Nvidia Investment Proposition

Before diving headfirst into the Nvidia stock pool, it’s prudent to pause and ponder. The wise sages at the Motley Fool Stock Advisor have recently unearthed what they profess to be the top 10 stock gems for investors to behold, and Nvidia, alas, did not make the pristine cut. Amid the glittering prospects, these chosen 10 equities hold the promise of lucrative returns in the imminent future.

Reflect on a distant April 15, 2005, when Nvidia first graced this esteemed list. Imagine if you had heeded the whisper of opportunity and invested $1,000 back then – today, you would be basking in the warm glow of $757,001*, a return that could make Midas blush.

Stock Advisor doesn’t just offer celestial prophecies but a practical roadmap to financial Eden, complete with insights to cultivate your portfolio, regular analyst nourishment, and twin stock cherries each month. This divine service has not merely doubled, tripled, but rather quadrupled the S&P 500 returns since the golden year of 2002*.

Contemplating the Road Ahead

As you stand at the crossroads of financial destiny, the question lingers – should you heed the call of Nvidia’s siren song and cast your lot with this titan of technology?

Considering the historical narrative of transformative returns and the sage counsel of the Stock Advisor oracle, the decision looms like a rising sun over a lush valley – promising illumination but also casting shadows of doubt.