The Earnings Landscape Unveiled

The 2024 Q2 earnings season has hit a fever pitch with the recent results from major banks. Investors are bracing for positivity, with the S&P 500 anticipated to continue its trend of positive earnings growth.

Netflix: Entering the Streaming Arena

Netflix, the streaming juggernaut, is gearing up to release its quarterly earnings on Thursday, July 18. Despite a recent earnings dip, the company’s shares have rebounded impressively, scaling new heights.

Subscriber metrics will be under scrutiny in this unveiling, with a notable transition on the horizon as the company plans to alter its reporting of quarterly membership numbers, beginning 2025 Q1.

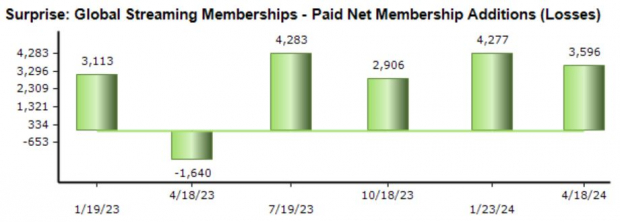

In its latest report, Netflix boasted 269.6 million total subscribers, marking a 16% year-over-year surge. The company has consistently outperformed expectations in subscriber additions, surpassing estimates in the last four quarters.

Taiwan Semiconductor: Riding the Semiconductor Wave

Taiwan Semiconductor (TSM) has thrived within the semiconductor uptrend in 2024, witnessing a remarkable 80% surge. The frenzy surrounding AI has been the catalyst for the semiconductor sector, prompting companies to invest heavily in AI chip technology.

Earnings predictions had remained steady before a recent uptick, with a projected $1.37 per share indicating a 20% increase from the previous year. Sales forecasts are equally optimistic at $20.2 billion, pointing to a 5% rise over the same period and a 29% year-over-year escalation.

Valuation multiples have expanded in anticipation of heightened growth, with a forward 12-month earnings multiple of 26.5X, exceeding the five-year median of 19.8X. However, the current PEG ratio sits at 1.1X, indicating investors are not overvaluing growth prospects.

Following its latest financials, TSM announced a 10% dividend bump, underscoring its commitment to rewarding shareholders, particularly those eyeing technology and semiconductor exposure.

Johnson & Johnson: A Steady Performer in Turbulent Waters

Consumer staple stalwart, Johnson & Johnson, has navigated three years of stagnant share performance, with a 4% overall decline. Nevertheless, the company has consistently delivered strong earnings, surpassing consensus EPS estimates in the last ten quarters.

Leading up to the upcoming release, earnings estimates have seen a modest decline, with the Zacks Consensus EPS estimate at $2.71, down 1% since mid-April. Revenue projections have held steady, with an expected $22.4 billion, showcasing a 12% decline year-over-year.

Concluding Thoughts

The forthcoming week promises riveting insights with Netflix, Taiwan Semiconductor, and Johnson & Johnson stepping into the earnings spotlight. These reports will undoubtedly shape investor sentiment and market trends moving forward.