Two behemoths in the semiconductor industry, Intel and Advanced Micro Devices (AMD), continuously battle for dominance in the market. TipRanks’ Comparison Tool scrutinizes these giants, shedding light on which stock holds more allure for investors.

While Intel predominately caters chipsets for PCs and laptops, its revenue heavily relies on key partners like Dell, HP, and Lenovo. In contrast, AMD operates as a “fabless” chipmaker, focusing on specialized technology sectors including AI, data centers, and gaming.

During the fiscal year, Intel shares have plummeted by 32%, whereas AMD stocks have soared by 20% year-to-date. Such divergent price movements urge further inspection to determine the underlying reasons and ascertain if the fluctuations are warranted.

Comparison against the semiconductor industry reveals a strikingly high P/E ratio of 64.1x, surpassing the industry’s three-year average of 35.2x.

Intel (NASDAQ:INTC)

Intel’s P/E of 36.5x mirrors the semiconductor industry’s average and presents an attractive prospect with a forward P/E of 27.5x. Despite these promising numbers, recent trends depict a certain uncertainty surrounding Intel’s path to progress.

One nudge in the right direction for Intel is the shift towards external fabrication facilities like Taiwan Semiconductor Manufacturing that has bolstered AMD’s position in the market. Intel’s collaboration with TSM for the manufacture of Lunar Lake chips underscores its strategic adjustment to embrace novel technologies.

Moreover, Intel ventures into the realm of artificial intelligence which holds promise, as highlighted by Melius Research analysts. But, this anticipated development remains speculative, casting a shadow over Intel’s immediate future prospects.

While Intel traditionally leads the market for laptop and PC chips, advancements in AI, data centers, and IoT domains remain pivotal to its resurgence. Despite signs of resurgence, Intel’s Relative Strength Index suggests a potential short-term dip before a definitive upswing.

Analyzing INTC’s Future

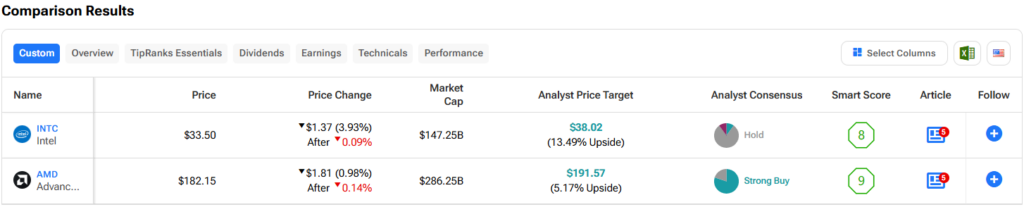

Avoiding extremes, Intel garners a Hold rating, with analysts divided between Buys, Holds, and Sells. With a projected price of $38.02, Intel stock forecasts a 13.5% upside potential.

Advanced Micro Devices (NASDAQ:AMD)

AMD maintains a steadfast premium over industry peers, boasting a P/E ratio of 268x. A forward P/E of 45.9x brings a semblance of rationality to its valuation, nudging AMD closer to industry norms. Yet, prudence dictates a neutral stance until after the imminent earnings announcement.

Heading towards an earnings report in July, AMD stands at a pivotal juncture where the outcome could sway investor sentiments substantially. A balanced earnings report might signal a buy-the-dip opportunity, whereas an unexpected surge could prolong the wait for an entry point.

Despite trailing Nvidia in revenue performance due to its AI chips, AMD showcases potential to close the gap. While profitability remains a concern, AMD’s trajectory seems primed for transformation, raising intrigue for prospective investors.

AMD vs. Nvidia: A Financial Faceoff

The Revenue Battle

Two titans in the semiconductor industry, AMD and Nvidia, recently showcased vastly different financial performances. While AMD reported revenue of $3.1 billion, Nvidia stole the show with a staggering 262% year-over-year revenue growth, leaving AMD in its wake. The stark contrast in revenue figures underscores the fierce competition between these industry giants.

The Profit Margin Showdown

When it comes to profitability, the figures tell an even more compelling story. AMD reported a net income of $123 million on a GAAP basis. In comparison, Nvidia’s net income surged an impressive 628% year-over-year, showcasing the company’s robust financial health and strategic prowess.

Analyst Ratings and Price Targets

Advanced Micro Devices is currently basking in the glow of a Strong Buy consensus rating, with 28 Buy ratings, seven Holds, and zero Sells in the past three months. As AMD’s stock hovers around $191.57, analysts are eyeing an average price target that suggests a potential upside of 5.3%. This positive sentiment reflects investor confidence in AMD’s future prospects.

Conclusion: A Neutral Stance on INTC and AMD

While AMD emerges as the frontrunner in this financial faceoff, caution is advised when considering investment opportunities. While AMD may seem poised for a bullish run, it may be prudent to await a more opportune entry point into the stock. On the other hand, Intel could potentially turn the tide if it meets analysts’ expectations, but a tangible demonstration of its strategic shift is necessary. Intel’s foray beyond conventional markets into areas like AI will be a critical factor in determining its future success.