Despite the tumultuous financial climate, Sapiens International (SPNS) stands as a beacon of hope for investors. With a robust portfolio and esteemed clientele, SPNS has not only outperformed its industry but has also exceeded sector growth.

Since 2012, SPNS has achieved a commendable top-line CAGR of 14.7%. In 2023, the company reported revenues of $514.8 million and witnessed a revenue increase of 7.6% year over year to $134.2 million in the first quarter of 2024. These staggering figures are a testament to the company’s steady climb towards success.

Strong Portfolio Vital for SPNS Stock

SPNS’s recent endeavors in enhancing its portfolio are projected to position the company for further growth. The introduction of an advanced AI-powered insurance platform and strategic investments in key sectors are set to propel SPNS to even greater heights.

Expanding International Footprint Bolsters Prospects

SPNS’s strategic expansion into markets such as the U.K., Germany, Thailand, and Canada is a strategic move that signifies the company’s commitment to global growth. Collaborations with renowned international companies further solidify SPNS’ position in the global market.

Sapiens’ Outlook for the Future

In 2024, SPNS anticipates revenues in the range of $550 million to $555 million, reflecting a positive growth trajectory. Operating income is expected to soar between $99.6 million and $102.7 million, underlining the company’s strong financial strategies.

Zacks Rank & Other Stocks to Watch

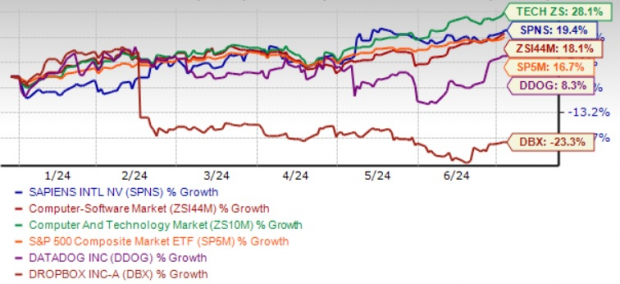

Currently holding a Zacks Rank #1 (Strong Buy), SPNS is primed for success. Additionally, other noteworthy stocks like Datadog (DDOG) and Dropbox (DBX) are also on the rise, making them potential contenders for investors seeking diverse investment opportunities.