As the sands of the market shift, investors look to the horizon, seeking the next wave of opportunity. The allure of artificial intelligence (AI) has captivated many, shining a light on potential treasures among the tech landscape. Amidst this burgeoning interest, the rise of Chipmaker Advanced Micro Devices (NASDAQ: AMD) has been a sight to behold, with its stock climbing a majestic 150% since the dawn of 2023. AMD’s notable presence in the graphics processing unit (GPU) domain has tantalized investors, buoyed by the surge in demand for potent chips.

Yet, as the stars align over these speculative grounds, a shadow looms over the AMD empire. Lackluster quarterly results, coupled with an inflated stock price, have cast a pall on the company’s fortunes. The fruit of its labors in the realm of AI has failed to meet expectations, beckoning investors to chart an alternate course towards brighter prospects.

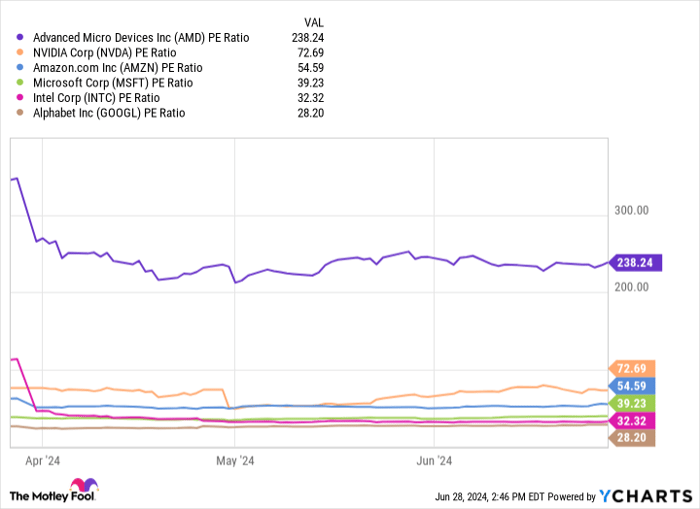

Data by YCharts

Examining the stars through the prism of price-to-earnings (P/E) ratios, the skies seem bleak for AMD, with a stratospheric P/E of 238. However, on the horizon, two celestial entities shine brightly as viable contenders in the cosmic dance of AI investments: Intel (NASDAQ: INTC) and Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG).

In the vast expanse of the cosmos, these companies traverse ventures in AI that hold the promise of astronomical returns over the long voyage ahead. While one set its sights on AI chip manufacturing, the other steers towards the horizon of AI software solutions.

Thus, cast aside the celestial allure of AMD in 2024 and set your sights on these AI stars that promise a brighter tomorrow.

Intel: Illuminating Paths to Prosperity

Treading the winding paths of uncertainty, Intel investors have weathered storms in recent memory. Their stock, a beacon in the night, has dipped by 35% since the epoch of 2019. Once a titan in the chip domain, Intel reigned supreme, basking in the glow of manufacturing prowess and establishing a fruitful rapport with tech luminary Apple as the premier chip purveyor for Mac devices. However, the tempest of competition, led by the likes of AMD and Nvidia, steered Intel off course, causing it to concede precious market share.

But in this cosmic opera, the measure of a company transcends its past triumphs. Recent overtures from Intel hint at a renaissance in the making, a resurgence that could redefine its trajectory. With a threefold increase in CPU market share over three consecutive quarters, Intel is mounting a celestial comeback. Since the twilight of 2023, Intel’s grip on the CPU universe has swelled from 61% to 64%, eclipsing AMD’s dwindling share from 36% to 33%.

Revelations from Intel’s recent earnings unveil a tapestry of progress. In the first quarter of 2024, Intel’s coffers swelled by 9% year-over-year, boasting a treasury of $13 billion. The anthem of success crescendoed with a 31% surge in client revenue, marking a boon in consumer transactions. Amidst this harmonious symphony, the data center and AI segment echoed sweet melodies of a 5% revenue surge, with operating income ascending to $184 million after dancing with losses amounting to $69 million in years past.

Intel orchestrates a metamorphosis across all spheres, crafting a narrative of sustained profits. With a grand vision to pivot its model around AI and manufacturing, Intel lays the foundation for prosperity, intending to erect a constellation of plants both in the US and abroad. As it charts a course to becoming the premier AI chip artisan in the land, Intel stands ripe to reap the fruits of burgeoning GPU demand rippling across the industry.

Amidst the constellations of growth and a stock price ripe for plucking, Intel beckons, a luminary choice over the fading star of AMD in 2024.

Alphabet: Navigating the Cosmos of AI Software

Bearing the weight of a galaxy of brands, Alphabet weaves a tapestry of tech mastery, adorning the heavens with products like Android and YouTube. Its ascent to the pantheon of the world’s fourth-most valuable company, with a market cap soaring above $2 trillion, is a testament to its celestial prowess.

Data by YCharts

Anointing itself as a paragon of steady investment, Alphabet outshines many of its rivals in the cosmic ballet of stock growth, as evident in the celestial chart above. And amidst this cosmic dance, it bears the mantle of the lowest P/E ratio among its kindred spirits, hinting at a star that shines brightest amidst the nebula. Moreover, with the least lofty stock price in this celestial realm of tech, Alphabet’s shares beckon, offering a celestial path accessible to all.

To gaze upon Alphabet is to witness a tale of boundless potential in the realm of AI. Pioneering investments in the bygone years, it infused AI into its search engine in the year 2001. By 2016, this tech titan donned the mantle of an AI-first company, charting a course well ahead of its peers. With its Google DeepMind AI research arm blazing trails, Alphabet stands poised on the precipice of innovation, poised to unfurl new horizons.

Embracing its AI manifesto, Alphabet recently unveiled its AI model, Gemini, a harbinger of generative advancements poised to invigorate its entire portfolio. Within these cosmic currents lies the promise of a stellar future in tech, making Alphabet an irresistible prospect at its current valuation—a clarion call in the winds of 2024, heralding a brighter tomorrow beyond the fading radiance of AMD.

Contemplating the Cosmic Constellations of Investment

Before setting sail into the turbulent seas of Intel investment, a moment of pause beckons:

Embark on a journey with the Motley Fool Stock Advisor analyst brigade, for they have unveiled the sacred scrolls detailing the 10 best stocks believed to harbor hidden treasures. Yet, Intel wasn’t amongst the anointed. The luminaries blessed by the Fool’s touch may usher forth a new age of riches in the epochs to come.

Dare to envision when Nvidia etched its name upon this illustrious list on April 15, 2005… Clutching the torch of opportunity, had you heeded the call and ventured $1,000 into the nether, a treasure trove of $757,001 would now grace your coffers!* Endeavor to fathom the depths of possibilities unfurled.

The Stock Advisor guides stalwart navigators along the path to prosperity, unfurling a map to success. Through counsel on portfolio construction, regular dispatches from seers, and two novel stock descents each lunar cycle, the service beckons adventurers to pursue fortunes as they sail adrift through the astral seas.

Embark on the Voyage of Discovery »

*Stock Advisor returns as of June 24, 2024