Investing in Olympic stocks can be likened to catching the tailwind of a sprinter – exhilarating and rewarding. The 2024 Summer Olympics in Paris are just on the horizon, presenting a lucrative opportunity for investors to ride the wave of companies associated with the Games. These companies, whether through sponsorships, advertising, or partnerships, stand to benefit from heightened exposure and increased sales during this grand sporting event.

Historically, Olympic stocks have reflected an upward trajectory during the Games, driven by the fervor surrounding the event. The allure of these stocks lies not only in their potential for growth but also in their ability to capture the imaginations of consumers worldwide.

Alibaba Group Holdings: A Powerhouse Player

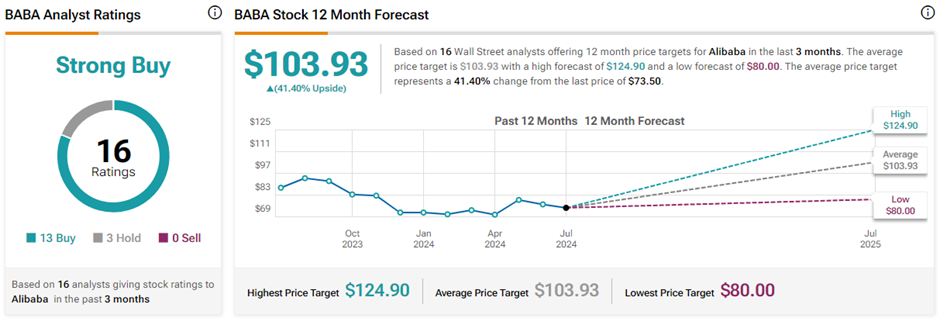

As a key partner of the Olympic Games since 2017, Alibaba Group Holdings has cemented its position as a global leader in e-commerce and technology. Through its cloud infrastructure services, Alibaba is at the forefront of digitizing the Olympic Games, enhancing the experience for athletes and spectators alike. The company’s strategic initiatives, including share buybacks and dividends, demonstrate its commitment to driving shareholder value amidst a backdrop of innovation and expansion.

With a Strong Buy consensus rating and a substantial upside potential, Alibaba’s stock presents an enticing opportunity for investors looking to capitalize on the Olympic fever.

Visa: Pioneering Payments at the Olympics

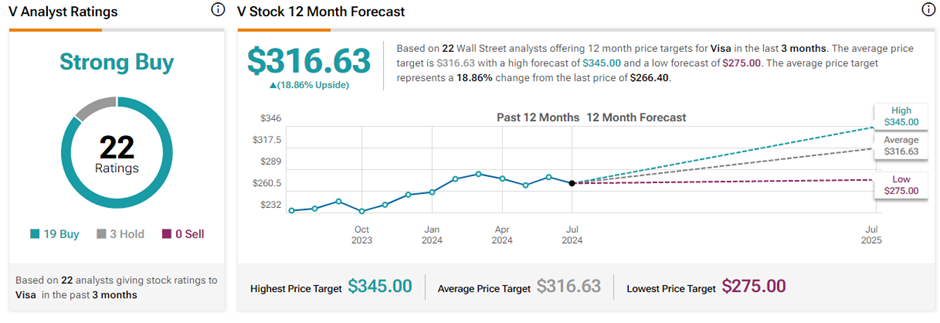

Visa’s long-standing partnership with the Olympics since 1986 underscores its position as a leader in the payment technology industry. As the exclusive payment partner for the Games, Visa offers cutting-edge payment solutions to enhance the experience for participants and viewers. The company’s commitment to supporting athletes through Team Visa and its robust financial performance further solidify its status as a premier Olympic stock.

With a Strong Buy consensus rating and a projected upside potential, Visa’s stock represents a compelling opportunity for investors seeking exposure to the Olympic landscape.

Sanofi: A Healthcare Touchdown with Olympic Partnership

Sanofi’s strategic collaboration with the Paris 2024 Olympics positions it as a prominent player in the healthcare and pharmaceutical space. Through its support of the Games and innovative healthcare solutions, Sanofi aims to not only drive business growth but also contribute to societal well-being. The company’s multi-faceted approach, spanning partnerships, sponsorships, and employee engagement, reflects a holistic commitment to leveraging the Olympic platform for a positive impact.

With an upcoming earnings announcement and a track record of dividends, Sanofi presents an intriguing investment opportunity for those looking to align their portfolios with the transformative power of the Olympics.

Investing Insights: Unveiling the Prospects of Sanofi Stock

The descending numbers on the stock market ticker are as ubiquitous as streetlights at night; they flicker, they fluctuate, and they vie for the attention of savvy investors seeking their next move. Amidst this tumultuous landscape, Sanofi (SNY) isn’t immune to the dance of the market numbers. As of the latest data, Sanofi’s stock has been yielding a modest 2.98%.

The Potential Valuation of Sanofi Stock

Delving deeper into the realm of analyst opinions and projections, SNY stock emerges with a noteworthy profile. Garnering three Buy recommendations and one Hold rating, Sanofi’s stock boasts a Strong Buy consensus rating on TipRanks. The average price target for Sanofi stands at $59.33, signaling a potential upside of 18.1% from its current trading levels.

The Strategic Implications of Investing in Sanofi

As the world gears up for the upcoming Olympic Games, a unique window of opportunity arises for investors eyeing the stocks of companies closely associated with this global event. Partnering and sponsoring the Olympics offers companies a distinctive platform to showcase their products and services to a vast global audience, potentially expanding their customer base. Against this backdrop, investors might want to consider exploring the prospects of investing in companies like Sanofi, which is intricately linked to this quadrennial spectacle.

When considering investment opportunities that are poised to benefit from this global spectacle, Sanofi emerges as a compelling player with potential upside. As investors navigate the tumultuous waters of the market, strategic choices aligned with global events such as the Olympics may offer a beacon of hope amidst the stormy seas of uncertainty.