Adobe ADBE is blazing a path in the generative AI arena, fueled by its exceptional Firefly family of creative, generative AI models. The company’s expansion of generative AI-driven solutions is set to propel its standing among customers in this ever-evolving landscape.

ADBE recently rolled out Adobe Content Hub in conjunction with Adobe Experience Manager (“AEM”) Assets. This release empowers various brands to efficiently manage a plethora of creative assets with the prowess of generative AI-backed Content Hub.

The integration with AEM paves the way for extended teams to seamlessly locate, modify, and distribute brand-endorsed assets. Users can remix assets directly within their workflow by harnessing Adobe Express with Firefly, enabling them to enhance content production for various platforms like websites, mobile, and social media through Adobe Express.

Businesses can seamlessly execute end-to-end operations and deliver content essential for marketing campaigns and personalized customer experiences with the aid of Content Hub.

Strategic Move to Propel Growth

The strategic rollout is poised to bolster Adobe’s foothold among diverse enterprises and marketers, ushering in new opportunities for growth.

The move bolsters Adobe Experience Cloud offerings, contributing significantly to the near-term performance of the Digital Experience segment.

In the second quarter of fiscal 2024, the Digital Experience segment raked in revenues of $1.33 billion, marking a 9% year-over-year surge.

For the third quarter of fiscal 2024, Adobe anticipates Digital Experience revenues ranging between $1.325 billion and $1.345 billion.

The enhancement of the Digital Experience segment is poised to bolster Adobe’s overall financial trajectory, with projected total revenues of $5.33 billion to $5.38 billion for the third quarter of fiscal 2024. The Zacks Consensus Estimate stands at $5.37 billion, signaling a 9.8% year-over-year upswing.

Adobe envisions non-GAAP earnings per share between $4.50 and $4.55, with the consensus figure pegged at $4.52 – reflecting a 10.5% year-over-year growth. Notably, the EPS estimate has been revised upwards by 1.3% over the past month.

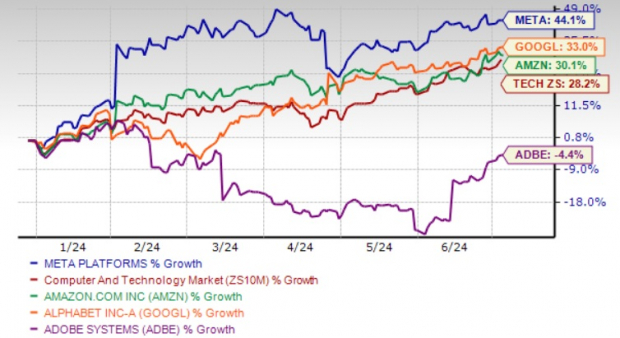

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Driving Force: Robust Generative AI Solutions

According to a Grand View Research report, the generative AI market size is anticipated to witness a CAGR of 36.5% between 2024 and 2030.

The Zacks Rank #3 (Hold) company is well-positioned to harness this growth potential through its fortified generative AI-powered solutions portfolio. Adobe’s recent introduction of the Firefly Image 2 Model, Firefly Vector Model, and Firefly Design Model represents a significant leap in its creative generative AI model spectrum.

The integration of Firefly-powered Generative Fill, Remove Background, Erase, and Crop features into Acrobat signifies a boon, allowing customers to edit images within PDFs. This move extends to integrating the Firefly Image 3 Model into Acrobat, facilitating customers in image generation and inclusion in their PDFs.

Additionally, the debut of Generative Remove in Adobe Lightroom, a potent Firefly-supported tool for effortless object removal from any photo with a single click in a non-destructive manner, adds another feather to Adobe’s cap.

The foray into Adobe Express for Enterprise, fueled by Firefly Image Model 3, stands out as a promising development.

Intense Competition: A Potential Challenge

Adobe’s year-to-date decline of 4.4% contrasts sharply with the Zacks Computer & Technology sector’s robust 26.7% growth. During this period, the company lagged behind behemoths like Meta Platforms META, Amazon AMZN, and Alphabet GOOGL, intensifying the competitive landscape within the generative AI domain.

Meta Platforms, surging 44.1% year to date, recently unveiled generative AI features aimed at aiding businesses in expediting the creation and editing of ad content.

Meanwhile, Amazon, up 30.1% year to date, is reaping the rewards of the widespread adoption of Amazon Bedrock, marking a breakthrough in the generative AI sphere.

On the other hand, Alphabet’s Google is leveraging the surging demand for large language models with Gemini, its most powerful AI model. The commendable momentum in Google’s Vertex AI, providing developers with tools to train, fine-tune, augment, and deploy applications using generative AI models, is another feather in its cap.

Alphabet’s shares have surged by 33.1% year to date.